MATIC shows strong bullish sentiment – Can it rally above $1?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- MATIC wallet holdings reflected that accumulation was still in play.

- Technical analysis showed momentum was overwhelmingly bullish but a retracement could occur.

Polygon [MATIC] saw an uptick in whale activity in recent weeks. Its market capitalization rose alongside prices, and accumulation was evident. The indicators on the higher timeframe charts also firmly favored the buyers.

A pullback from resistance levels below the $1 psychological level was possible. A retest of a key higher timeframe support level could offer bulls another opportunity to push higher.

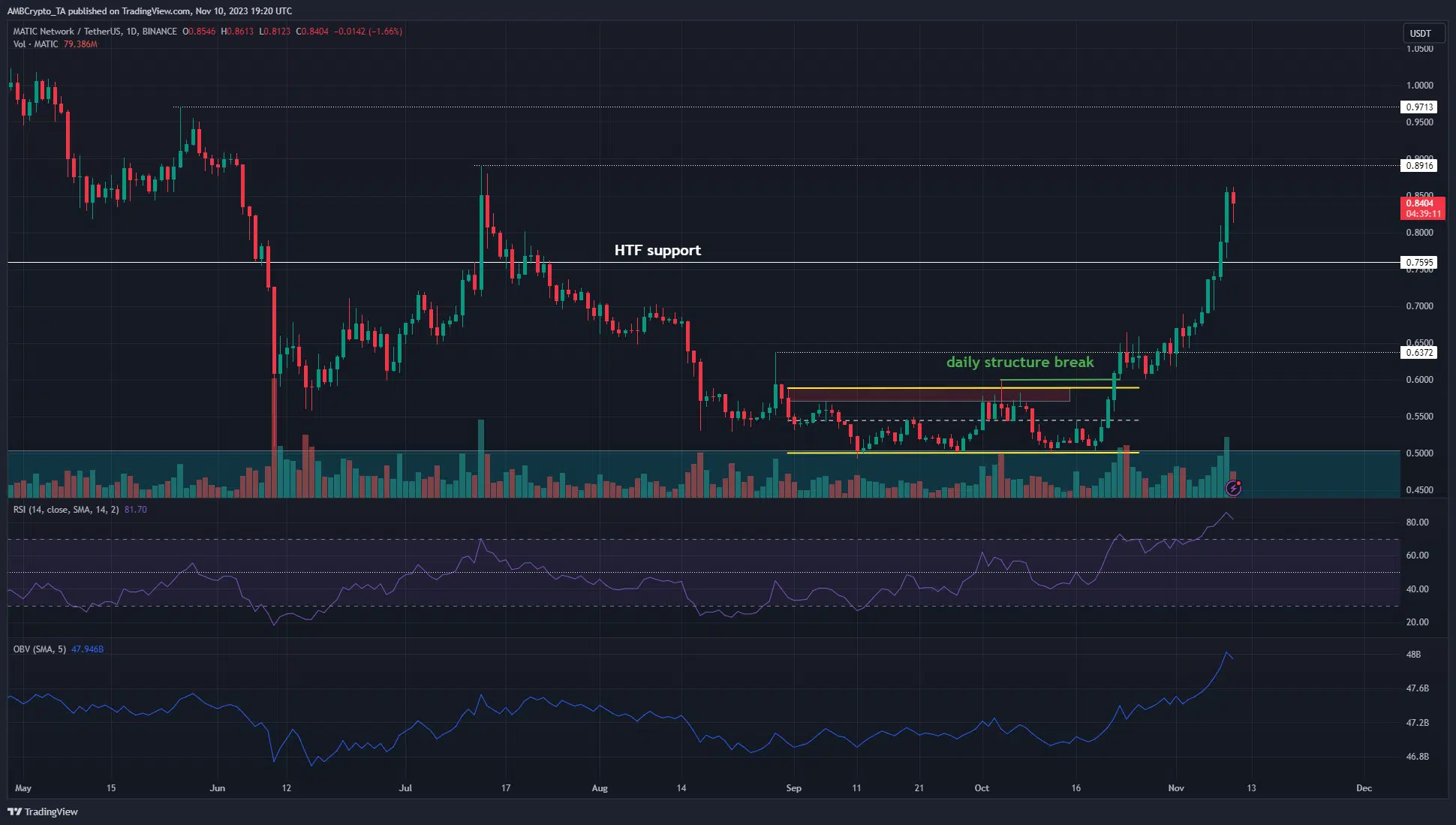

The weekly resistance levels show what the MATIC bulls can expect in November

The one-day market structure of MATIC has been bullish since 22nd October. Not only was the range (yellow) breached convincingly, but MATIC consolidated beneath the $0.637 resistance before another rally in November.

The RSI has been above neutral 50 since mid-October, reflecting intense upward momentum at press time alongside the structure. The On-Balance Volume has also increased significantly in the past month as buying volume was steady.

The next higher timeframe resistance levels were the $0.89 and $0.97 levels. If MATIC faced rejection at $0.89, a drop to the $0.75-$0.8 region was possible. This would likely offer a good risk-to-reward buying opportunity targeting $1 and above.

A jump in these two metrics meant holders have some reason for concern

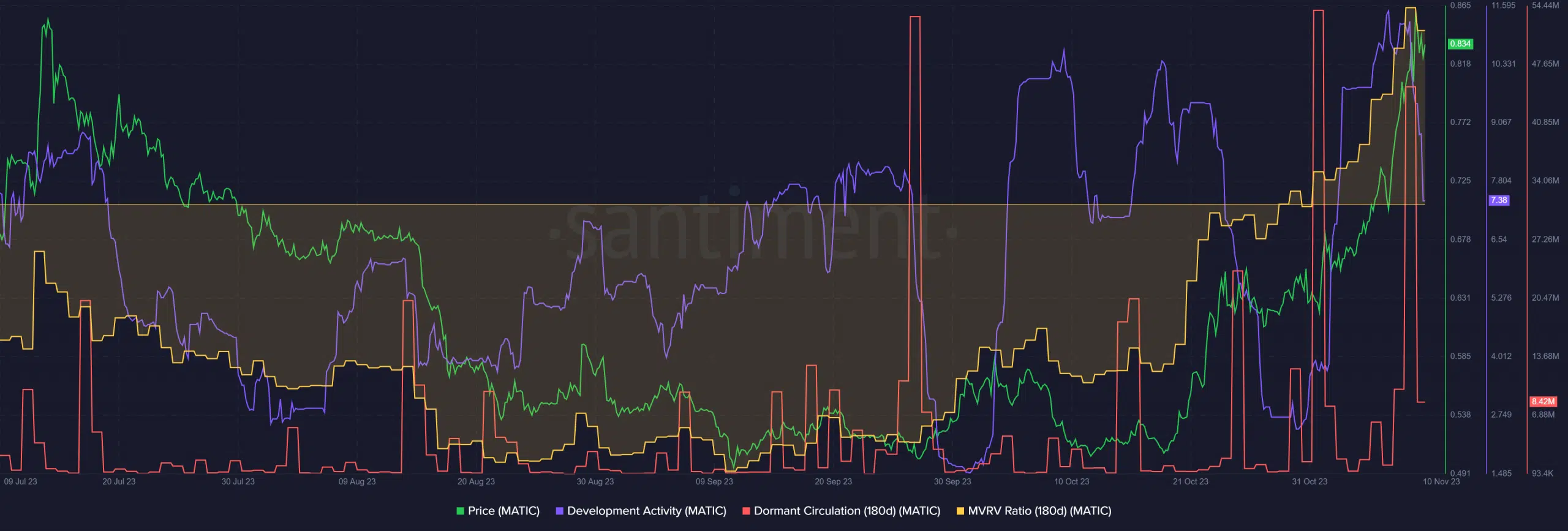

Source: Santiment

The development activity has been going strong in the past six months and was a factor that would inspire investor confidence.

However, the huge leap in the dormant circulation on the 9th of November coincided with MATIC’s minor dip from $0.862 to $0.812. The large dormant token movement could see a wave of selling in the coming days.

The MVRV ratio was also at highs not seen since April. This meant that holders would likely be tempted to book profits and could force a minor pullback. The Santiment chart posted on 9th November showed wallets continued to accumulate MATIC.

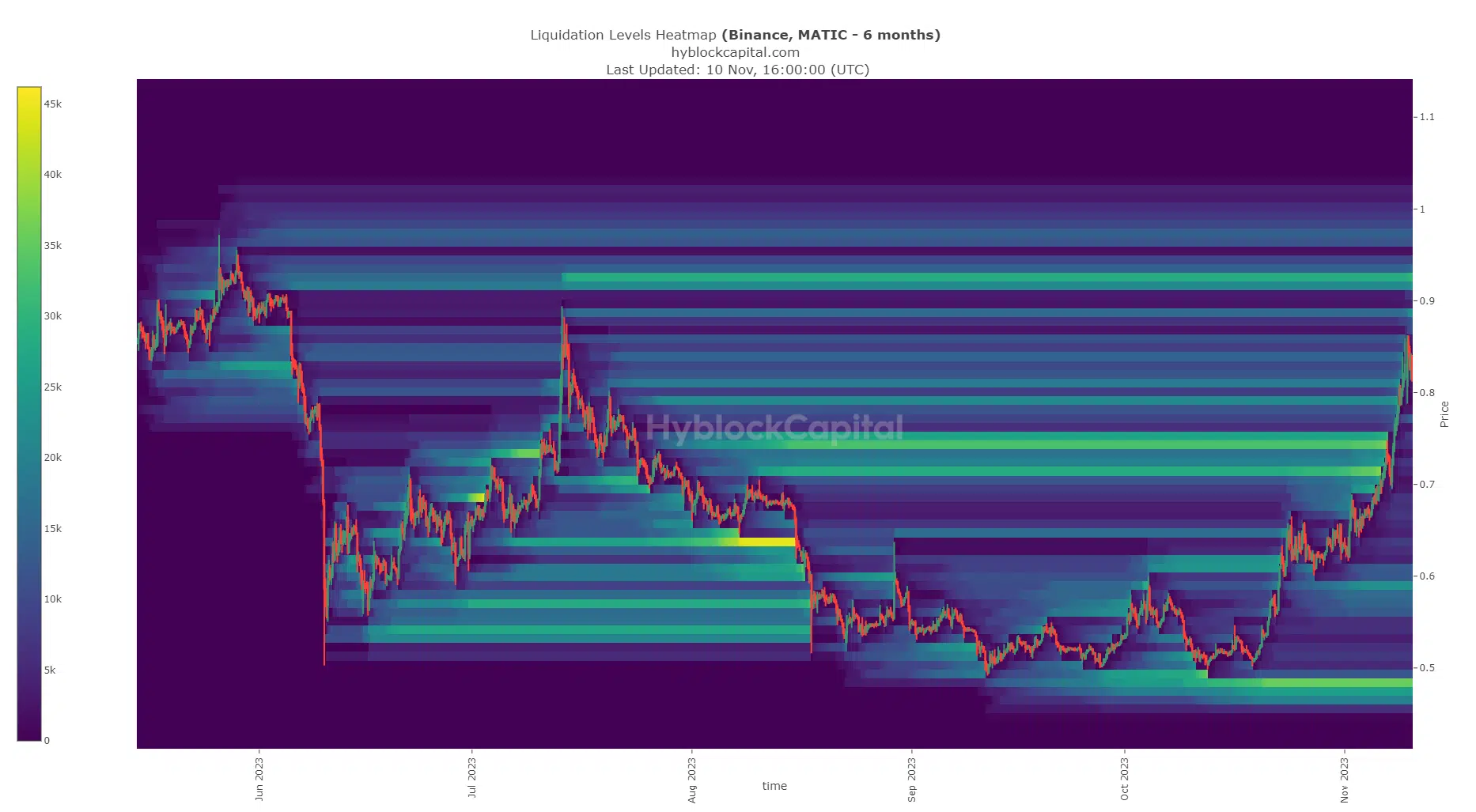

Source: Hyblock

The six-month look-back period on the liquidation levels heatmap showed the $0.925 mark was likely the next target and offered a huge amount of liquidity.

Is your portfolio green? Check the MATIC Profit Calculator

The $0.88 and $0.97 levels were also possible candidates for a local top for MATIC.

The lower timeframe charts suggested that a move above $0.85 and retest could offer a buying opportunity targeting $0.89 and $0.96, which were close to the liquidity pools highlighted in the Hyblock chart.