Metaverse mania: AXS, MANA, ENJ, SAND show no signs of stopping

The crypto-verse is not new to overnight pumps that send coins to the moon. Over the last one week Metaverse tokens have enjoyed rather hyped rallies and quite a bit of social media attention, as social media giant Facebook announced its ‘Meta’ rebrand.

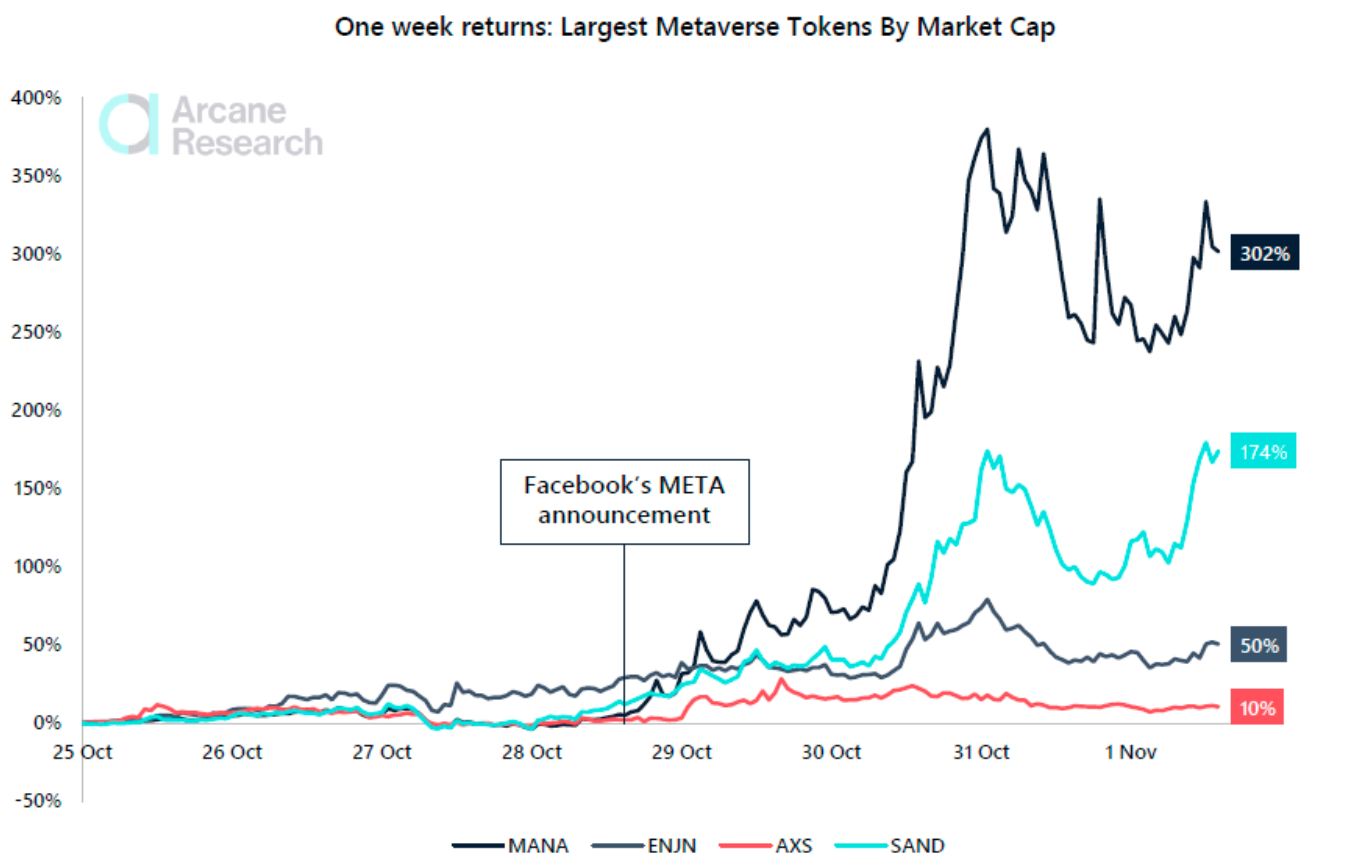

As the Meta mania took over, MANA led the race of gains, followed by SAND, ENJ, and lastly the gaming giant Axie Infinity (AXS).

Like any other hyped phenomenon, as the Meta hype gained momentum, naturally traders and investors sought to jump in on the bandwagon. However, with most of the aforementioned alts already at a price ATH, what could be the right strategy going forward and how are Metaverse tokens looking?

High ROIs and higher retail FOMO

Apart from the newly found social attention, another common thing that Decentraland’s native token MANA had in common with Enjin Coin (ENJ) and Sandbox (SAND) was the massive gains.

While Facebook’s Meta rebrand announcement was the driving force behind the coins’ rise as other companies like Nike and Microsoft rushed into Metaverse hype, the coins found themselves in a sweet spot.

Post the announcement on October 28, the native tokens of Decentraland and Sandbox saw incredible returns. While MANA reaped 302% weekly returns SAND gave 174% weekly gains to its HODLers. Additionally, Enjin coin had close to 50% weekly ROI while Axie came in last in the race of ROIs with 10% returns.

These coins’ rallies were also supported by massive retail FOMO, which could be seen in their high trade volumes. MANA, SAND, and ENJ the trade volumes saw considerable upticks signifying participants flocking onto the hype. So it seemed like institutional interest coupled with retail FOMO did sail the boats of these alts.

So, what next?

While the coins shot up to glory, at the time of writing on shorter time frames MANA, ENJ and SAND all saw sideways movement. AXS on the other hand has been in consolidation mode since early October, peaking once after the announcement, but largely it failed to make any major moves.

So, with the hype easing in and the coins consolidating, could these coins still make a good addition to your portfolio? Well, the answer is yes.

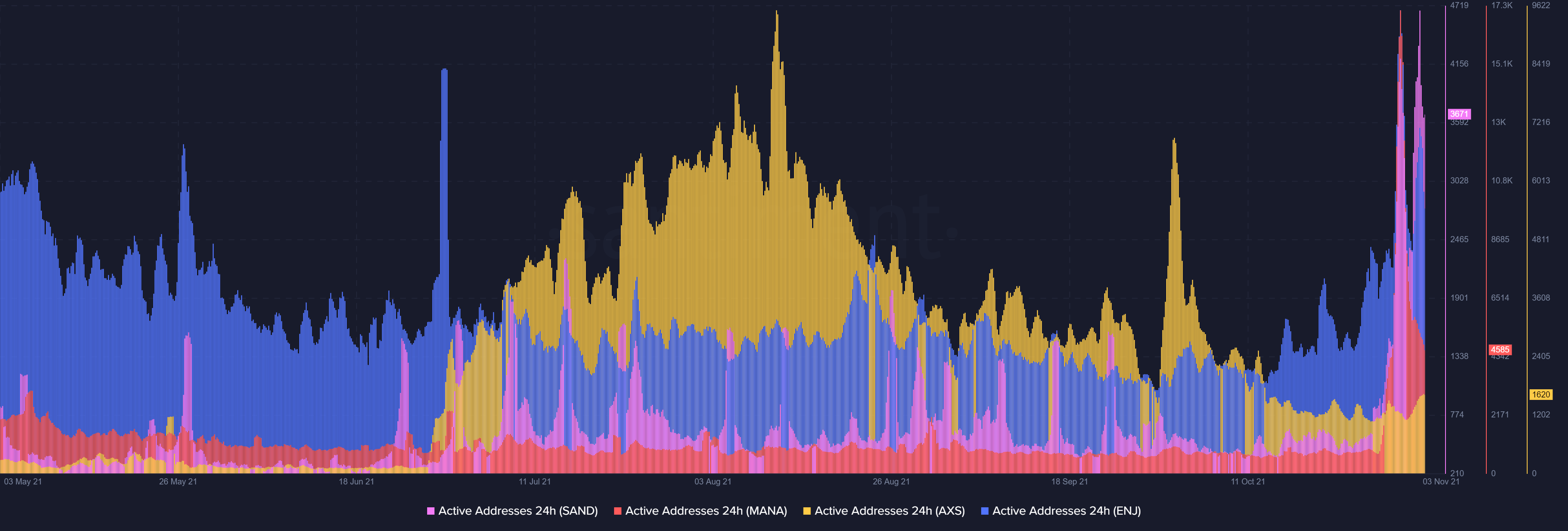

Notably, most of these coins saw large exchange outflows, which could mean that HODLers strengthened and held the assets in cold wallets outside exchanges. Now, this could act as a cushion for prices. Additionally, their active addresses even saw a drop, still held above-average levels.

As seen above, MANA and SAND saw a considerable fall in their active addresses, while Enjin Coin’s active addresses still held higher levels. On the other hand, AXS’s active addresses were still noting below-average scores.

However, this wasn’t the end of the Metaverse hype. In fact, interestingly, this looked similar to the NFT boom, wherein alts pumped alongside the NFT mania. So, it could be possible that further growth of the Metaverse narrative pumps these alts. Nonetheless, it is best to ‘do your own research’ and jump in on the bandwagon.