Minor inflows of $14M suggest investors are ‘buying the dip’ for Bitcoin and…

The sell-offs over the past few weeks were aggravated after the crypto-market suffered massive price correction. At the time of writing, the global crypto-market capitalisation stood at just $1.62T. However, digital asset investment products experienced inflows last week for the first time this year (2022). A small, yet significant development.

A ‘buy-the-dip’ underway?

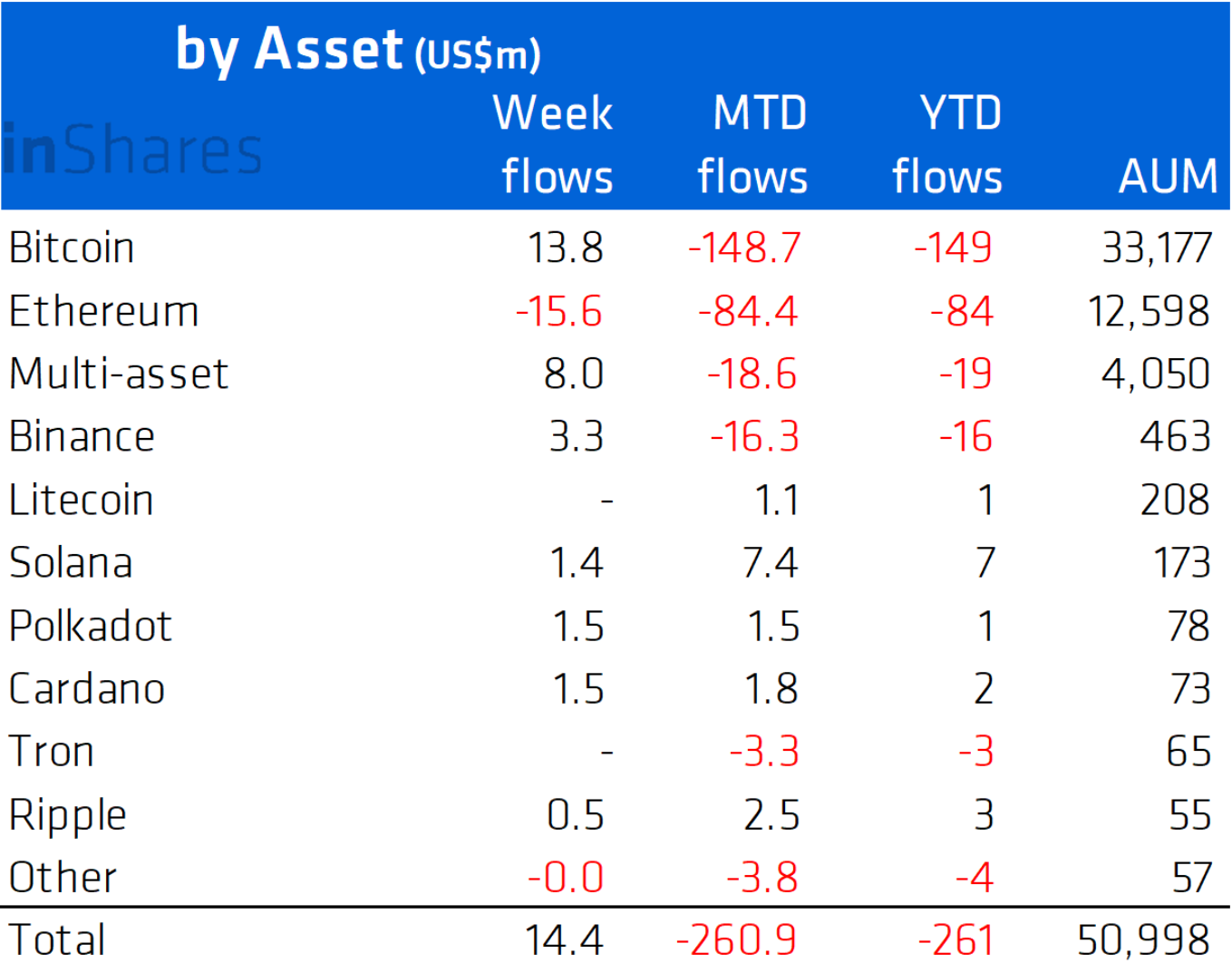

According to the latest CoinShares report, this past week saw a break in the five-week streak of outflows. However, total assets under management (AuM) shrunk to its lowest level since early August 2021 – A free-fall of 41% from its $86 billion peak in November 2021.

Source: CoinShares

Digital asset manager Coinshares’ executive, James Butterfill stated,

“Digital asset investment products saw inflows totalling US$14.4m last week, breaking the prior 5 week run of outflows. The inflows came later in the week during a period of significant price weakness, suggesting investors, at current price levels, are seeing this as a buying opportunity.”

As per the report, inflows of $14M suggested investors have been taking advantage of the price dip, thus giving support to the “buy the dip” narrative.

However, this isn’t the whole picture. In fact, different cryptocurrencies have a different set of report cards.

Bitcoin

The king coin finally found some good news coming its way. Bitcoin enjoyed inflows last week of $14 million after losing nearly $320 million in outflows over the last five weeks. This represented 1% of AuM over the 5 weeks prior.

The table attached herein can be used to highlight the aforementioned statistic.

Source: CoinShares

Needless to say, altcoins had a slightly different experience.

Ethereum facing troubles

Indeed, this was the case with Ethereum, the market’s largest altcoin. Digital asset investment products based on the second-largest cryptocurrency continued to see outflows. According to the report’s findings,

“Ethereum continues to see outflows, with US$16m of outflows last week. The current 7 week run of outflows now total US$245m, or 2% of AuM, highlighting much of the recent bearishness amongst investors has been focused on Ethereum rather than Bitcoin.”

Meanwhile, among altcoins, Cardano, Polkadot, and “investors’ favourite” Solana saw inflows of $1.5 million, $1.5 million and, $1.4 million, respectively.