Monero, Algorand, Verge Price Analysis: 06 February

Monero scaled above its $155.5-resistance level, with its indicators pointing to more bullishness in the short-term. ALGO was on its path to recovery after the price dipped by over 5% since touching a local high. Finally, XVG failed to rise above the $0.017-resistance and the price could continue to move within its present channel over the next few sessions.

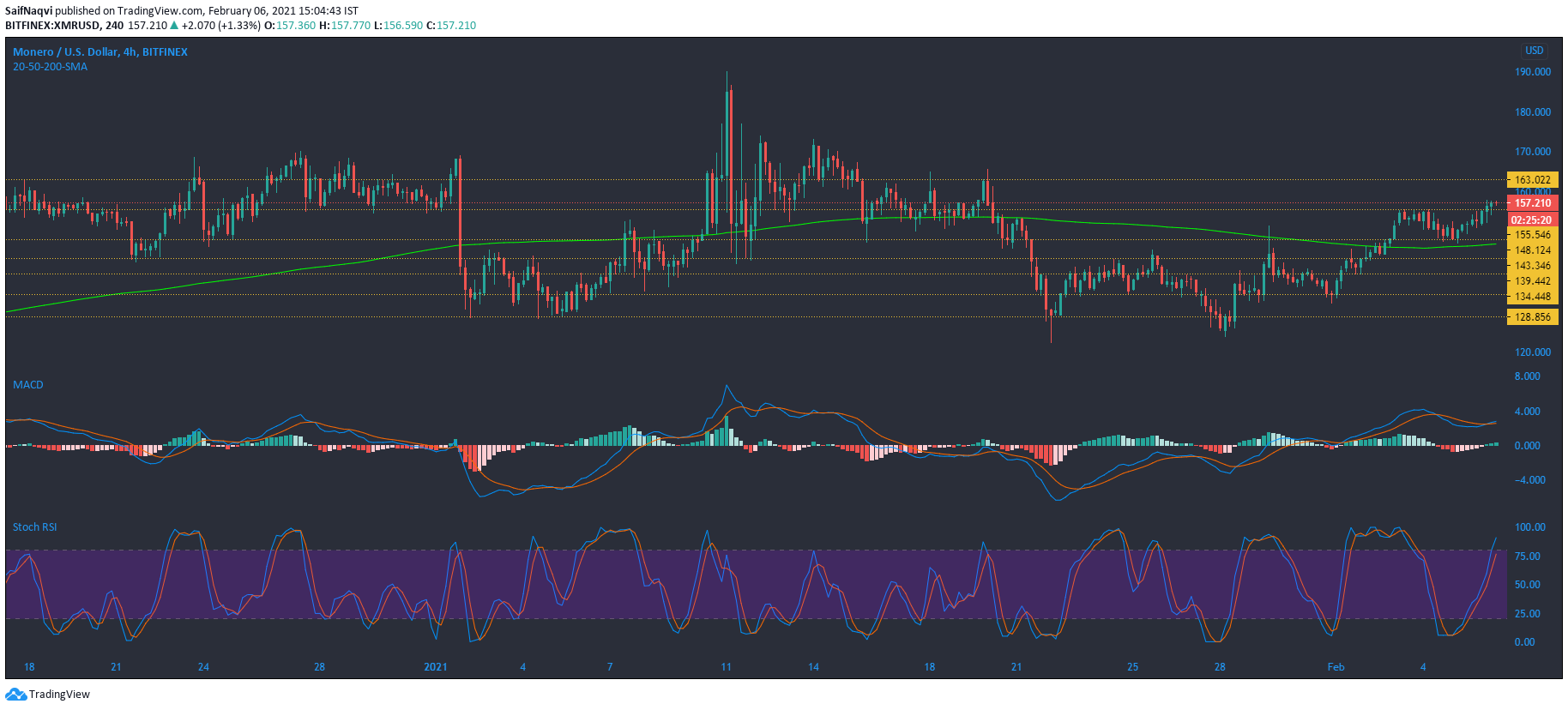

Monero [XMR]

Source: XMR/USD, TradingView

At the start of the month, Monero signaled the onset of an uptrend after the price scaled its 200-SMA (green). More recently, XMR also flipped the $155.5-resistance level as the market bulls maintained control over the price. Additional buying activity, supported by an extended crypto rally, could see XMR rise north of its $163-0resistance.

The MACD was in favor of a bullish outcome after the fast-moving line rose above the Signal line. The Stochastic RSI was not yet at its tipping point and a further rise was definitely on the cards.

On the other hand, a pullback in the broader market could drag XMR lower on the charts. In such an event, the support at $155.5 would likely hold the price.

Algorand [ALGO]

Source: ALGO/USD, TradingView

Algorand’s price recovered from a minor correction at the time of writing as the bulls targeted the $0.85-resistance once again. ALGO’s bullish cycle, coupled with an uptick in the 24-hour trading volumes, made a strong case for a rise towards its local high.

The On Balance Volume highlighted the prevailing buying pressure as the index moved in tandem with the price. The Relative Strength Index settled below the overbought zone, but was pointing north, at press time.

Verge [XVG]

Source: XVG/USD, TradingView

Despite several attempts, Verge was unable to rise above a strong resistance level of $0.017. Some selling pressure mounted on the cryptocurrency at press time as the bears targeted a move below the $0.016-support level. If the sell-off extends over the coming sessions, XVG could challenge the next line of defense at $0.014.

The Awesome Oscillator backed the sellers in the short-term, but momentum seemed weak in the market. Finally, the Chaikin Money Flow stabilized around zero. As the indicators were largely neutral, some rangebound movement can be expected moving forward.