Monero, Ontology, Crypto.com Coin Price Analysis: 06 March

Monero struggled to maintain a level above its $225.5-resistance since the bears were asserting their control on the market. Ontology flipped a key resistance line at $1.05, but looked unlikely to hold on to the aforementioned in the next few trading sessions. Finally, CRO projected rangebound movement as volatility remained on the lower side.

Monero [XMR]

Source: XMR/USD, TradingView

Despite several attempts, Monero’s bulls have been unable to rise above the coveted resistance of $225.5, with the price moving lower on each occasion after touching the upper ceiling. The lack of buying interest could be one of the several factors that have negatively affected the price off-late. The same was evident on the On Balance Volume after it formed lower lows after XMR’s drop from a local high of near $280.

The press time downtrend also put the bulls at the risk of losing out to the 200-SMA. Moreover, the MACD line moved below the Signal line and underlined the bearish conditions in the market. Further selling at the press time price level could put the $168.9-support under the spotlight.

Ontology [ONT]

Source: ONT/USD, TradingView

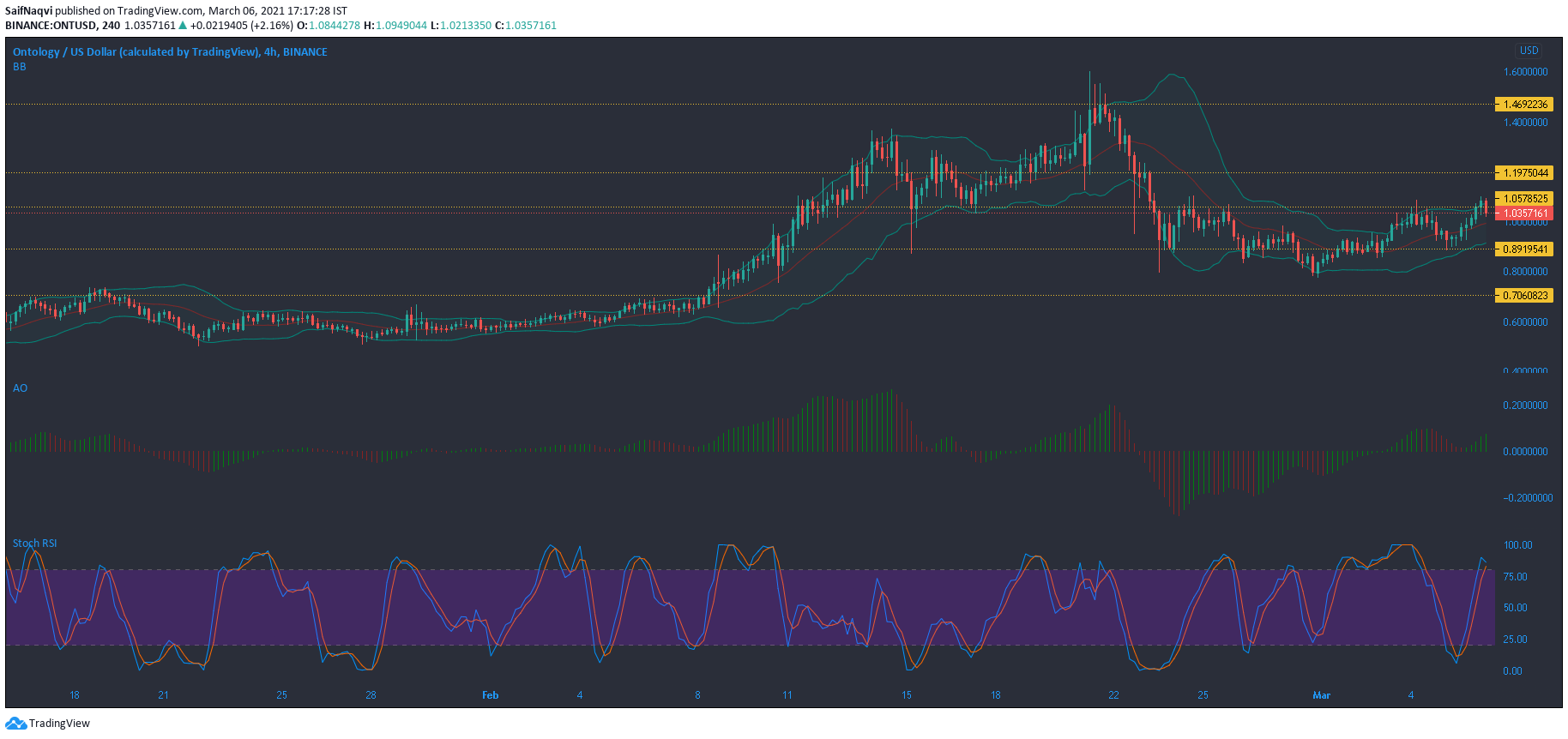

A hike of over 11% in the last 24 hours helped Ontology’s bulls flip a crucial resistance level at $1.05, a point that has not been breached since a sharp pullback in the broader market nearly two weeks ago. The Awesome Oscillator’s green bars continued to rise above the half-mark as momentum rested with the buyers. What remains to be seen is whether the bulls can maintain the price moving forward considering the consolidatory nature of Bitcoin.

The Stochastic RSI was quick to counter any optimism and favored a short-term pullback after pointing lower from the overbought zone.

Crypto.com Coin [CRO]

Source: CRO/USD, TradingView

The psychological impact of Bitcoin’s hike towards its newest ATH in late February was colossal for the broader crypto-market. Altcoins such as Crypto.com Coin, which were rather quiet since the beginning of 2021, spiked by 62% in a single day after the king coin rose north of the 58,000-level. However, the same went both ways, and CRO registered a drop of over 30% the very next day after Bitcoin suffered a correction on the chart.

Since that point, CRO has entered an accumulation phase, largely trading between $0.16 and $0.1.44 as neither side was able to assert dominance in the market. At the time of writing, the Bollinger Bands were constricted and registered low volatility in regards to the price. The ADX rested around the 10-mark and echoed the state of equilibrium in CRO’s market. In the short-term, CRO could continue to move sideways as it awaits stronger signals from the broader market.