Monero [XMR] traders looking for spread betting tips can go…

If you were looking to place a healthy short position this week, Monero [XMR] might be a good option especially after its recent rally.

The altcoin had a solid bull run from its latest local low and had already started showing signs of weakness at press time.

Monero topped out at $152.80 on 20 July, before pulling back to its press time price of $146.30.

Its recent top represents a 54% gain from $96.50, its lowest price in 2022 which it achieved on 18 June.

XMR’s latest price action suggests that the bulls are running out of strength. More importantly, this observation took place right above the 0.236 Fibonacci retracement line, mapping from the top of the latest bear market to its bottom.

XMR’s price action crossed above the Fibonacci retracement line slightly before showing signs of momentum weakness. This was also after crossing above its 50-day moving average for the first time since end of May.

The coin is still not overbought despite the latest upside. This means there might still be some wiggle room for the bulls before it enters into the Relative Strength Index’s (RSI) overbought zone.

However, this would only happen if there is enough buying volume to push the price up some more.

Taunting the bear

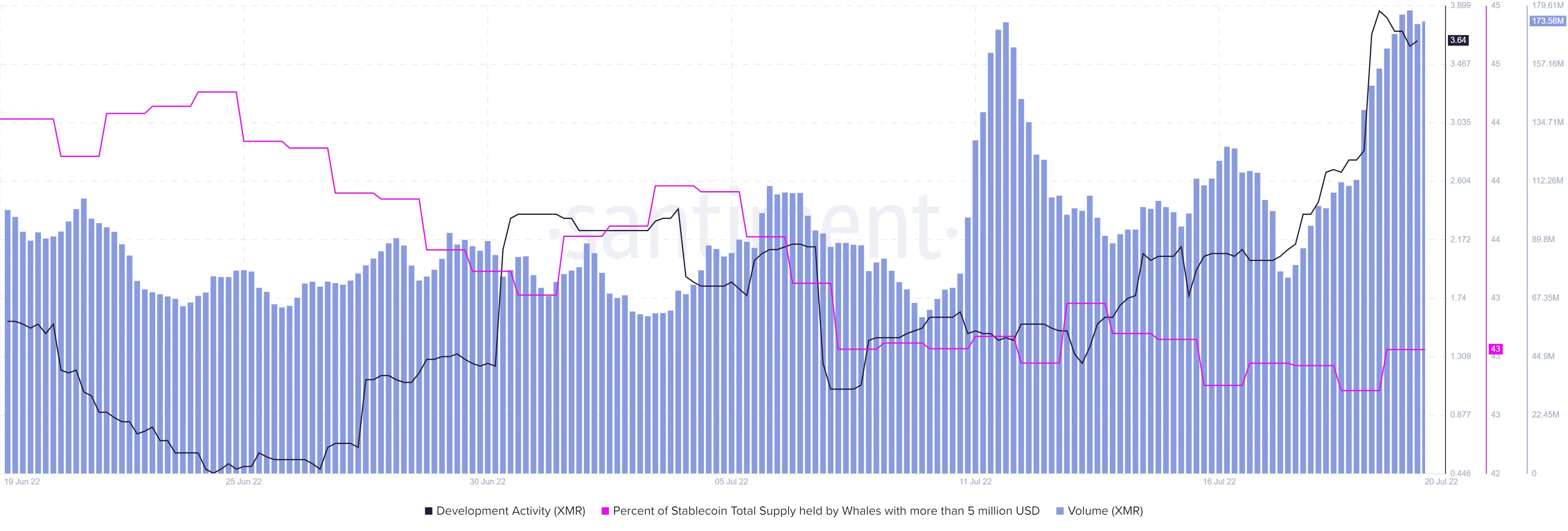

Well, XMR’s latest upside was backed by strong volume which reached its four-week peak in the last 24 hours of press time.

Although this volume increase and solid price performance paint a healthy picture for Monero, the supply held by whales demonstrated an unfavorable outlook.

Additionally, the supply held by whales improved by a small margin despite the strong uptick.

A sign that whales are not yet confident enough to shed more funds into the market. It also signifies that most of the price action was controlled by the retail segment.

The retail market can support strong short-term price rallies but a bearish retracement is almost always served up if whales don’t provide enough support.

This might be the current outcome for Monero, hence the potential for a significant reversal.

Hopes of a soft landing

Monero’s latest rally took place on the heels of strong development activity. It recently revealed its latest developments as part of its upcoming protocol upgrade that will release on 13 August.

We're excited to announce that CLI 'Fluorine Fermi' v0.18.0.0 has been released!https://t.co/tEt6YdjIxp

'This is a major release, which a user, service, merchant, pool operator, or exchange should run to be sufficiently prepared for the scheduled protocol upgrade of August 13'

— Monero (XMR) (@monero) July 20, 2022

Perhaps the upgrade may cushion XMR from a sharp retracement.

Investors have something to look forward to, which may potentially encourage them to hold on to their XMR for more upside in the near future.