MultiversX makes these moves to reignite its ailing DeFi ecosystem

- MultiversX has launched a new security feature for its users.

- EGLD’s accumulation has climbed steadily in the past few weeks as the price grows.

In November 2022, Elrond decided to rebrand as MultiversX [EGLD], a decentralized blockchain network focusing on the metaverse. The rebrand came with a new roadmap outlining new products that the protocol intended to launch in 2023, some of which included features to help its DeFi vertical grow.

Read MultiversX’s [EGLD] Price Prediction 2023-2024

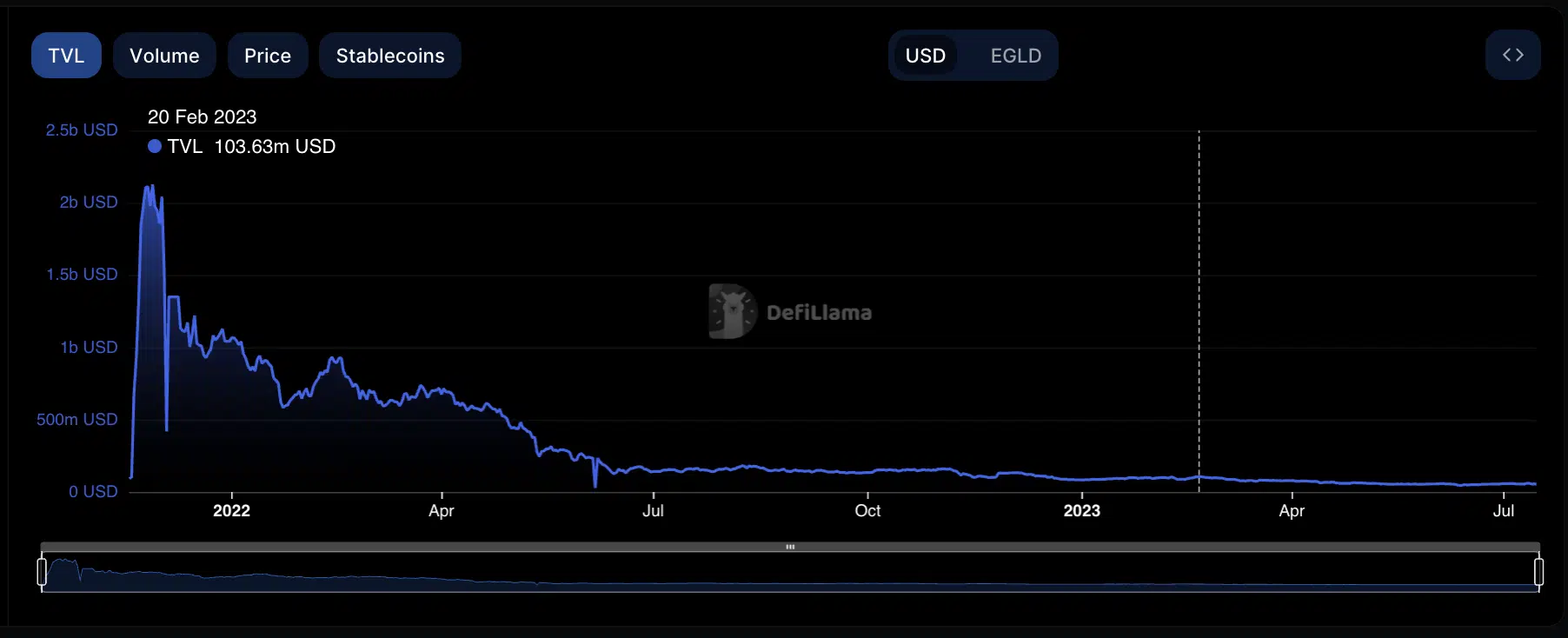

While some of these have been launched (MultiversX Wallet, xExchange, MultiversX Bridge, and xMoney), MultiversX’s TVL has declined to its lowest level since June 2022.

According to data from DefiLlama, the protocol’s TVL stood at $54.26 million at press time. As of December 2021, this was pegged above $1 billion. So far this year, the project’s TVL has declined by 35%.

Let’s beef up security

With a surge in DeFi hacks and exploits, MultiversX announced the launch of “Guardians,” an opt-in, on-chain two-factor authentication (2FA) security standard, in a bid to increase network activity on the protocol.

As users have the assurance of fund safety, they are more likely to deposit additional funds into the decentralized exchanges (DEXes) housed within MultiversX, resulting in an increase in TVL.

Guarded accounts & guarded transactions – two terms soon to become the norm in the crypto world.

What's up with them and how #MultiversX users can enjoy bulletproof protection for their wallet accounts starting today, after epoch change.https://t.co/8EsNEldZ7W pic.twitter.com/QcHwwLnvGv

— Lucian Mincu | MultiversX.com (@lucianmincu) July 14, 2023

According to co-founder Lucian Mincu, in the control of digital assets, ownership of the vault is separate from owning the key, and losing control of the key means losing exclusive access.

To address this, “Guardians” was launched to enable users to become the “actual owners” of their wallet accounts. By using Guardians, users can enforce their consent and approval for any fund movement within their vaults.

EGLD sees increased accumulation in the last few weeks

MultiversX native token EGLD registered a 24% price uptick last month, according to data from CoinMarketCap. According to the cryptocurrency price tracker, the altcoin exchanged hands at $36.48 at the time of writing.

Is your portfolio green? Check out the EGLD Profit Calculator

An assessment of EGLD’s price movement on a daily chart revealed a steady rally in its accumulation in the last few weeks. Key momentum indicators were positioned in uptrends above their respective center lines at press time.

The alt’s Relative Strength Index (RSI) was 59.58, while its Money Flow Index (MFI) rested at 65.30 at press time.

Likewise, the asset’s Chaikin Money Flow (CMF) logged a positive value of 0.27. A CMF value above the zero line is a sign of strength in the market as it signals the entry of the required liquidity into the market.