NEAR: Troubled waters of Q4 2022 bear fruit – Protocol records all-time high in…

- Despite the market decline in 2022, NEAR saw an uptick in user activity.

- NEAR token might be due for a price reversal.

In its assessment of NEAR Protocol’s [NEAR] performance in Q4 2022, cryptocurrency research firm Messari found that the network experienced a surge in user activity in the last three months of the tumultuous trading year.

Read NEAR Protocol’s [NEAR] Price Prediction 2023-24

In its report titled “State of NEAR Q4 2022,” Messari noted that NEAR’s network activity showed significant growth year-over-year despite the bear market and unprecedented turmoil.

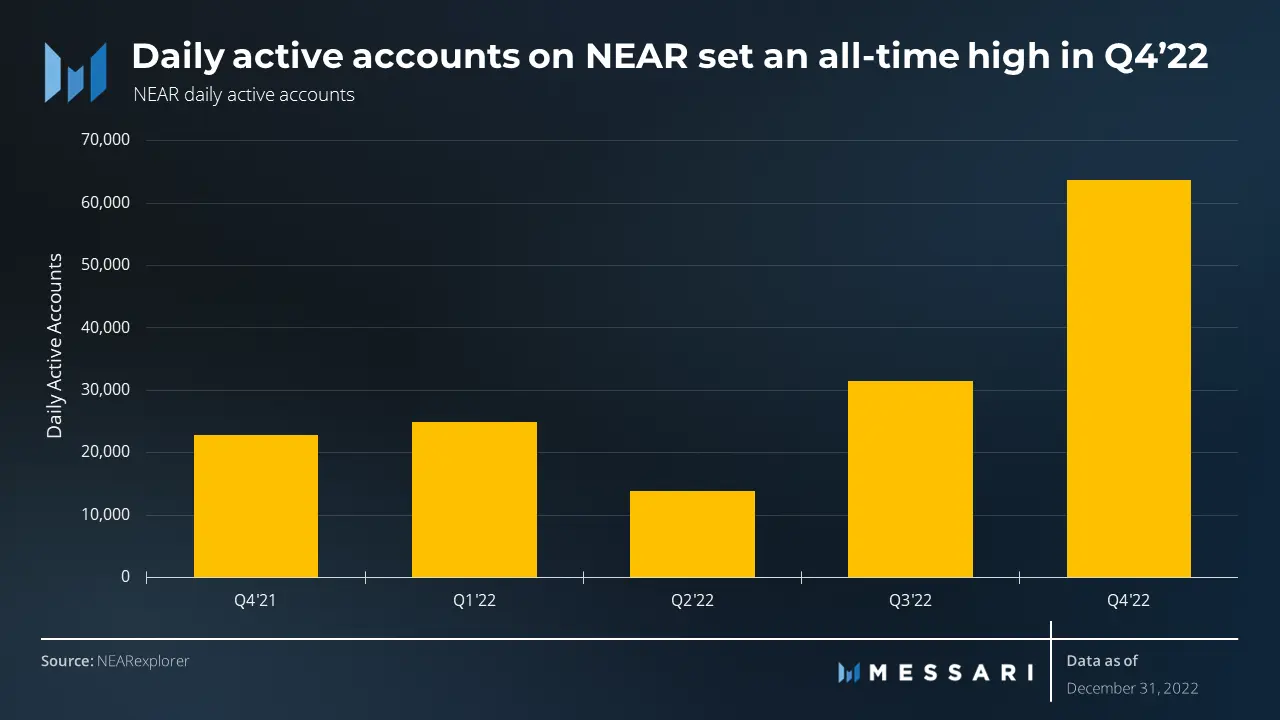

Between October and December 2022, daily active accounts on NEAR clinched an all-time high. According to the report, the number of daily active accounts increased nearly three times compared to the previous year.

Regarding what might have caused the spike in active accounts on NEAR, Messari found that the launch of Sweatcoin [SWEAT] as Sweat Economy in July was the main contributory factor. Messari noted:

“In Q4, the momentum continued as Sweat surpassed 16 million unique wallets, 4 million daily active users, and 200 million SWEAT staked. While new account creation slowed, the sustained increase in active accounts indicates that the new users are remaining engaged.”

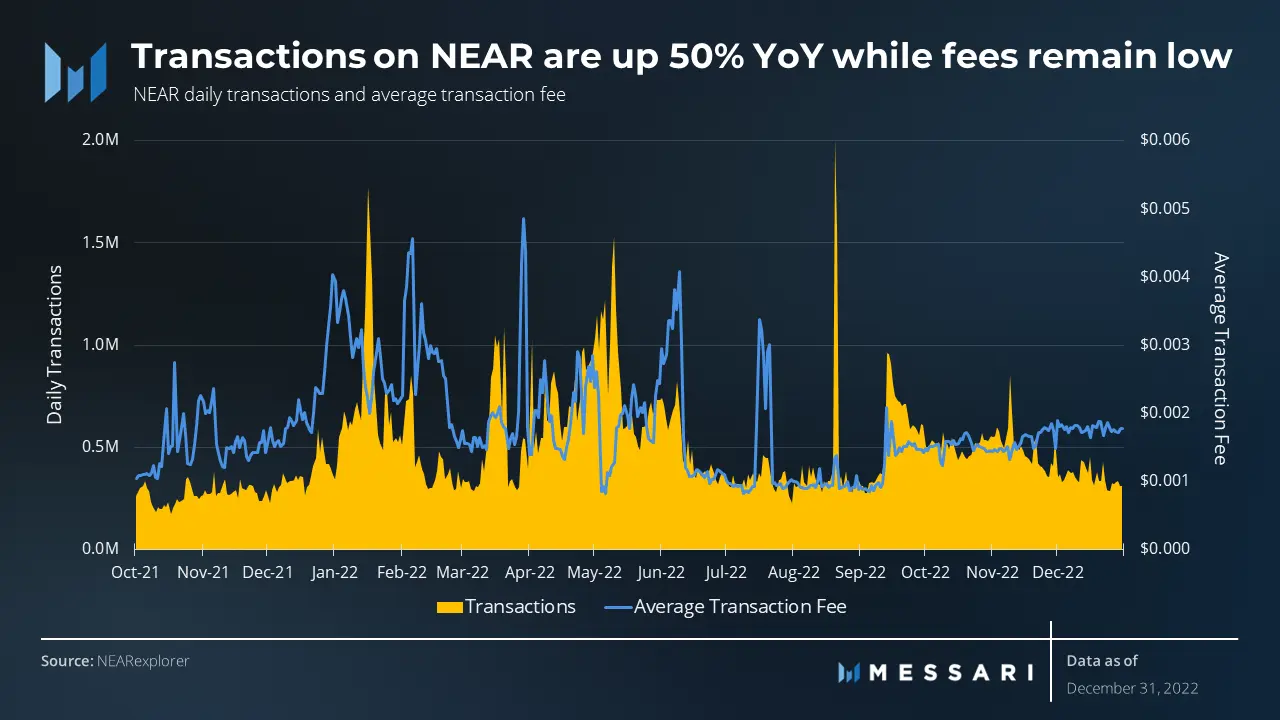

Likewise, the daily transactions count on the network grew by 50% on a YoY basis. Within the 90-day period under consideration, transactions processed on NEAR totaled 41.71 million, a 2.4% growth from the 40.73 million transactions processed on the network in Q3.

Interestingly, NEAR network recorded a spike in transactions despite having low transaction fees in Q4 2022, averaging at less than one cent.

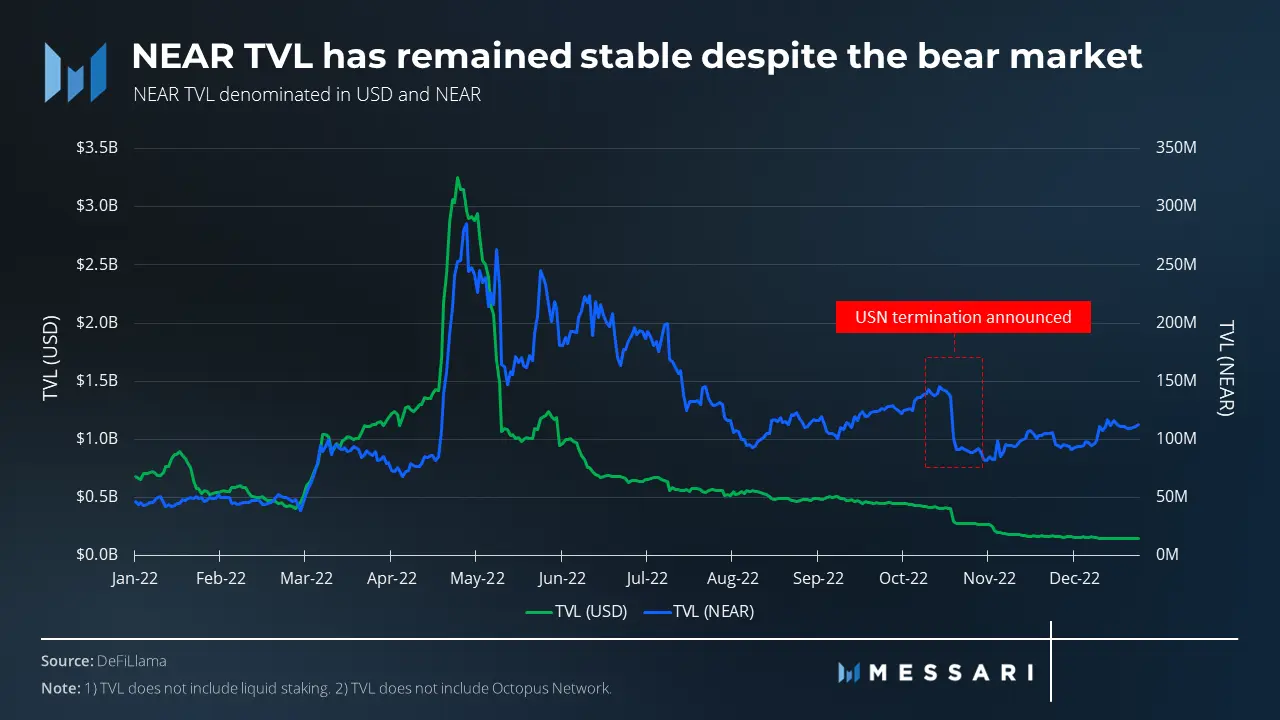

Furthermore, in the fourth quarter of 2022, NEAR’s total value locked (TVL) experienced a 10% decrease quarter-over-quarter (QoQ), but a significant 160% increase YoY from 43 million to 113 million. Messari noted that was a remarkable achievement, particularly considering the discontinuation of its USN stablecoin in the same quarter.

The steady growth of TVL on the NEAR Network suggested that it continued to attract investors and maintained its position in the market.

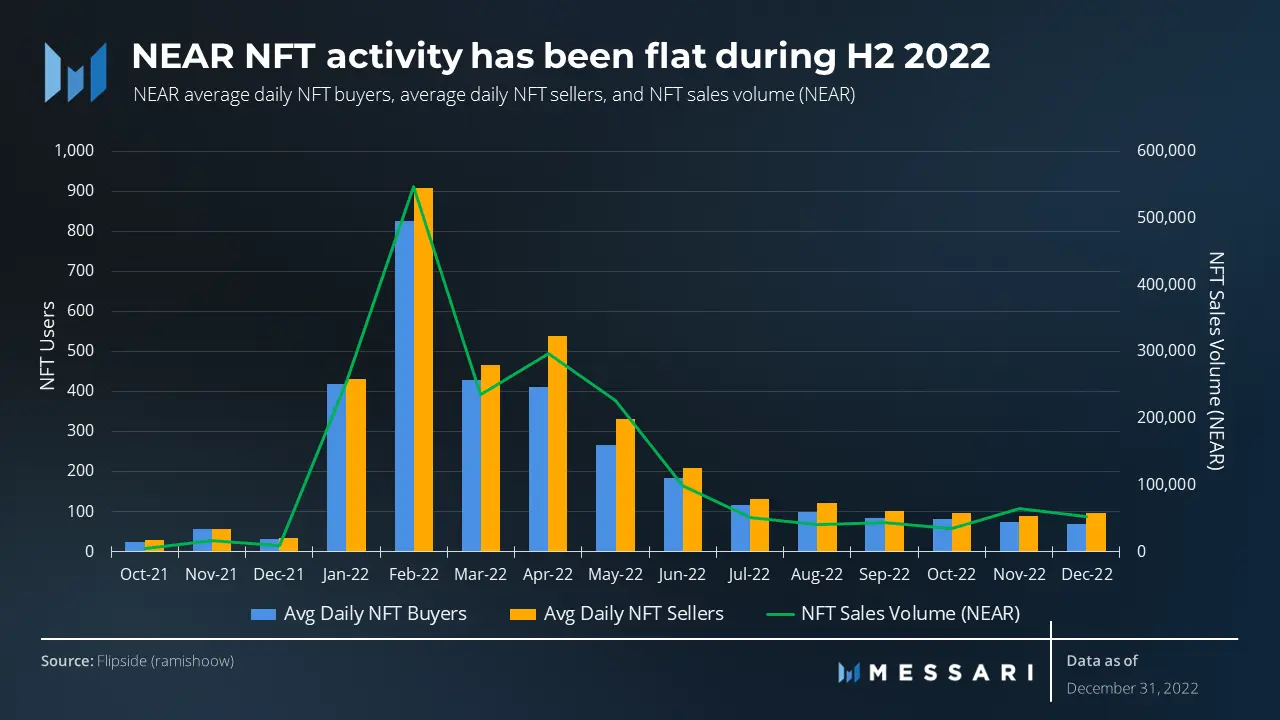

As for the chain’s NFT ecosystem, Messari found:

“NEAR’s NFT-related metrics remained relatively unchanged during the latter half of 2022. However, when compared to the same period in the previous year, NFT Sales Volume on NEAR has risen by 374%, and the average daily number of NFT buyers and sellers has increased by 101% and 133%, respectively.”

NEAR’s performance on a year-to-date basis

At press time, one NEAR token was obtainable for $2.29. In the last month, the alt’s price has risen by 82%, per data from CoinMarketCap.

How much are 1,10,100 NEARs worth today?

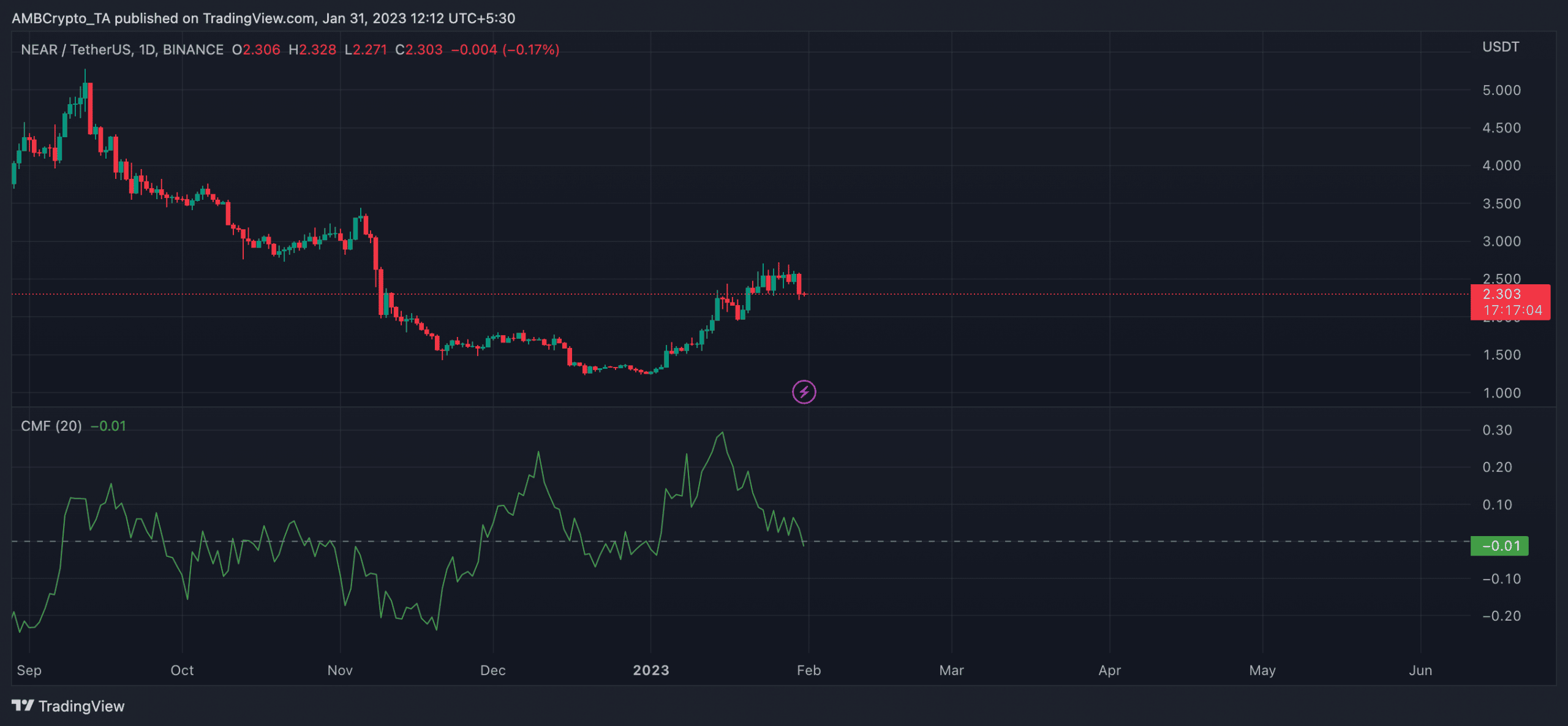

An assessment of NEAR’s performance on a daily chart revealed that a price correction might be underway. While its price rose in the past few weeks, NEAR Protocol’s Chaikin Money Flow (CMF) embarked on a downtrend since mid-January.

This created a bearish divergence that is found in markets where bullish sentiment was on a decline. At press time, the alt’s CMF was negative at -0.01. Thus, sellers were gearing up to regain market control.