New ATH for Cardano, but is it REALLY something investors can bank on

Cardano is in the news today after ADA finally breached its previous ATH levels over the last few hours. In fact, the crypto climbed as high as $2.54, well over the price levels last seen in May. At the moment, ADA seems to be the only major cryptocurrency to have overturned the effects of the 19 May crash.

Ergo, the question – Is this a sign that proves ADA is a better option than Bitcoin and Ethereum? Should you now switch your investments and put your money in Cardano? Let’s look at what data tells us.

Alonzo-fueled ATHs for Cardano

In less than 3 days, the altcoin climbed from $1.9 to $2.5. This represented a 30.42% rally, on the back of a 137.8% rally over the last 30 days. Before that, the altcoin was struggling to even break $2. However, with the upcoming Alonzo update, social sentiment seems to have fueled the crypto’s price performance.

Now, with ADA soaring, investors might just move their money out of Bitcoin and Ethereum thanks to a host of reasons.

Cardano reached a new ATH of $2.5 | Source: TradingView – AMBCrypto

Consider this – At the moment, both BTC and ETH are 25% and 22% away from their respective all-time highs. Not only that, but when it comes to investments and returns, Cardano has been winning hands-down since February too.

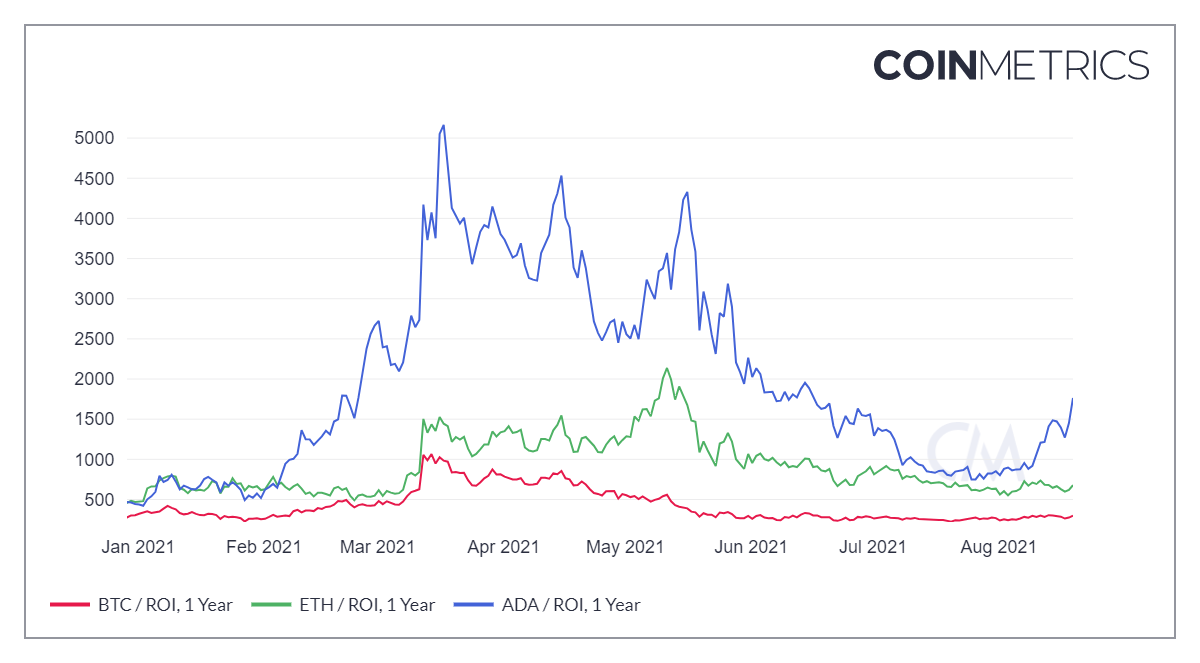

ADA’s return on investment (ROI) has been significantly better for months now. Even after their recent rallies, the two cryptos failed to beat ADA. Presently, Cardano’s RoI looks promising as it is 9x better than Bitcoin and 3x higher than Ethereum.

Cardano has a better ROI | Source: Coinmetrics – AMBCrypto

Do investors agree though?

As a matter of fact, they do. When social metrics are taken into consideration, Cardano’s social volumes appear to be remarkably better than other coins. More than that, ADA investors are much more profitable than any other holder right now.

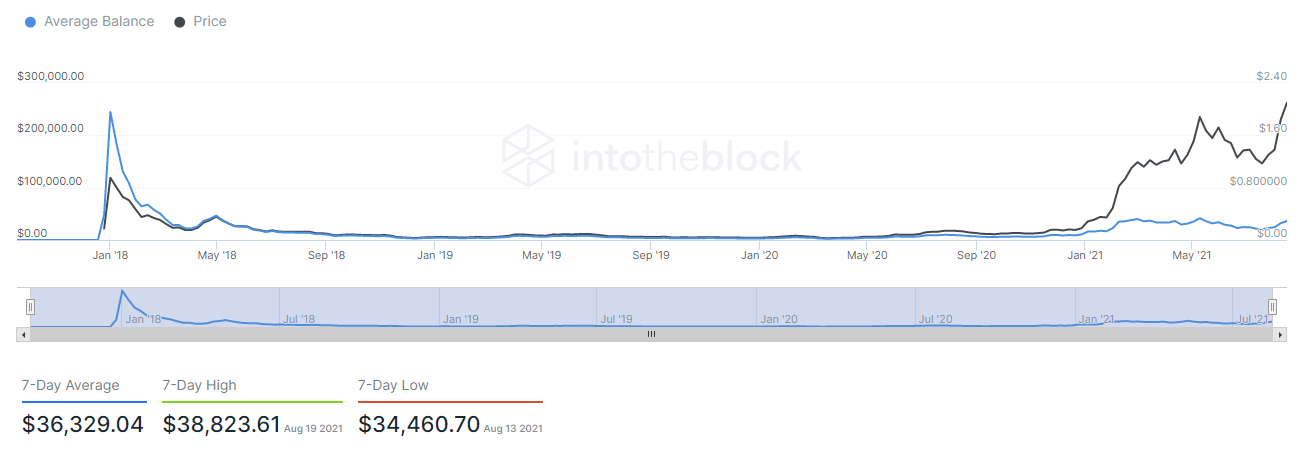

The average balance on Cardano addresses was $36k, at press time, while the same for BTC and ETH addresses was $22k and $6k, respectively.

Cardano average balance | Source: Intotheblock – AMBCrypto

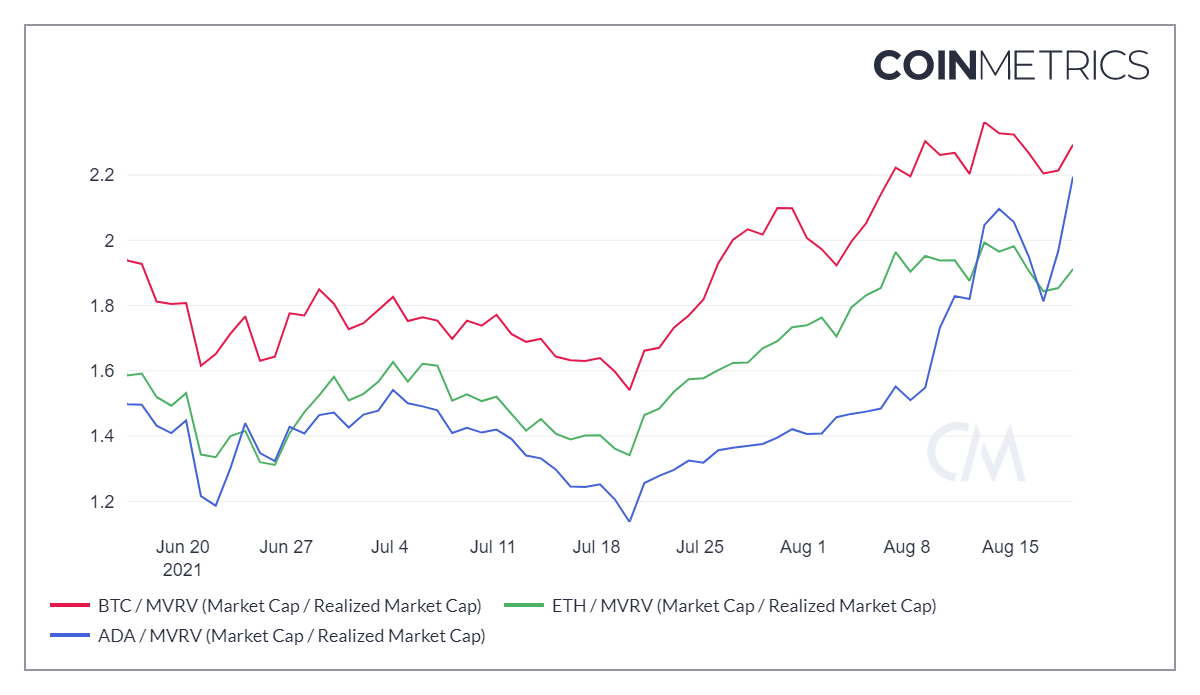

Additionally, looking at the network’s properties, the MVRV suggested that Cardano has a better value than ETH. What’s more, it is also inching closer to crossing over BTC.

Finally, the transaction speed for Cardano has been better than either of the others. Even back in 2017 during the test phase, Cardano was able to process 257 tps. On the contrary, BTC and ETH, to date, can only process 4.6 and 30 TPS, respectively.

MVRV comparison | Source: Coinmetrics – AMBCrypto

Despite the London hard fork, ETH has not been able to generate enough craze to lure investors because Cardano seems to be promising better use cases.

This argument, however, does not affect Bitcoin since it is widely considered a Store of Value. What this means is that for many, Cardano may be the right option.