On the up, yes, but here’s what Lightning Network means for Bitcoin’s MoE credentials

Over the last few months, the Bitcoin community has seen a lot of positive developments about the Lightning Network. In fact, on-chain data and activity levels seemed to support the narrative too. At the moment, Bitcoin’s medium of exchange characteristics are re-surfacing as well.

However, a part of the ecosystem remains skeptical. A 2nd layer payments solution that remained obsolete for the better part of the last two years, suddenly being revived on the adoption front, is momentary to some. There are actually many who even argue this is solely due to the market’s bullish trend.

However, a recent report analyzed the sustainability of the network for the next few years, and for the 1st time, the Lightning Network might seem like a credible ecosystem.

Slow and steady wins the race?

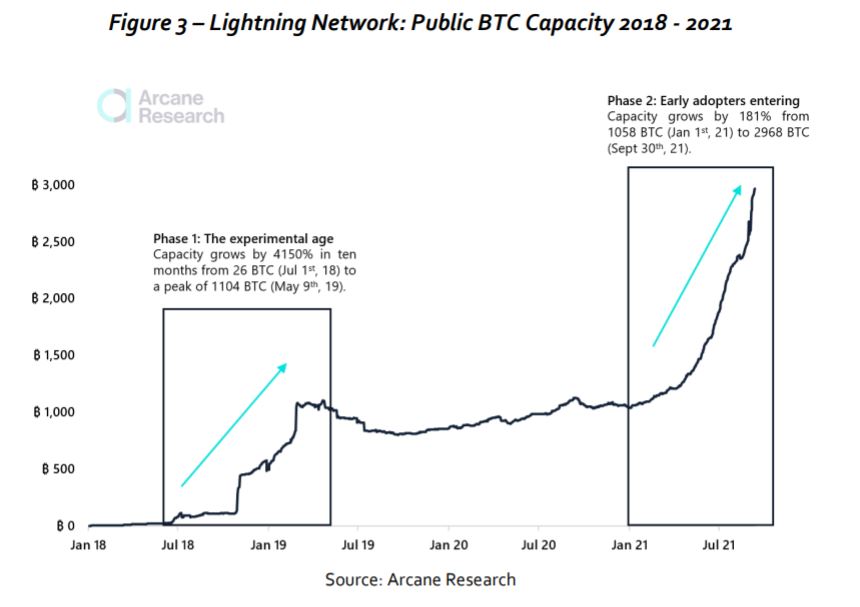

Patience is a virtue seldom shared by most people in the crypto-ecosystem as most spectators are often looking for the next best thing in the space. When the Lightning Network was introduced in mid-2018 and early 2019, the initial response was positive as the network capacity peaked at 1104 BTC by May 2019.

During that time, Bitcoin crossed $10,000 for the first time in a year. However, the network capacity did not increase after that, stagnating in the same range. Soon after, the community lost interest.

Fast forward to September 2021 and the network capacity has jumped to ~3000 BTC, up by almost 190% since January 2021. Now, according to Arcane Research, this might not actually be the entire magnitude of growth.

The aforementioned report stated that the available data is only based on mainstream usage provided through wallet providers They do not include other activity from developers, channel rebalancing, and other b2b transactions.

Bitcoin lightning’s actual user access

Now, the recent adoption perspective has taken off after the legal tender announcement in El Salvador. However, the scope of additional users might be a legitimate factor behind Lightning’s future functionality. From August 2021 to September 2021, the number of users increased from a mere 87,000 to a whopping 9.7 million users. That’s a growth rate of 11,164%.

The important thing to note here is that these numbers weren’t pumped only by El Salvadorans.

For instance, on 1 October, President Nayib Bukele claimed that 2.7 million people onboarded the Chivo wallet that used the Lightning Network.

That means around 5 million other users were generated from other regions. Interestingly, Paxful, with a userbase of 7 million, announced its own Lightning Network integration on 14 September.

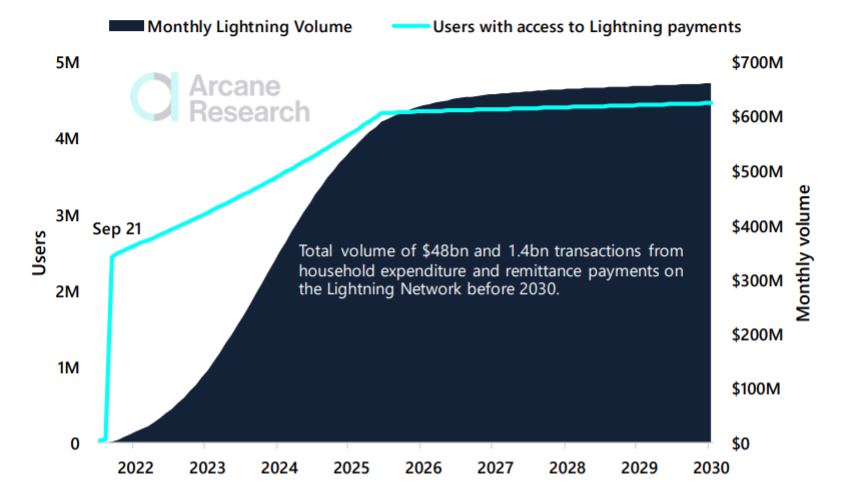

Source: Arcane Research

As far as the speculative adoption curve is concerned, the report added that by 2030, the total remittances completed would be worth around $48 billion. What’s more, it is projected that over 1.48 billion transactions will take place.

While these number projections should be taken with a pinch of salt, these were only El Salvador’s numbers. That means that if other countries with weak banking access and weakened fiat value follow El Salvador’s blueprint, overall remittances will be much higher.

Bitcoin as an MoE when other cryptos do it better?

Over the last two years, Bitcoin’s position has evolved since it was largely classified as a Store-of-Value asset. Its transactional capacity fell short of other crypto-projects and it was widely accepted that BTC had a different role to play in the industry.

Even so, with the resurgence of its Lightning Network, an argument can be made that the 2nd layer payments network is already behind other well-established projects.

However, Bitcoin’s strength remains in its rigidness. And the fact that it has never failed. Not once.

For example – Ethereum’s code is always under a constant process of development and it has had coding issues from the beginning. It started with The DAO, which led to the creation of ETC. Then there were multiple Parity bugs which led to millions of dollars being lost on Ethereum.

Now, agreed it happened in 2017 and the network is much more secure now. However, other casualties of the network continue to rise.

Consider the largest DeFi hack of $600 million – Poly Network attack. The hacker drained assets from Binance Chain, Ethereum, and the Polygon network. This highlighted that smart contracts remain vulnerable to contract calls. The hacker did reportedly return the funds, but the glaring loopholes were pushed under the limelight.

Irrespective of Bitcoin being slow and sticking to its old protocol, it remains impenetrable to date. That is something the larger community will begin to respect more and more if BTC’s Lightning Network actually improves its MoE characteristics.

The Lightning Network is not without its fair share of shortcomings. However, Bitcoin brings more trust than any other crypto. This could be a big deal for the 2nd layers payment network if growth continues to be parabolic.

![Bonk Coin [BONK]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-19-1-400x240.webp)