One ETH is worth more than one ounce of gold, here’s what this means?

The cost of 1-ounce of gold in USD is $1824, at the moment and the price of 1 ETH is $1871. This means that if you had bought one ounce of gold a year ago, you would have an unrealized profit of 15.84 percent on your investment currently. However, if you had bought ETH, a year ago when one ounce of gold was worth $1575.10, you would be in possession of 5.76 ETH and the same is the equivalent of $10776.96 – a 584 percent return on investment.

After discounting a few Ethereum in Network fees, considering the fact that most traders on Crypto Twitter including CZ of Binance have ranted about it, the return is still much higher than a Gold investment.

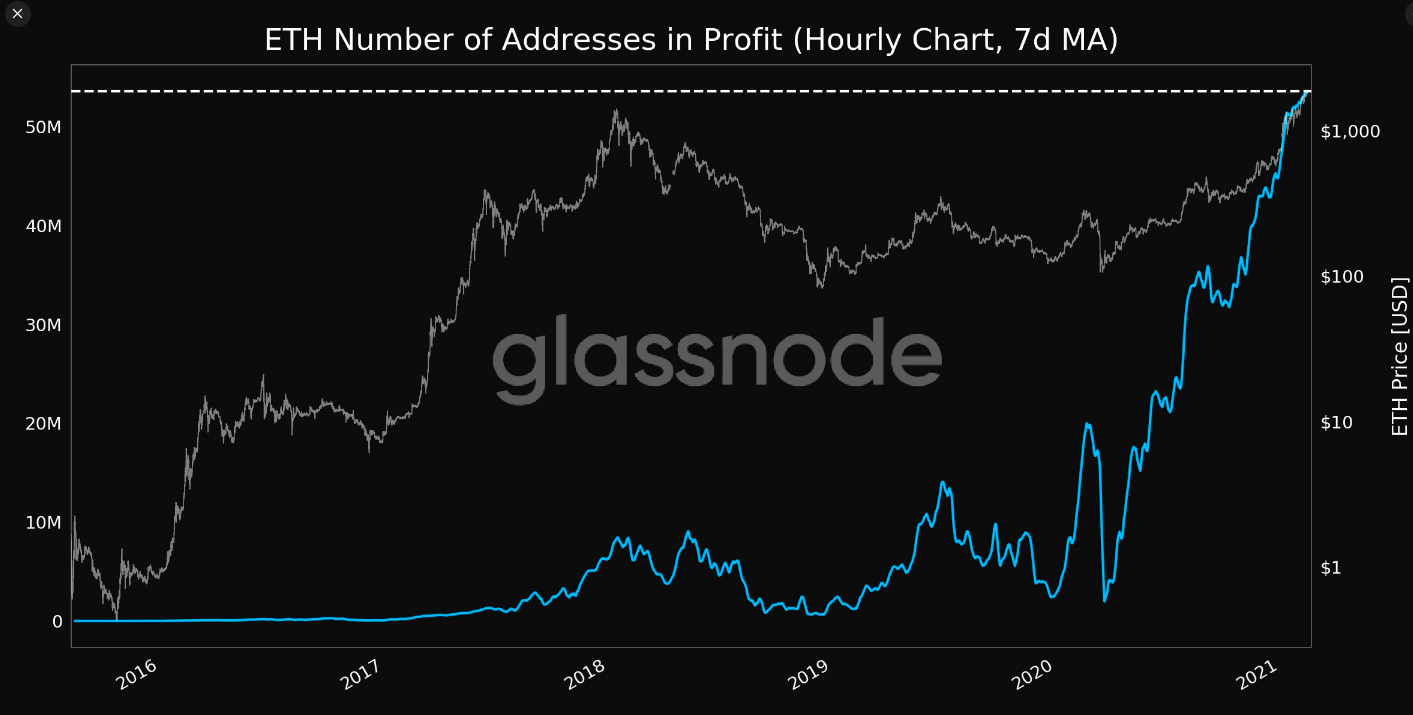

So what does this mean for Ethereum’s price rally and trend? To analyze the trend consider a curious metric, the number of addresses in profit at a 7-day moving average.

ETH number of addresses in profit || Source: Twitter

Earlier today, the number of Ethereum addresses in profit hit an ATH of 53.5 million based on the above chart from Glassnode. Despite a high number of addresses sitting on unrealized profits, Ethereum’s price has not given in to the selling pressure. The price is currently closer to the new ATH above $1800 and on-chain analysis suggests that the sentiment among traders is neutral, and for Ethereum that is a positive sign for the price since that leaves a place for vertical price growth.

Interestingly, Ethereum’s correlation with Bitcoin is at 0.85, and though there are talks of Bitcoin flipping Gold, Ethereum is emerging as a competitor having crossed the price of 1-ounce of gold, in less than a decade of its existence. This is a bullish sign in the long-term as more institutional investment is targeting Bitcoin, and Ethereum may benefit from the spillover.

Major altcoins, in the top-100 based on market capitalization, have broken out, and the alt season fractal ensured that traders were sitting on unrealized profits with double-digit growth. Ethereum stands out as an enabler of a majority of alts and the DeFi ecosystem and a price correction in the short-term is only indicative of upcoming growth.