Can OpenSea drown if PFP NFTs continue to not captivate investors

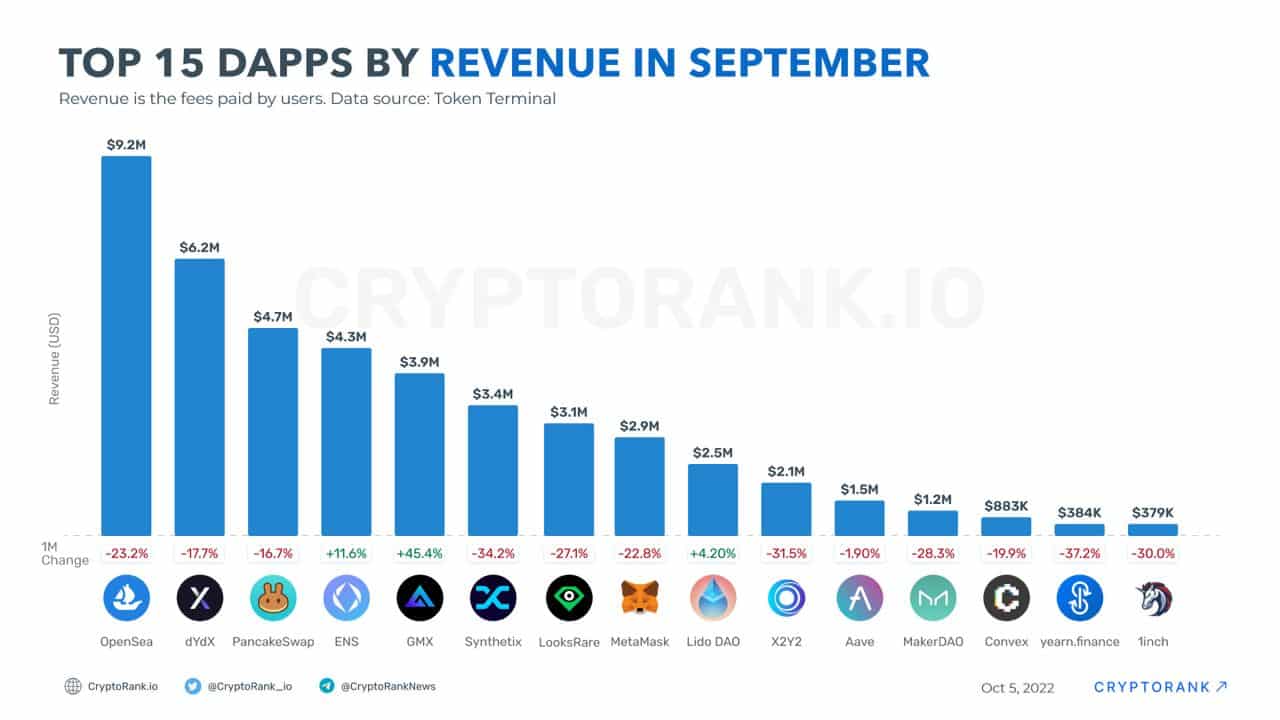

With $9.2 million netted as revenue, OpenSea, the world’s largest NFT marketplace led dYdX, PancakeSwap, and Ethereum Name Service with the highest monthly growth in September. This, according to data from cryptocurrency research platform Cryptorank.

Interestingly, the $9.2 million accrued in revenue by OpenSea in September represented a 23.2% decline in the platform’s revenue in August.

All is not good in the hood

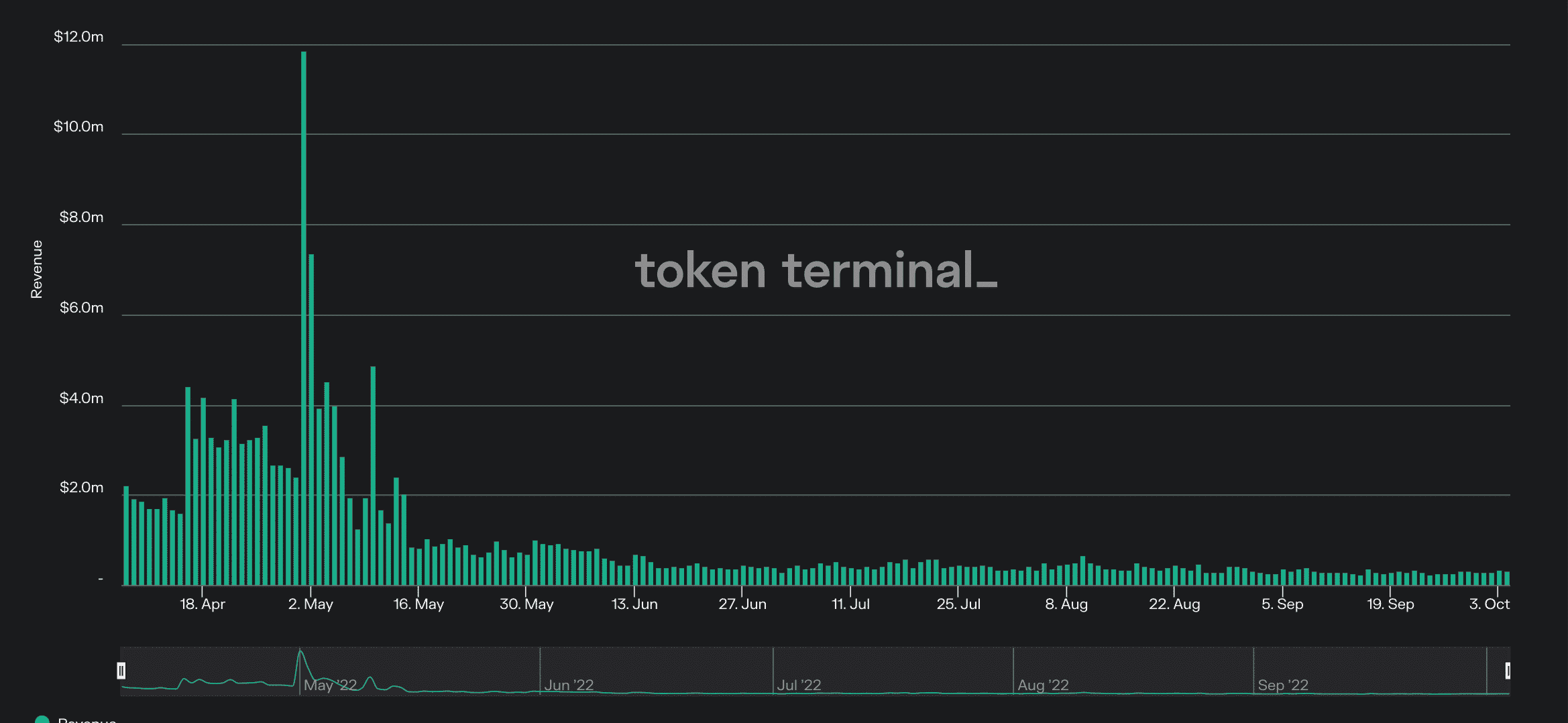

Although OpenSea ranked as the decentralized application (dApp) with the most revenue in September, data from Token Terminal revealed that there had been a consistent fall in daily revenue on the platform over the past few months.

According to the crypto-asset data provider, in the last 180 days, daily revenue on OpenSea dropped by 59%. It dropped by 77% in the last 90 days.

It is common knowledge that tightening economic conditions and a general decline in the cryptocurrency market have led to investors’ interest shifting from speculative asset classes to those with less associated risks. This has led to a severe decline in the demand and sales volume for NFTs as a class of digital assets.

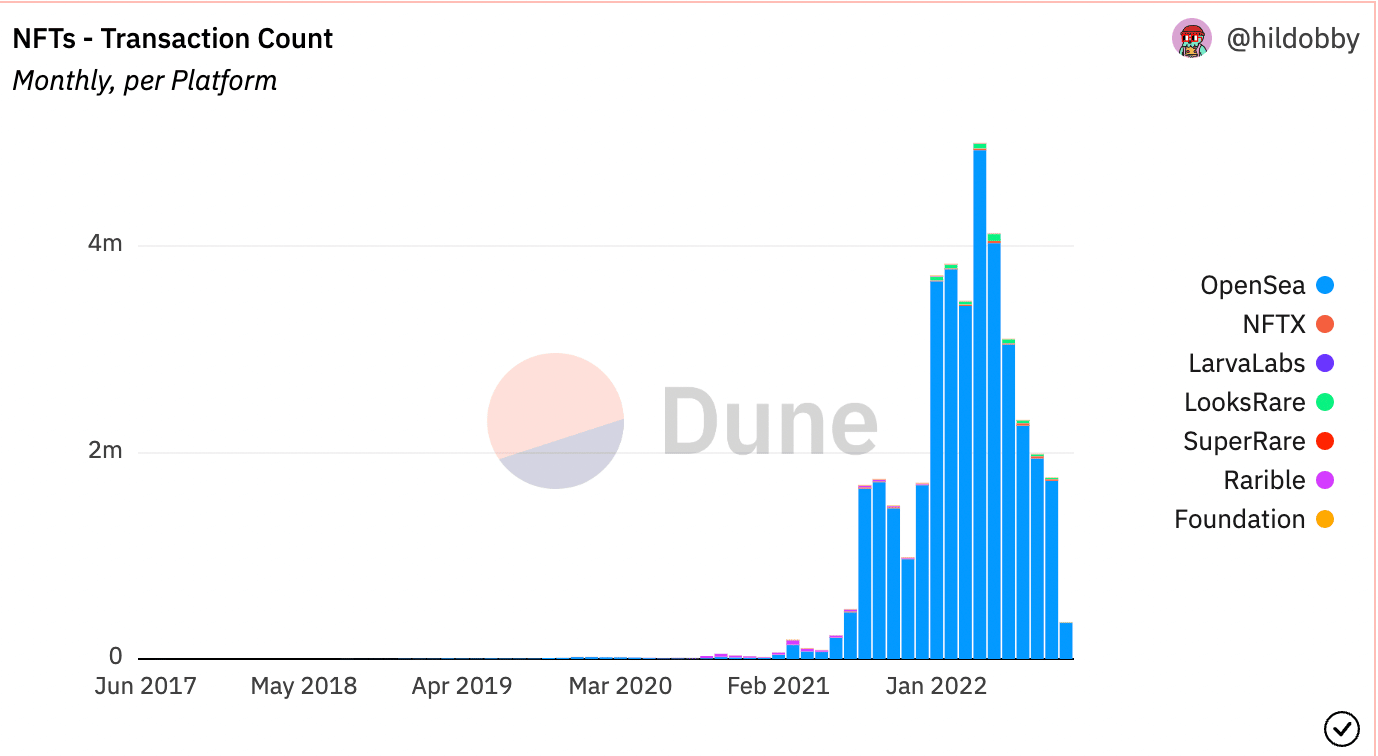

Per data from Dune Analytics, sales volume across NFTs marketplaces has plummeted since the beginning of the year. Leading the squad with the most decline, monthly NFT sales volume on OpenSea has dropped by 94% in the last ten months. For context, OpenSea closed January with a sales volume of $5.88 billion. By the end of September, this had dropped to $343 million.

Likewise, LooksRare, with $11 billion in sales volume in January, saw a 97% decline in the same by the end of September.

Willing buyers and sellers who use these platforms facilitate buy and sell transactions on NFT marketplaces. However, with a persistent decline in interest in PFP NFTs, the count for monthly NFT buyers and sellers has dropped significantly since the year started.

Data from Dune Analytics showed that buyers and sellers across NFT marketplaces in January totalled 441,363 and 292,904, respectively. However, by the end of September, these figures had declined by 94% (226,959 buyers) and 16% (252,908 sellers).

With a fall in buyer and seller count across NFT marketplaces, NFTs transactions count also fell. According to Dune Analytics, OpenSea logged the highest decline in transactions count since January. The marketplace closed January with 4.9 million NFT transactions. However, as investors’ interest dwindled as the year progressed, the transaction count was pegged at 1.7 million by the end of September.

With the NFT ecosystem largely dominated by PFP projects, a consistent decline in this category of NFTs might lead to heightened investors’ interest in music NFTs, gaming NFTs, and so on.