Optimism [OP] hit a key resistance, but an extra 35% hike is possible if…

![Optimism [OP] hit a key resistance, but an extra 35% hike is possible if...](https://ambcrypto.com/wp-content/uploads/2023/02/ahmed-zayan-ABUWC-0a7_A-unsplash-scaled-e1677302423558.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Optimism faced a key hurdle at $3.225.

- A whale category was primarily responsible for selling pressure witnessed at press time.

Optimism [OP] defied Bitcoin’s [BTC] price action and hiked 33% between Wednesday and Friday (22 and 24 February). One of the driving factors behind the rally was the announcement of the Optimism Superchain. A bold step to push Ethereum to an internet-level scale to drive mass adoption.

However, the rally reached a key resistance level of $3.225 at the time of writing, which could delay the momentum uptrend.

Read Optimism [OP] Price Prediction 2023-24

When can bulls re-enter the market?

Optimism’s [OP] price action in February chalked a parallel channel. It oscillated between $3.225 and $2.1 but hit the upper boundary and could retract, clearing some of the gains made in the last few days.

Is your portfolio green? Check out the OP Profit Calculator

Long-term bulls could wait to re-enter the market if OP dropped to $2.837 or the channel’s mid-level of $2.657. However, the ideal entry for a long position would be $2.479 or the channel’s lower boundary of $2.1.

The target would be the overhead resistance level of $3.225 or a bullish breakout target of $4.367, based on the channel’s height. A hit on the bullish target would offer an extra 35% hike.

A break below the parallel channel’s lower boundary of $2.1 would invalidate the bullish thesis. The drop could be checked by $1.911 or $1.500.

The OBV (On Balance Volume) has been rising since the beginning of 2023, showing a genuine demand for the token. Although RSI exhibited a divergence to price action, the value was above 50, hence bullish.

OP saw a high positive weighted sentiment, but …

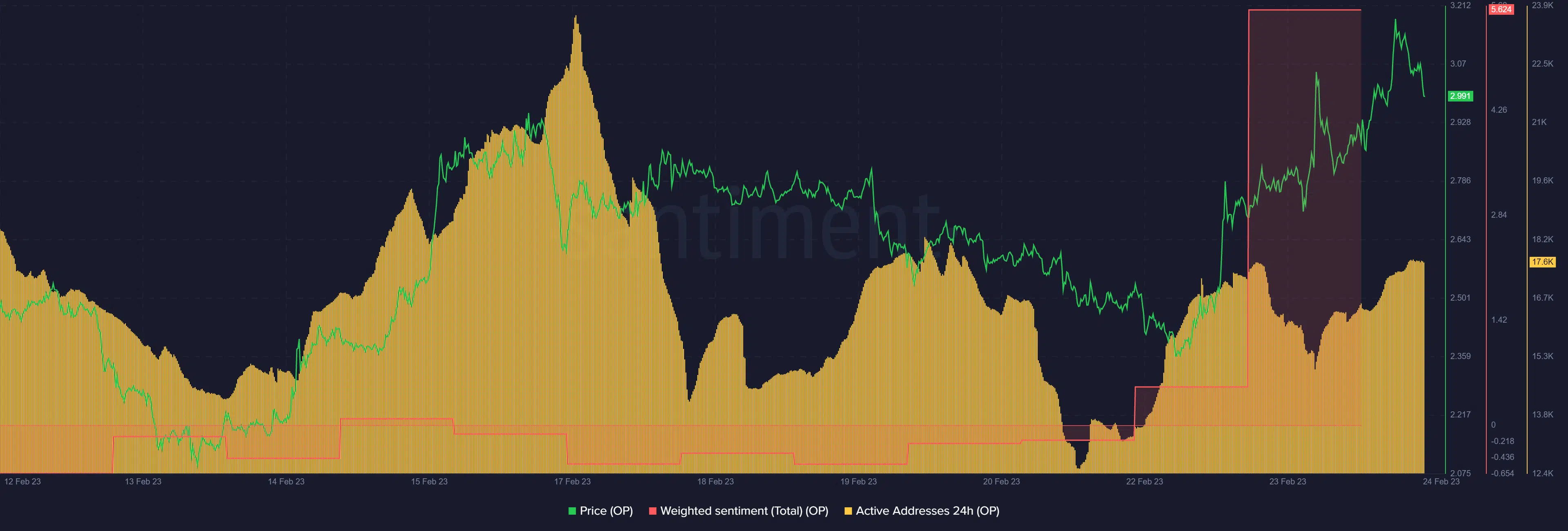

According to Santiment, OP registered a spike in sentiment, showing the recent announcement on its Superchain received positive social interactions. Similarly, active addresses rose in the past 24 hours, indicating a rise in trading volume and overall buying pressure that boosted the uptrend.

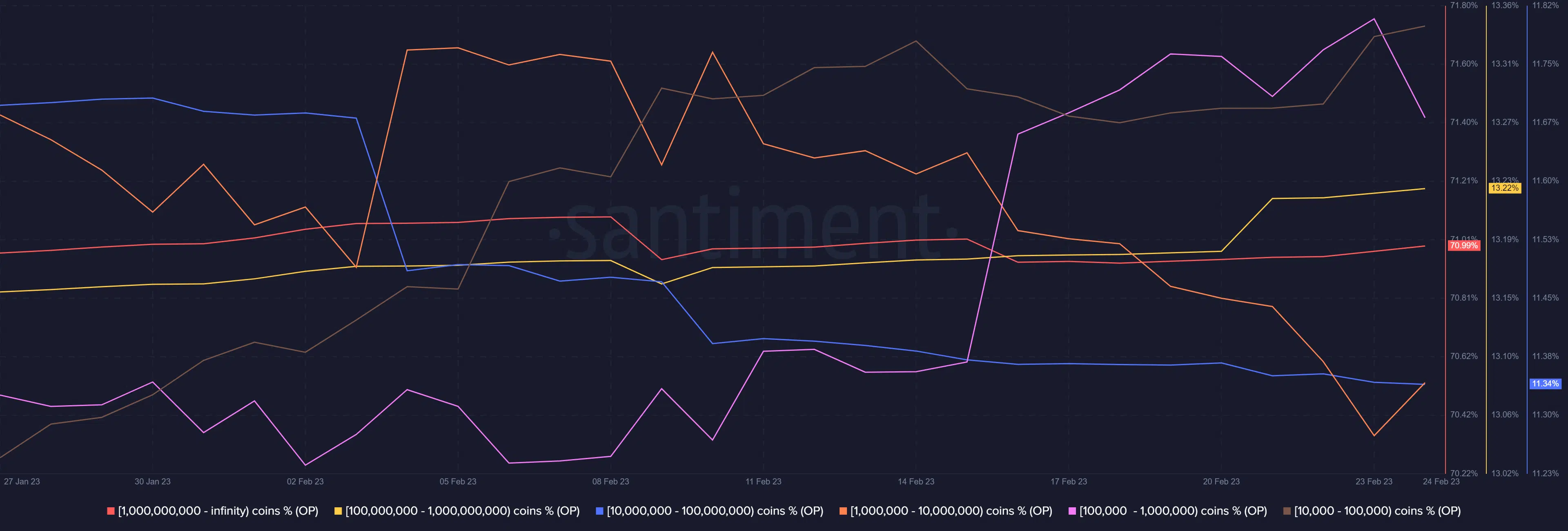

Notably, the selling pressure seen at press time after OP hit the overhead resistance came from a key whale category holding 100K – 1M OPs.

However, a major whale holding over 1 billion OPs, 70% of the supply, was accumulating. Other whales controlling 13% and 11% of the supply were also accumulating. This suggests that the bullish run could continue.

However, caution is advised given that $1.9M short-positions and $1.5M long-positions have been liquidated in the past 24 hours, according to Coinanalyze.