Osprey Funds cashes in on Solana’s hype by filing SOL Fund application

Solana (SOL), the single-chain, delegated, Proof-of-Stake protocol has been seeing growing awareness and popularity of late. In fact, at the time of writing, it was still valued at just under $70 after corrections pulled it down from its 21 August ATH of $81.25

A new Solana-based offering

Osprey Funds, a premier boutique digital asset investment firm, is the latest entity seeking to capitalize on the crypto’s surging demand. The New York-based firm is striving to bring an investment offering focused on Solana (SOL).

It recently filed a document with the U.S Securities and Exchange Commission (SEC) for an Osprey Solana Trust. According to the registered document, the firm aims to launch the said service to accredited investors. However, outside investors could also utilize the service with a minimum investment of $10,000.

Situated in Tarrytown, the firm in question could be the very first private Solana investment offering in the United States. Worth noting, however, that other renowned institutions have also expressed their interest in incorporating SOL. Grayscale Investments, for instance, announced in June that it is considering adding Solana to its crypto-token tree.

Cashing in on the hype?

Having said that, none of Osprey Funds’ spokespersons made any additional comment on this development. Looking at the company’s history, it offers the Osprey Bitcoin Trust (OBTC), as well as trusts that provide a way for accredited investors to access the native tokens of Algorand and Polkadot networks.

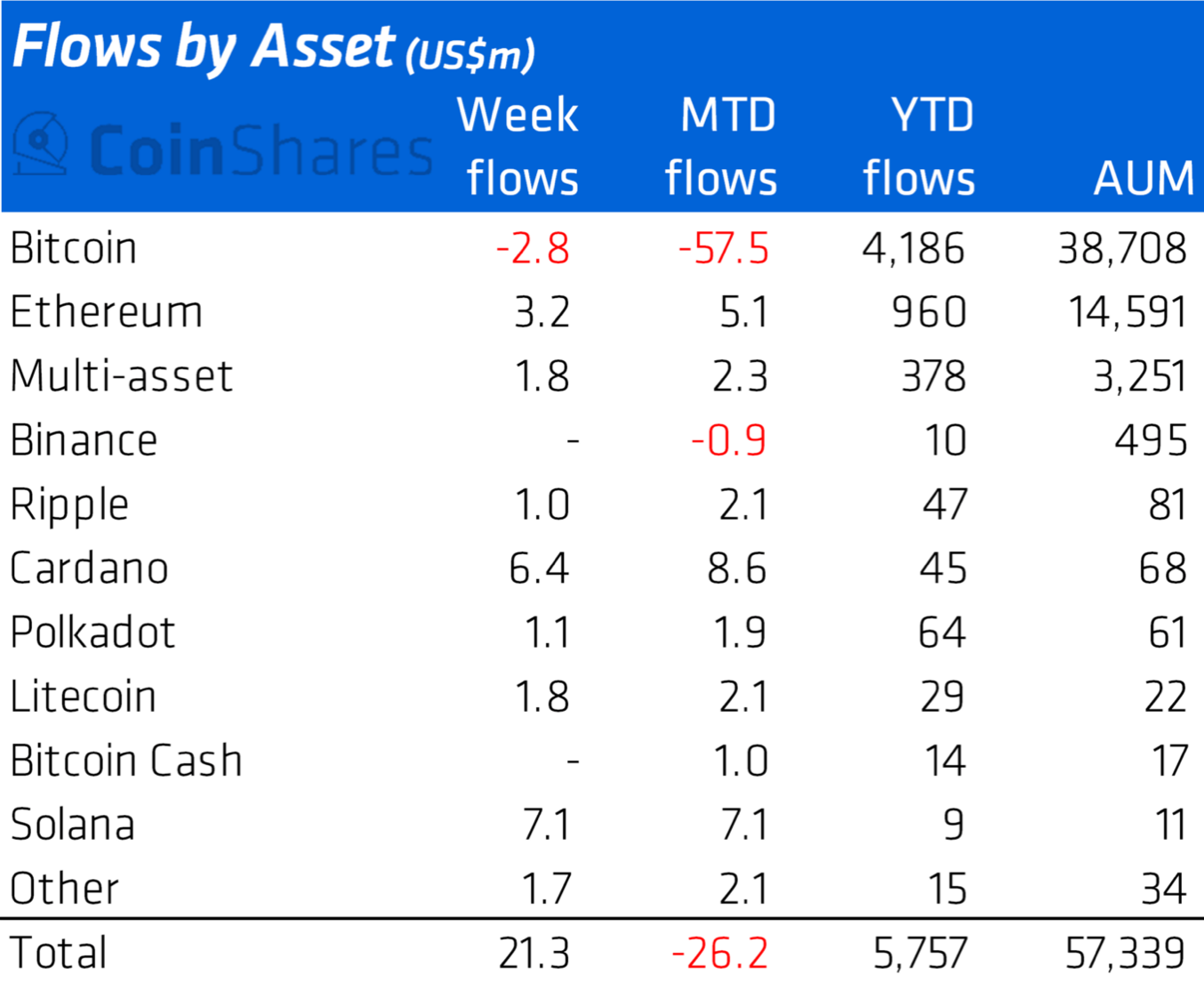

Here, it’s also worth noting that as per a CoinShares report, Solana recorded the largest inflows of any digital asset last week, bringing in around $7.1 million.

Source: CoinShares

![Solana's [SOL] high fee generation figures are misleading - Here's why!](https://ambcrypto.com/wp-content/uploads/2025/05/B6ACB721-6173-4255-91A4-FEE8D9DE21D1-400x240.webp)