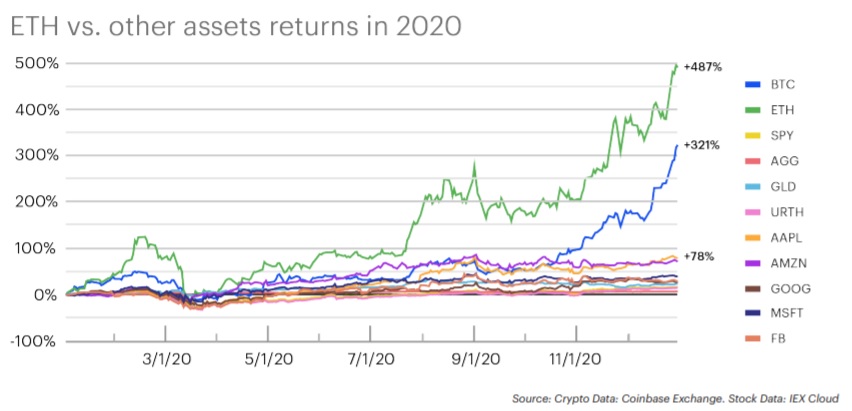

Other than Bitcoin, Coinbase notes institutional demand for Ethereum as well

Coinbase ‘Year in Review’ 2020 report stated that there was a growing institutional demand for Ether, amid increasing corporate investments in Bitcoin. According to researchers at Coinbase Institutional, while the exchange’s clients predominantly bought Bitcoin last year, a growing number also took positions in Ethereum.

Most institutional clients at Coinbase think of Ethereum as a “decentralized computing network” that shares some of Bitcoin’s key properties. With regard to owning Ether, these clients see “a combination of” the asset’s potential as a store of value and it being a digital commodity that is essential to power transactions on Ethereum.

Many think that a growing interest in DeFi is a primary reason behind the surge in Ether’s price. At the same time, David Grider at Fundstrat, predicted that a booming DeFi economy could propel ETH to a sevenfold increase.

Last year, Ethereum developer and investment activity in DeFi grew, as did Ethereum-based stablecoins, according to Coinbase’s review. However, the exchange noted issues with applications currently using Ethereum, including scaling friction, high gas fees, when the network becomes congested, and “complex smart contracts,” which can “grow to hold large stockpiles of crypto assets and thus attract bad actors.”

Coinbase clients believed that Ethereum may become the primary settlement network underpinning this new financial system. According to the review:

In 2020 DeFi protocols built on Ethereum began to demonstrate clearly that the use cases for “programmable money” extend far beyond ICOs.

Additionally, Coinbase is “closely” observing CBDCs development and noted the “obvious” benefits to digital currencies. It also hoped that governments developing CBDC “will work to preserve individual liberties and privacy.” The exchange encouraged the crypto community “who understand these systems” to advocate that a government develop e-currency on “top of open, public blockchain networks.”