Over 40 days after Ethereum’s EIP-1559, here’s where it stands

The last couple of months have seen Ethereum steal the show on the charts, as well as in the larger market. In fact, the implementation of EIP-1559 in the 1st week of August this year gave ETH much of its market-wide hype. That, coupled with the wider market’s resurgence, has allowed many in the mainstream to finally move beyond just Bitcoin.

While this has been revolutionary for the network and its participants, issues of scalability and high gas prices have been repeatedly raised. In line with these concerns, the emergence of ‘ETH-killers’ such as Solana and the rapid rise of layer-2 scaling solutions has thrown a spanner in the works.

EIP-1559 a ‘parasitic tax?

Recently, analyst Willy Woo sparked an interesting debate with his take on EIP-1559 and capital rotation out of the Ethereum network. He ran a poll on whether his followers consider EIP-1559 a “parasitic tax” driving decentralized applications (dApps) to other networks for short-term deflationary effects. The reactions were mixed, but it’s an interesting take on the situation.

Over the last few months, the increased usage of ETH network in dApps, NFT surges, and yield farming has caused the network fees to hit 100-200 Gwei several times. Previously, ETH developers had spoken about EIP-1559 being focused on tackling hiked gas fees and making it predictable.

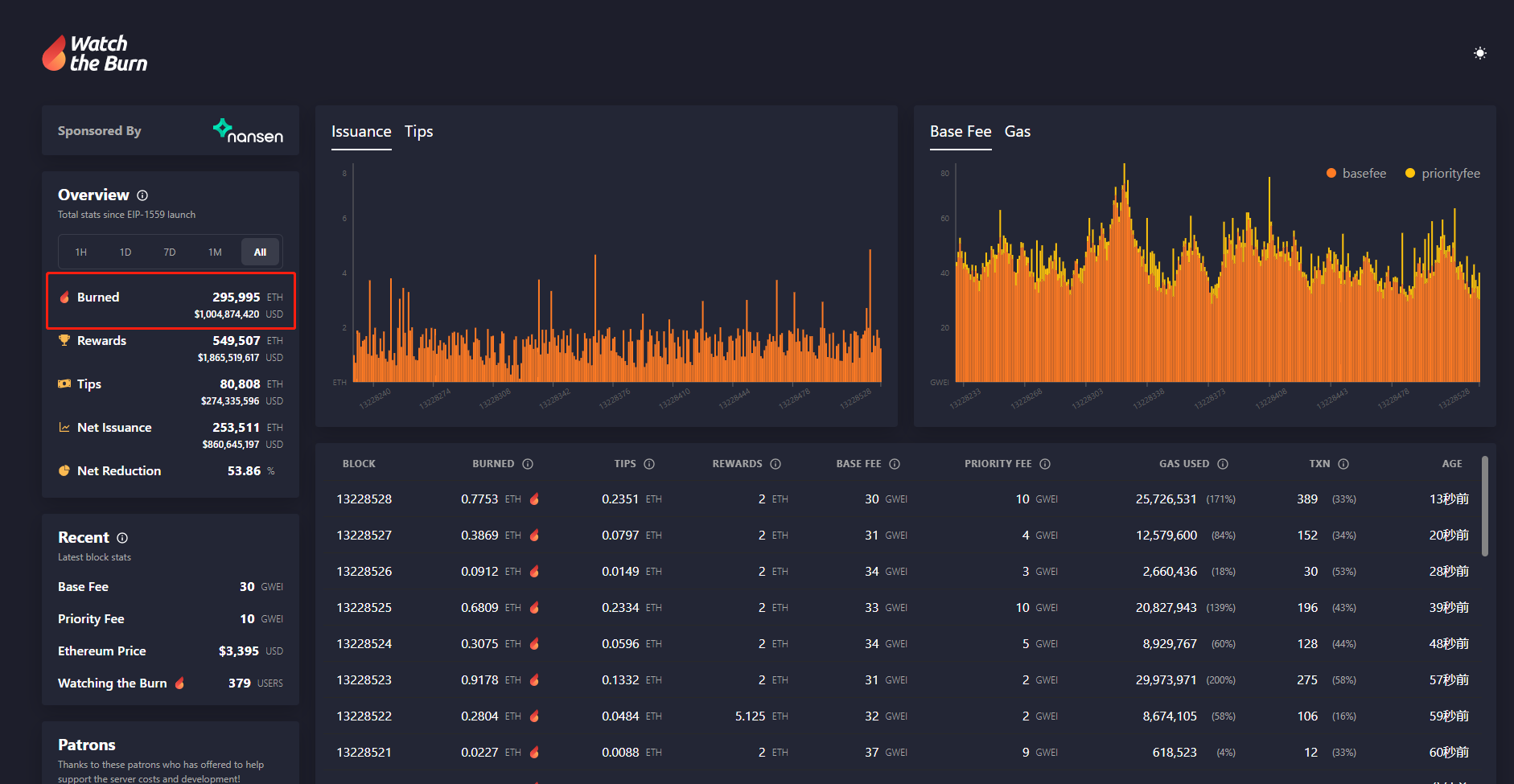

Notably, in the 40 days since EIP-1559 was first implemented, the amount of ETH burned has exceeded 296,000 ETH. What’s more, the burn value has exceeded $1 billion with OpenSea burning the largest number, more than 40000 ETH.

Source: Wu Blockchain

So, who benefited from EIP-1559?

While for the Ethereum network the post-London phase was a bittersweet time with criticism and applause coming in equally, there were other networks that reaped the advantages of it. In fact, the high gas fee over the last couple of months was a blessing in disguise for layer-2 scaling solutions. At the time of writing, over 3.6 billion were locked in layer 2 solutions on Ethereum.

Further, interestingly, Solana’s exponential growth can also be attributed to its low transaction costs and high speed. Ethereum has relied on Optimistic Ethereum, rollups, and zero-knowledge tech to increase speed and lower gas fees. On the other hand, Solana is in a more favorable market position.

In fact, the narrative that Solana is “the fastest blockchain network in the world” could be ETH’s doing and indirectly a post-EIP-1559 effect.

Now, for the future, it seems like there are two ways forward for the second-largest blockchain. Either the high gas fees will continue to drive capital rotation out of Ethereum (to L-2 solutions) or aid the transition to a scalable and relatively low-fee blockchain post-ETH 2.0

For now, however, with the NFT buzz cooling off, it seems like dApps might be migrating away from the ETH network. Thus, looks like the short-term effects of EIP-1559 are debatable.