PancakeSwap could climb to $3.3 this week but short-term bulls can wait for…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- PancakeSwap reached the highs of a short-term range

- The longer-term trend remained bearish

The market structure of PancakeSwap has remained bearish on the price charts since 11 December. The token found good support at $3.11, but it still did not show promise of a sizeable upward move.

Are your CAKE holdings flashing green? Check the Profit Calculator

The presence of the lower timeframe range offered trading opportunities. Bears will want to see a rejection at the $3.21 area, while bulls can wait for a retest of $3.24 as support before buying.

PancakeSwap reaches lower time range highs and rejection is likely

CAKE has traded within a range from $3.21 to $3.12 in the past five days. This lower timeframe range was important to keep an eye on, especially as the price approached the range highs with short-term bullish momentum.

When trading within a range, it is more likely that breakouts reverse back into the range. Moreover, CAKE was in a downtrend on higher timeframes. Therefore, it remained likely that the retest of the range highs can.24 would be met with selling pressure.

A 608.01x hike on the cards IF CAKE hits Bitcoin’s market cap?

On the other hand, if the bulls are able to reclaim the $3.21-$3.24 area and retest it as support, a move upward to $3.3 can follow. The Chaikin Money Flow (CMF) stood at +0.05 and its ascent showed some buying pressure in the past few days. The Relative Strength Index (RSI) also threatened to break out past neutral 50, a level which has acted as resistance since mid-December.

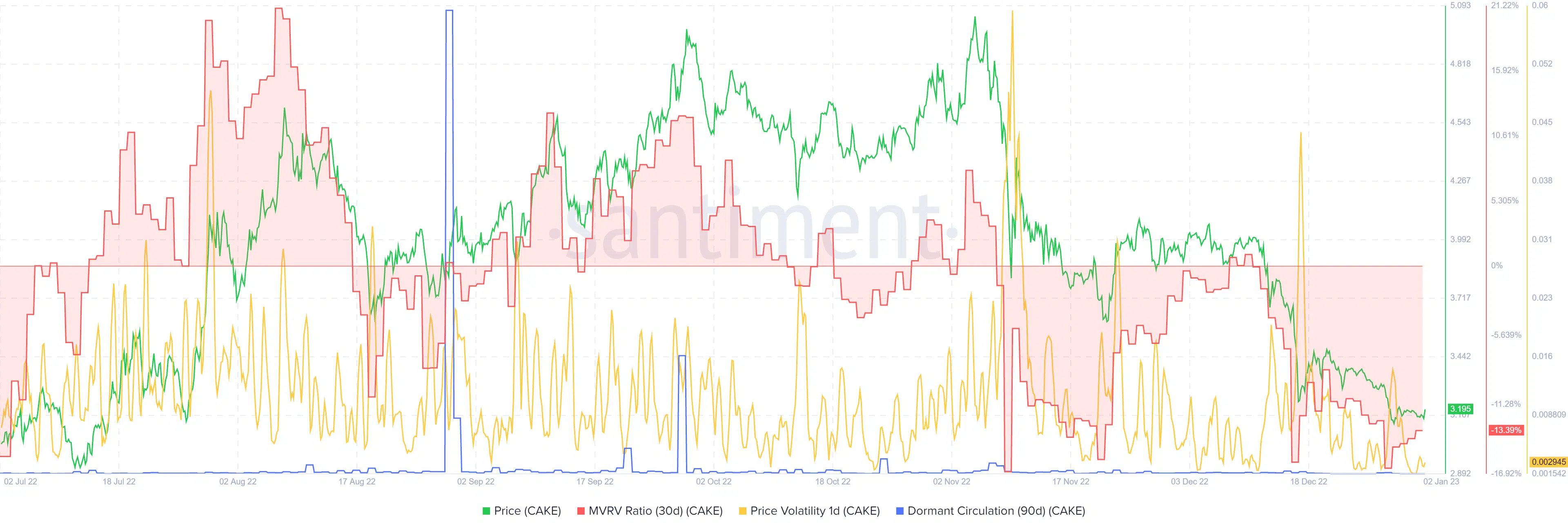

Dormant circulation continues to hibernate while price volatility remains low

Source: Santiment

The 90-day dormant circulation saw a large spike in late August, when the price began to rally from $3.7. Another spike was witnessed near the end of this move in late September when CAKE reached the local top at $4.9. Since then, and especially since mid-December, the dormant circulation showed no spike in token movement.

The price volatility has also declined in the past two weeks. The 30-day Market Value to Realized Value (MVRV) ratio has consistently dropped since mid-December alongside the price. This highlighted the bearish bias, but also showed the asset could be undervalued in the lower time scales.