PEPE: Are more shorting gains likely?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Price action hit a crucial roadblock at $0.00000070.

- PEPE maintained an accumulation trend since August as prices dropped.

Pepe [PEPE] defended its recent all-time low of $0.00000060 and suggested a price reversal. However, Bitcoin [BTC] was stuck in a narrow consolidation after recent losses, which could delay the memecoin’s strong recovery.

Read Pepe’s [PEPE] Price Prediction 2023-24

Two weeks ago, AMBCrypto projected that a retest of $0.00000060 could present a buying opportunity for PEPE. The idea was validated, but the small bounce at press time faced a key confluence and overhead hurdle.

Will sellers exploit these hurdles?

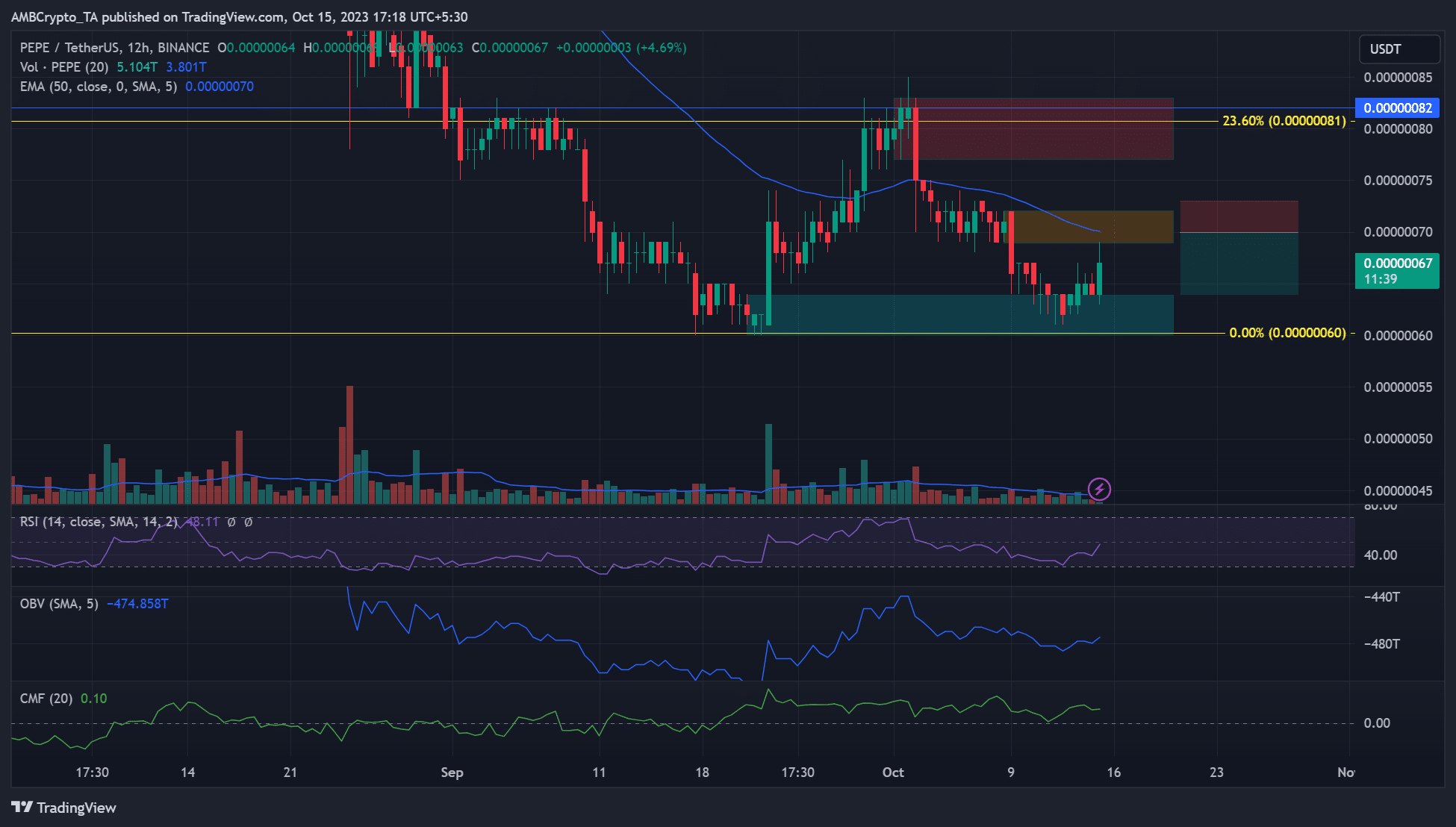

At press time, PEPE’s higher timeframe market structure bias was bearish. The recent rebound hit a confluence of a 50-EMA (Exponential Moving Average) and H12 bearish order block (OB) of $0.00000069 – $0.00000072 (orange).

Another daily bearish OB sat at $0.00000077 – $0.00000083 (red). On the H12 chart, the confluence of 50-EMA and bearish OB could make the area a critical bearish zone. Besides, BTC exhibited muted price action at press time, which could further derail the rebound.

A reversal at $0.00000070 could present an 8.5% potential gain if the drop hits the range-low and the daily bullish OB at $0.00000060 (cyan.

In the first half of October, the OBV and RSI declined, indicating a dip in Spot market demand and buying pressure over the same period. However, capital inflows into PEPE remained positive over the same period.

Players extended accumulation as PEPE prices dropped

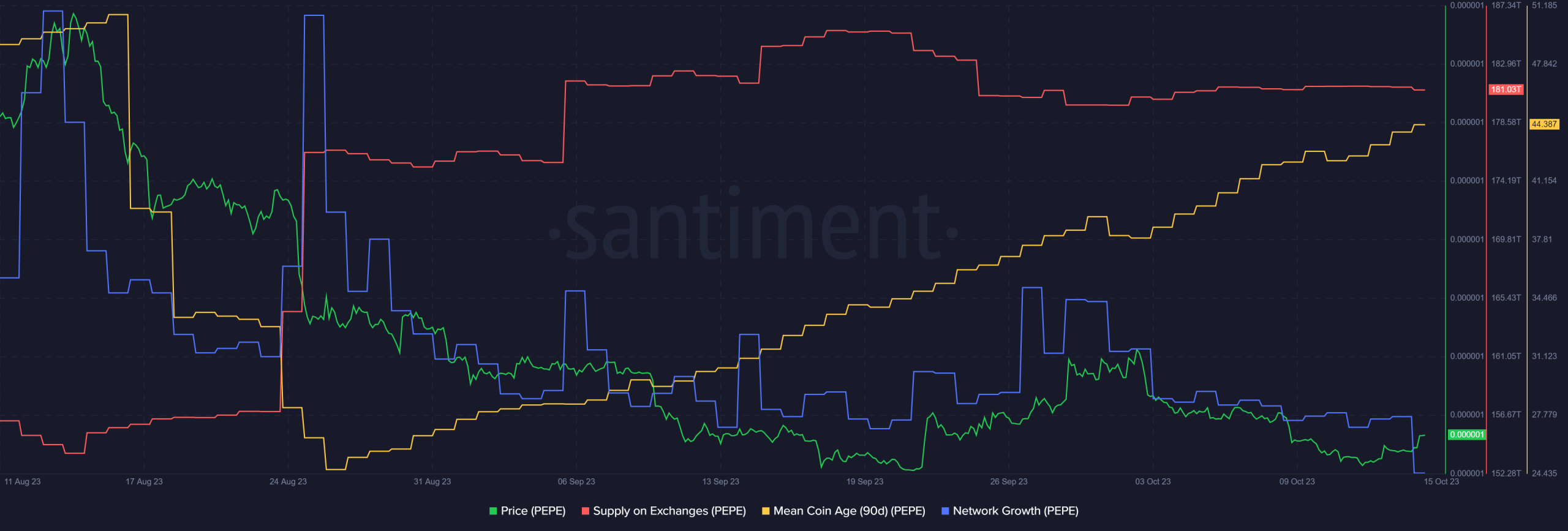

On-chain metrics confirmed the positive capital inflows. Notably, PEPE recorded sharp accumulation during the price dips, as shown by the rising 90-day Mean Coin Age. It meant players were confident of a future pump.

How much are 1,10,100 PEPEs worth today?

However, PEPE’s network traction has declined with prices and hasn’t recovered since August. The trend indicated that interest in the memecoin dropped over the same period.

In addition, sell pressure spiked in the past few weeks, as shown by an increase in Supply on Exchanges. If the selling pressure intensifies in the next few days, PEPE could retest its recent lows, presenting potential shorting gains.