PEPE reels under high sell pressure and the prices will…

- PEPE was down by nearly 7% over the last 24 hours, along with an increase in trading volume.

- Most on-chain metrics and market indicators remained bearish on the memecoin.

Pepe [PEPE] was once again trending at number one on CoinMarketCap, but not for a good reason this time. The token has witnessed a major price correction over the last 24 hours, which almost brought its value down by double digits. The latest data revealed a possible reason for this decline. Its metrics also suggested that things could turn worse in the coming days. However, a market indicator provided much needed hope for a halt in PEPE’s price decline.

Realistic or not, here’s PEPE market cap in BTC‘s terms

Selling pressure peaks

A look at CoinMarketCap’s data revealed that not only was PEPE’s daily chart red, but its weekly price also declined by more than 10%. At the time of writing, PEPE was down by over 7% in the last 24 hours and was valued at $0.000001454. The memecoin had a market capitalization of more than $569 million, making it the 69th largest crypto. Interestingly, the drop in PEPE’s price was accompanied by a rise in its trading volume, which is a typical bearish signal.

Lookonchain’s recent tweet pointed out a sell off, suggesting that the coin was under selling pressure. As per the tweet,

Dimethyltryptamine.eth sold another 180B $PEPE for 149.4 $ETH($279K) an hour ago, and there are currently 2.07T $PEPE ($3.24M) left.

He spent 0.125 $ETH ($251) to buy 5.9T $PEPE very early and has sold a total of 3.83T $PEPE for 2,411 $ETH($4.5M).https://t.co/cUqMO6zIVO pic.twitter.com/czCC3jeNcM

— Lookonchain (@lookonchain) July 9, 2023

A similar selling notion was also revealed by Santiment’s chart. The memecoin’s supply on exchanges increased while its supply outside of exchanges declined, proving that investors were selling the coin. Additionally, investors’ trust in PEPE also seemed to have declined, as evident from the drop in its supply held by top addresses.

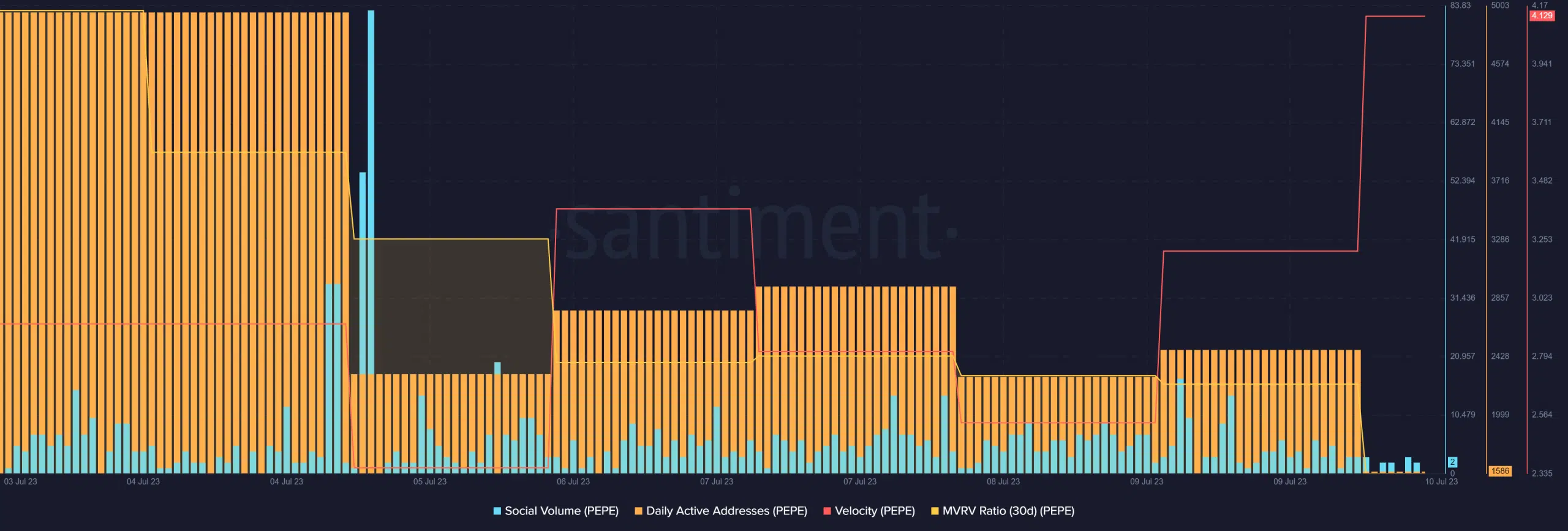

A few other metrics also looked bearish on PEPE. For instance, the memecoin’s daily active addresses declined over the past week. The same remained true for its social volume, reflecting a decrease in its popularity. PEPE’s MVRV Ratio plummeted sharply, which was bearish. However, the velocity remained high.

How much are 1,10,100 PEPEs worth today

PEPE investors must consider this

PEPE’s losing streak might come to an end as its price was entering a low volatility zone, as pointed out by the Bollinger Bands. Its Exponential Moving Average (EMA) Ribbon revealed that the bulls were setting up their game as the 20-day EMA flipped the 55-day EMA.

However, the MACD displayed a bearish crossover. Its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) both registered downticks, further increasing the chances of a continued price decline.