PEPE’s hopes of a corrective bounce remain elusive

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Pepe’s [PEPE] frenzy seemed to be fizzling out, dragging its price with it. A recent report dissected the uncertainty and future surrounding the months-old frog-themed meme coin.

From over a billion dollars’ worth of market cap at its peak, PEPE has dropped to below $500 million as of press time, according to CoinMarketCap. That means it has shredded over 50% of its value on the price charts.

PEPE’s price was $0.0000011922 at press time, down about 7% in the past 24 hours. The plunge followed Bitcoin’s [BTC] sharp drop from the $27k price zone, setting PEPE to retest a key demand zone.

Will the demand zone inflict a price reversal?

In early May, PEPE saw a strong corrective bounce at the demand zone of $0.000000850 – $0.000001188 (cyan). The demand zone is also a bullish order block (OB). There was another substantial bounce from the above level in mid-May, making it a key demand zone.

However, a retest of the zone in late May only led to a meek price bounce, discarding hopes of a price reversal. The recent BTC move has exerted more bearish pressure on the meme-coin, pushing it to retest the bullish OB again at press time.

The weak BTC could expose PEPE to more selling pressure, and a drop to $0.0000008579 or lower is feasible.

Conversely, a bullish BTC and subsequent retest of $28k could set PEPE to a strong recovery. Northwards, resistance levels lay at $0.0000015155, $0.000001759, and $0.000002082.

How much are 1,10,100 PEPEs worth today?

The RSI hovered below the neutral position in the second half of May and early June. It shows selling pressure increased in the same period. Also, the OBV dipped – demand declined.

A neutral position …

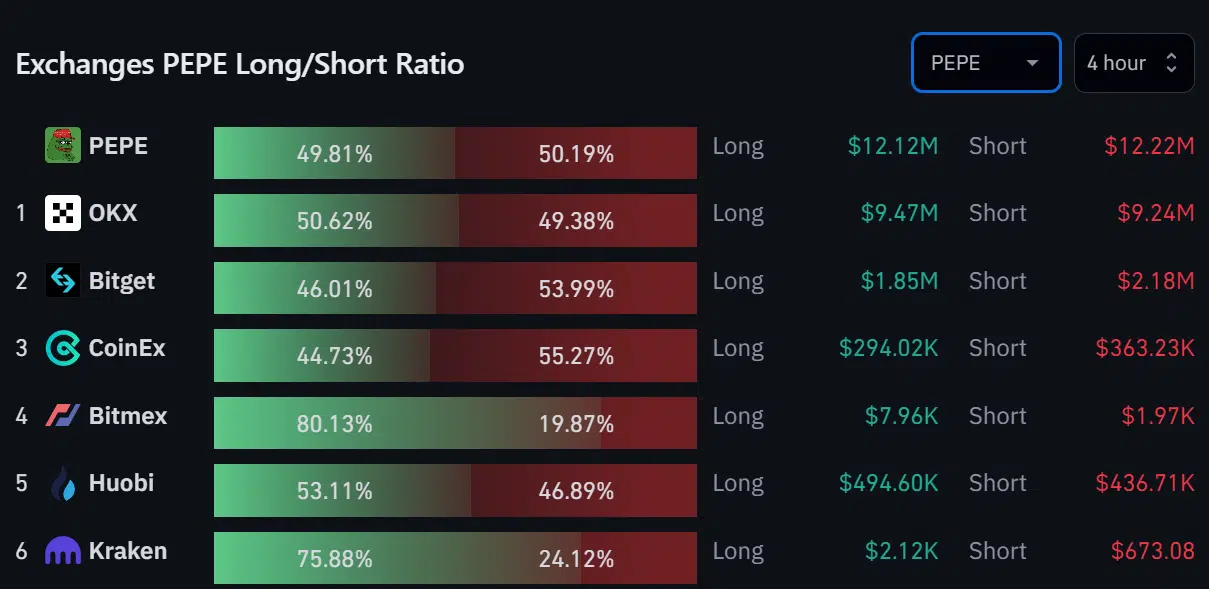

PEPE’s exchanges’ long/short ratio exhibited a small spread between longs and shorts. Sellers had slight leverage at 50.19%, but longs were close by at 49.81%. As such, the futures market is neutral, and prices could take any direction from the press time level.