Polkadot bulls fight to push past $5, traders can wait for a reaction at this level

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The quick surge of DOT prices over the past week has emboldened bulls

- Bears can wait for a rejection around the $5.11 level

Bitcoin climbed past the $17k mark and most coins in the crypto market saw relief rallies as well. Many assets saw their higher timeframe market structure beaten and flipped to a bullishly biased one.

Read Polkadot’s Price Prediction 2023-24

Polkadot was one of these assets. It has posted significant gains despite the fearful sentiment of the past few weeks. The inefficiency on the charts has been filled, and a rejection at key Fibonacci retracement level could see a reversal.

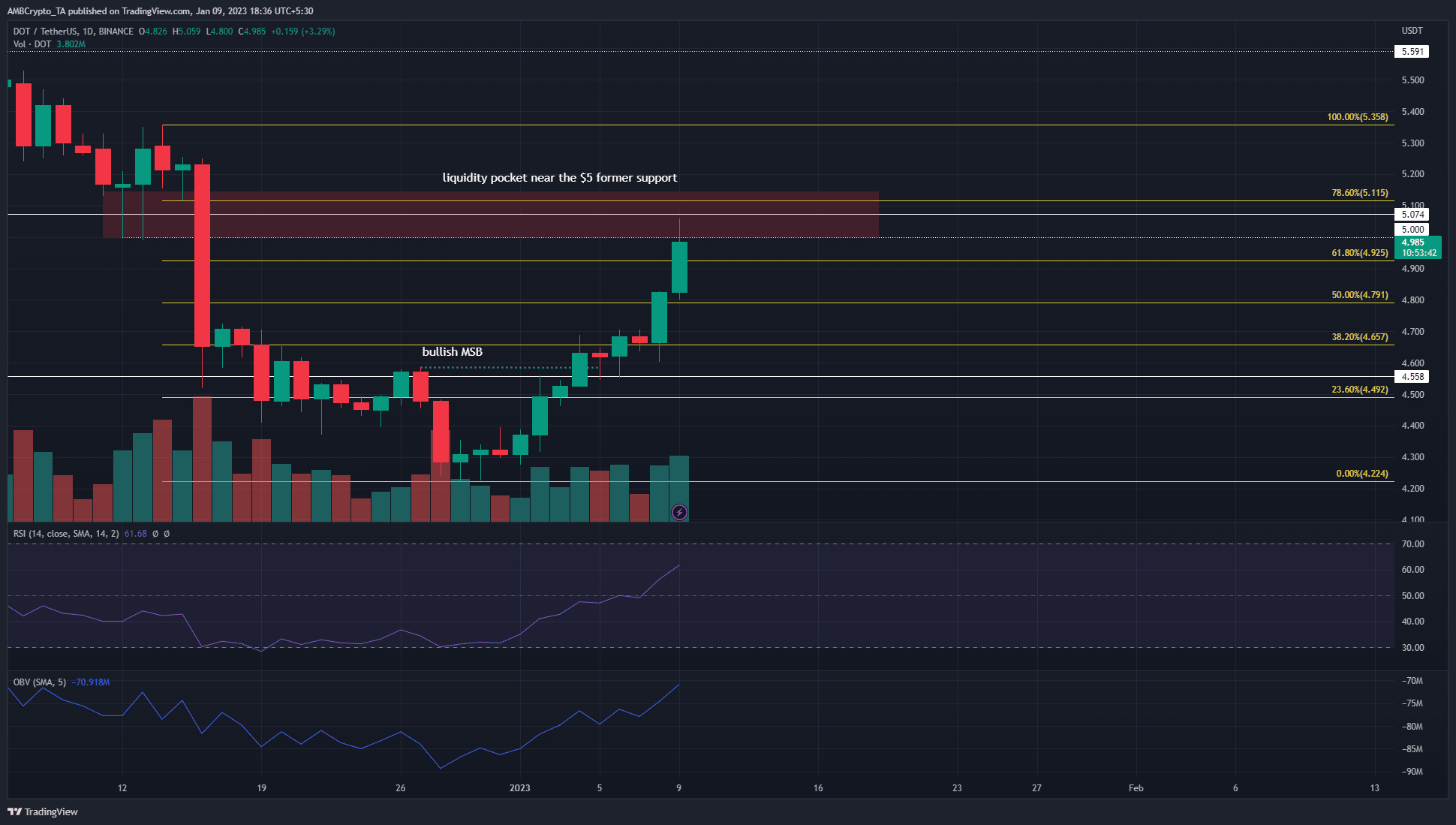

Polkadot reaches the psychologically significant $5 mark

The $5 mark is an important round number that bulls will be eager to beat. Moreover it had confluence with the 78.6% Fibonacci retracement level. This was based on the move down from $5.35 to $4.22 in December.

The sharp fall last month saw a fair value gap appear on the daily and 12-hour chart that extended from $4.7 to $4.99. This inefficiency has been filled at the time of writing. However, the market structure was bullish, having been flipped a few days earlier. Taken together, it could be the case that the price has shot higher to collect liquidity just as BTC runs into a zone of resistance at $17.3k.

Are your holdings flashing green? Check the DOT Profit Calculator

To the north, a pocket of liquidity ran from $5 to $5.15. This region can see some lower timeframe selling pressure. On the daily chart, the RSI showed strong bullish momentum with a reading of 61 and the OBV also made gains.

Yet, a move above $5.11-$5.15 and a retest of this zone would offer bulls a higher likelihood of another move upward toward $5.35. This was because the $5 and $5.11 levels can act as stubborn resistance levels.

Traders can wait for a decisive move past $5.11 before buying. Alternatively, they can wait for a move to the $5.11-$5.15 region and look for a drop back below $5 before looking to enter short positions. As things stand, the market had not yet shown its hand.

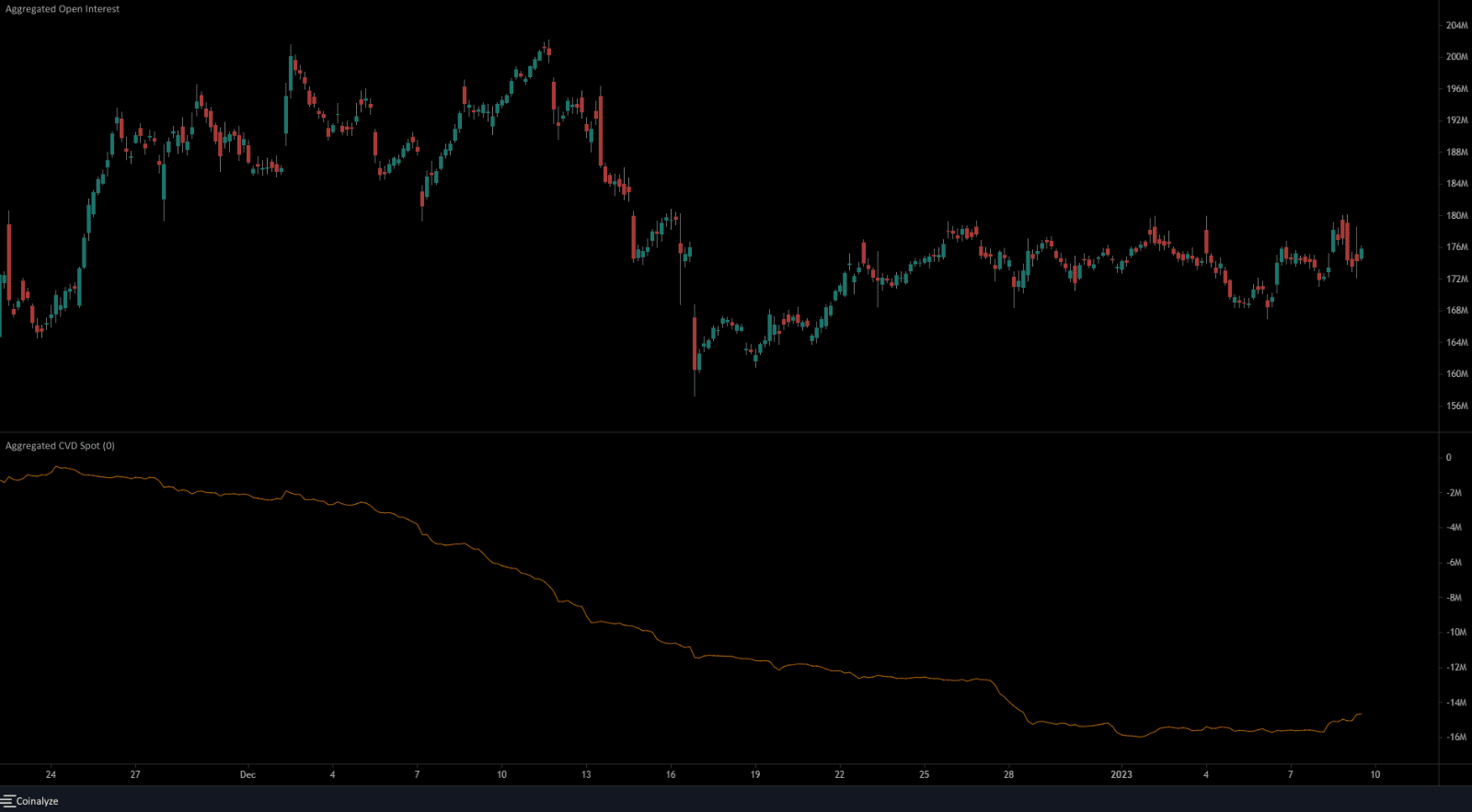

Spot CVD and Open Interest see some resurgence in the past few days but is it enough?

Source: Coinalyze

Over the past five days, the Open Interest has been slowly gaining ground to show capital flow into the market. Meanwhile the price has been in a strong uptrend. Therefore, the inference was bullish momentum. The spot CVD also rose by a small margin to show buying pressure behind the coin.

Further rise in prices alongside a rising OI will indicate strong bullish sentiment, and buyers can look for lower timeframe buying opportunities. Meanwhile, a rejection at the $5.11 level and a session close beneath $5 thereafter could interest the bears.