Polkadot development surges, but revenue decline concerns investors, as…

![Will Polkadot's [DOT] new parachain fix the blockchain?](https://ambcrypto.com/wp-content/uploads/2023/01/dot-him.jpg)

- Polkadot development activity increased, but revenue declined.

- Stakers on the network remain undeterred, as volatility presented buying opportunities.

Polkadot [DOT]’s development activity soared over the past few months, Token Terminal reported on 16 January. This spike in activity could be attributed to the growing number of projects and developments within the Polkadot ecosystem.

long-term builders at work on @Polkadot ?️? pic.twitter.com/X1xVgFNdxG

— Token Terminal (@tokenterminal) January 16, 2023

Read Polkadot’s [DOT] Price Prediction 2023-2024

Parachains such as Moonbeam Network and the Astar Network were just a few examples of projects that were showing signs of progress and improvements. These developments also attracted a significant number of developers to the ecosystem, further driving its growth.

1/ Every Monday the #PolkadotRoundup brings you the very latest from the Polkadot ecosystem.

This week's ? is ready for you now. Read on for the key news and announcements from Polkadot’s parachain teams, ecosystem projects, and infrastructure providers. pic.twitter.com/sgjIhwneFe

— Polkadot (@Polkadot) January 16, 2023

More than meets the eye

Despite this growth in development activity, the revenue collected by Polkadot decreased from 21.76 million to 10.74 million between 9 – 15 January, according to Twitter account Polkadot Insider.

? Let's get to know the on-chain weekly recap of @Polkadot?

The below picture illustrates:

?Daily transfer amount

?DAILY NEW USERS

?Total revenue #Polkadot #DOT $DOT pic.twitter.com/kBFKhffzWe— Polkadot Insider (@PolkadotInsider) January 16, 2023

This decline in the number of transfers had a direct impact on the revenue generated by Polkadot, which fell by 36.4% in the last month. This declining revenue could be a cause for concern for investors.

Polkadot echoes the people

One reason for the declining revenue could be Polkadot’s decreasing activity on the social front. Based on data provided by LunarCrush, it was observed that the number of social mentions for Polkadot declined by 46.9%, while the number of social engagements decreased by 64.4% in the last three months. This could indicate a lack of interest or engagement from the community, which could have a direct impact on the platform’s growth and revenue.

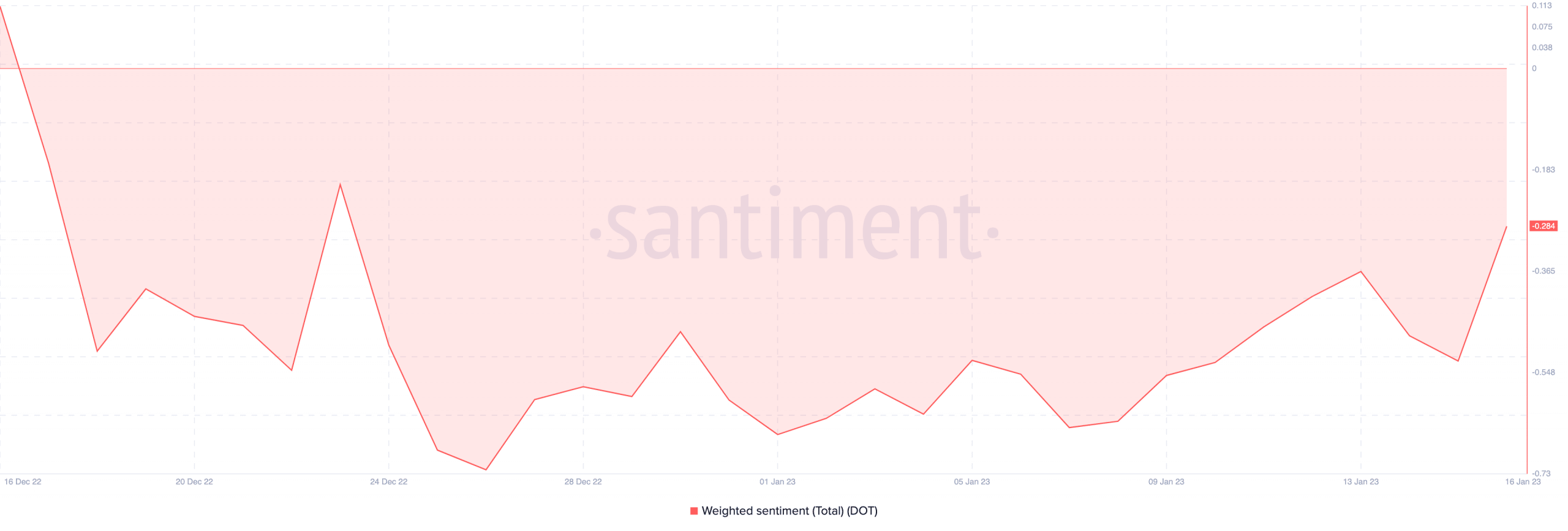

Moreover, the sentiment towards Polkadot remained negative as well, according to Santiment. Thus, the crypto community’s outlook towards Polkadot remained negative, which could have a further impact on the platform’s improvement and adoption.

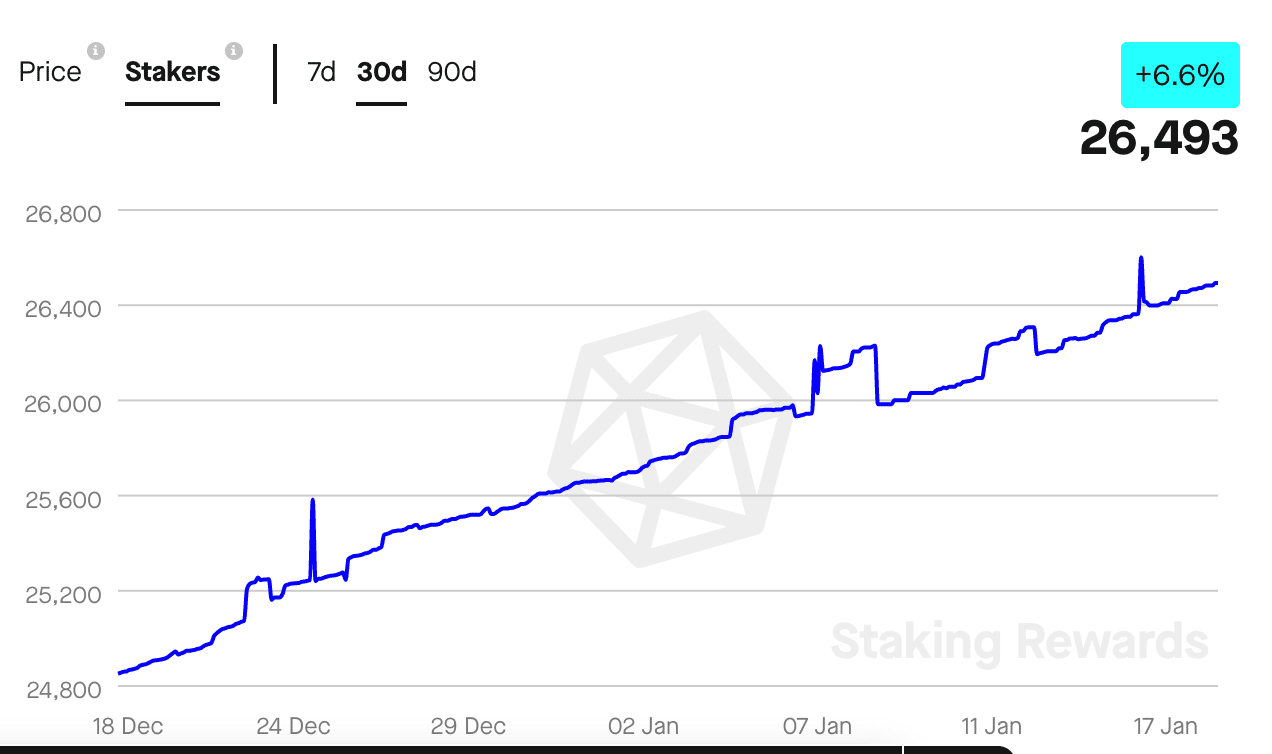

However, notwithstanding these factors, stakers on Polkadot’s network remained undeterred as they grew by 6.6% over the last 30 days. This could be due to the popularity of Polkadot’s nomination pools, which allowed users to stake even with just pne DOT.

This feature has made it more accessible for users to participate in the network and earn rewards, which could have contributed to the growth in stakers.

How many are 1,10,100 DOT worth today?

It remains to be seen how the Polkadot’s token DOT will respond to these developments. As its volatility declined by 47% over the last week, investors could use this opportunity to buy DOT at a relatively stable price.