Polkadot [DOT]: As new developments come to the fore, will investors reap benefits

- New developments on Polkadot’s dApps failed to have a positive impact on DOT.

- Activity on the protocol declined while the price of DOT continued to fall.

Polkadot [DOT] has been known for showcasing high development activity on its GitHub consistently over the last few years. dApps on its parachains have followed suit and have made additions to its technology as well.

Realistic or not, here’s DOT’s market cap in BTC’s terms

According to a 30 April development, a zk1 (zero knowledge layer 1) protocol, known as Manta Network, witnessed new improvements in terms of security.

? New updates in @MantaNetwork, a zk #Layer1 blockchain in @Polkadot that brings programmable privacy to #Web3

The team just launched a suite of new products enabling private identity on #MantaNetwork. Here's what you need to know ??#Polkadot #DOT #MANTA pic.twitter.com/ZHkodPWEJk

— Polkadot Insider (@PolkadotInsider) April 30, 2023

Despite efforts being made to improve various protocols on Polkadot, the network’s overall activity continued to decline. Interest from new addresses in Polkadot also waned, according to Subscan’s data.

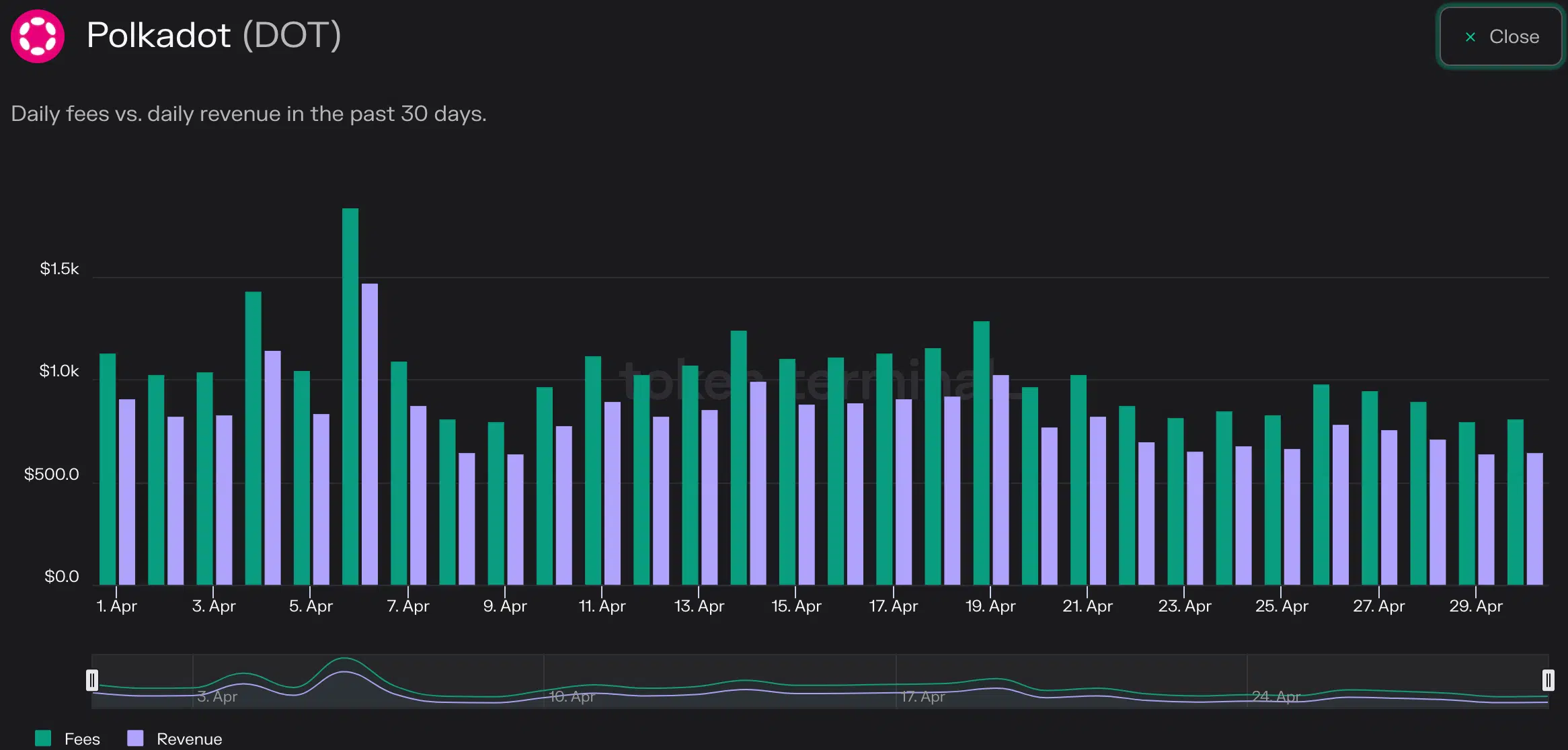

This falling activity impacted Polkadot’s finances. According to Token Terminal’s data, the fees generated by the network over the last month fell by 14.4%, a slump that was reflected in its revenue.

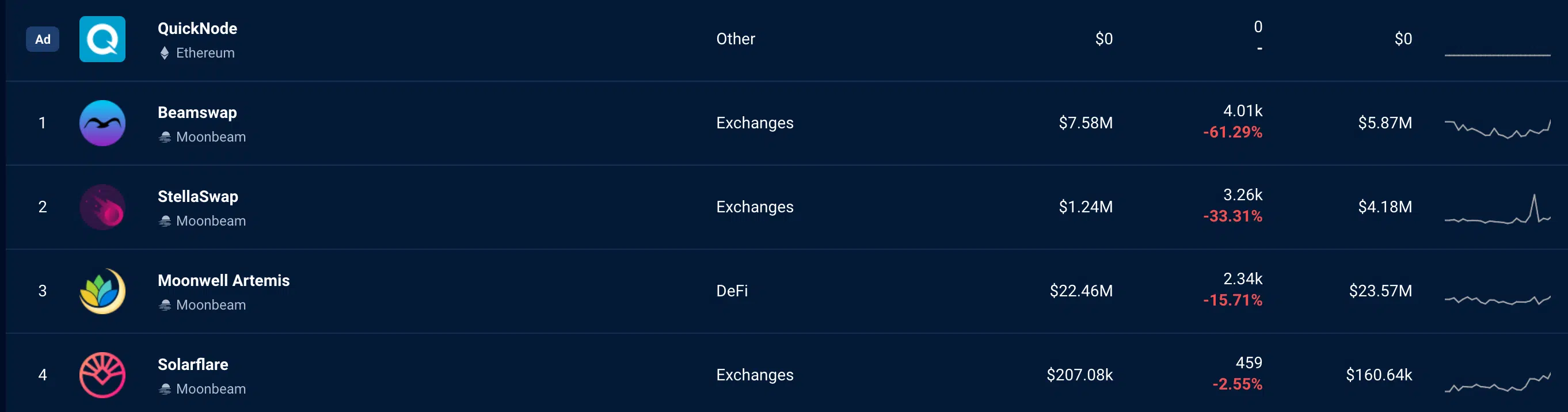

One reason for the diminishing activity would be the state of dApps on the Polkadot Parachain. Parachains such as Moonbeam and Moonriver both observed a decline in interest at press time.

This was showcased by the falling unique active wallets (UAW) on both these protocols’ dApps over the last 30 days. One popular dApp that stood out was StellaSwap, which also observed a decline in volume and transactions along with a fall in UAWs.

What should DOT holders do?

When it came to DOT, holders faced a few setbacks as prices declined. After testing the $6.59 resistance level on 18 April, the coin’s price fell by 16.59%. The highest price that DOT witnessed during this period was $5.916, indicated by the point of control line (red).

At press time, DOT was trading below this line, which could act as support going forward. The RSI was 39.16, implying that the price momentum wasn’t on DOT’s side. The CMF (Chaikin Money Flow) was at -0.09, suggesting that there is slight net selling pressure in the market for DOT.