Polkadot [DOT] enters critical support level, should investors bet on it

DOT is still bleeding as the bear market extends for yet another week, with no sign of slowing down. This has especially been the case in the last two days during which selling volumes increased after failing to bounce back.

Now the cryptocurrency is closing in on yet another support and resistance level near $7, but the question is- Will it reverse or maintain its bearish trajectory?

DOT traded at $8.11 at the time of this press, following a slight recovery within the last few hours after dipping as low as $7.30. Zooming out reveals that the $7 price level has historically acted as a support and resistance zone. There is a significant probability that DOT may achieve some upside if the $7 price level provides ample support.

There are numerous reasons for the expectation of a bounceback from support. The price is already deep in the oversold zone as indicated by the RSI. The MFI has so far registered heavy outflows that coincide with the current price level. The slight bullish recovery after entering the support zone suggests that there has been some accumulation but this has not registered in the MFI.

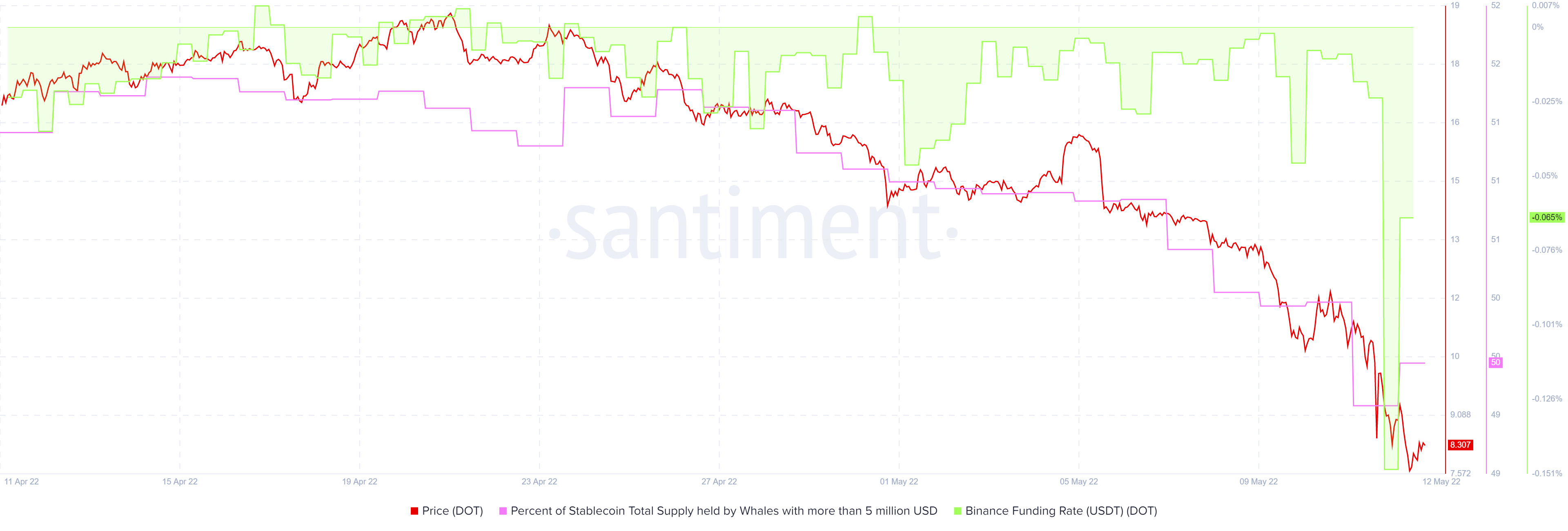

Some of DOT’s on-chain metrics are currently in favor of bullish recovery. For example, supply held by whales registered a slight uptick in the last 24 hours, suggesting that whales are buying at low prices. The same metric registered significant outflows from whale addresses in the last four weeks.

The Binance derivatives funding rate plummeted between 9 May and 11 May, reflecting reduced interest in the derivatives market. However, the uptick in the last 24 hours suggests that the derivatives market is taking up an interest in DOT at the lower price levels.

Is there a risk of more downside?

The lack of a significant uptick in the MFI and RSI despite being deeply oversold reflects the lack of enough buying pressure. This is due to the low investor confidence as the market struggles to shake off the FUD. As a result, the bears have maintained a stronghold on DOT’s price action.

The relentless sell-off that has prevailed in the last few days may still continue, well into the weekend. If that will be the outcome, then there is a significant possibility that DOT will drop to $5 or lower.