Polkadot ETFs in Europe outperform Bitcoin, Ethereum, traditional finance

Exchange-traded products (ETP) are the next big thing for many institutional cryptocurrency investors. In fact, crypto-ETFs have captured a huge share of the market within no time. In one such case, crypto-backed ETFs in America and Australia broke several records within days of trading.

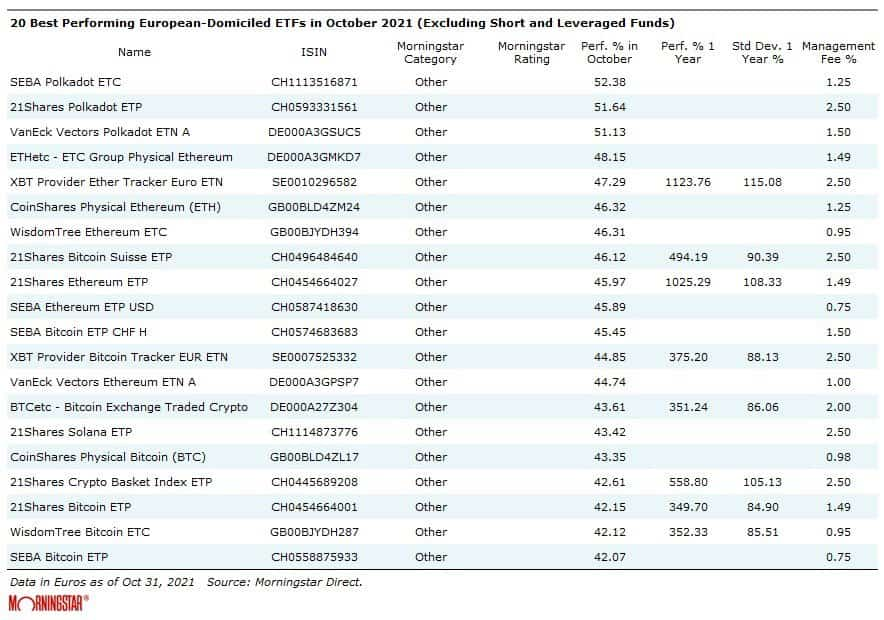

Surprisingly, throughout October, the top 20 best-performing ETFs in the European market were the ones that were backed by cryptocurrencies. Natural gas and Brazilian exchange-traded funds (ETFs) were at the bottom of the list, compiled by Morning Star.

Interestingly, the top eight ETFs were backed by tokens of L-1 protocols like Polkadot and Ethereum. At the top was SEBA Polkadot ETC (SDOT), which was issued by SEBA Bank and began trading on the SIX Swiss Exchange in July, with 52.8% appreciation.

It was followed by Polkadot ETFs by VanEck and 21Shares, leading to DOT taking center stage by cornering the first three positions.

Notably, Ethereum ETFs followed those backed by Polkadot. However, Bitcoin ETFs trailed further behind.

Much to everyone’s surprise, the top-ranking non-crypto ETF was positioned 34th, indicating a rising appetite for institutionalized cryptocurrency investment products.

Several European countries have sensed the market opportunity by entering the crypto-ETF space early. The U.S. has been quite slow in greenlighting one of its own, with the first few Bitcoin Futures-backed ETFs launching just last month.

That being said, many enthusiasts in the country are now rallying for an Ethereum-backed ETF. The absence of approval for spot BTC ETFs in the U.S. indicates that those backed by Ethereum remain much farther off, and Polkadot ETFs even more so. Either way looks like it will be Europe taking the lead on this front.

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)