Polygon’s ecosystem registers growth, but these metrics sound a bearish alarm

- Polygon’s ecosystem outperformed other Layer 2 solutions.

- However, stakers were seen losing interest in MATIC.

Despite the competitive landscape of the Layer 2 sector, Polygon managed to perform well. According to data provided by Artemis, Polygon’s ecosystem has been thriving. Interestingly, it outperformed L2 solutions such as Optimism and Arbitrum in various areas.

ETH L2s comparisons ⚔️

#1 in users: $MATIC ?

#1 in transactions: $MATIC ?

#1 in TVL: $ARB ?

#1 in DEX volume: $ARB ?

#1 in fees: $ARB ?

#1 in revenue: $MATIC ?

#1 contract deployed: $ARB ?@0xPolygon @arbitrum dominating on fundamentals pic.twitter.com/ZSyfOdKvnz— Artemis ? (@Artemis__xyz) February 18, 2023

One of the major sectors where Polygon showed dominance was revenue generation. Based on Artemis’ data, it was observed that Polygon’s revenue grew materially over the past few months. In this matter, MATIC outcompeted other L2 solutions such as Optimism and Arbitrum.

Read Matic’s Price Prediction 2023-2024

One of the reasons behind Polygon’s commendable performance was the increase in the number of users on the network.

Well, this saw the number of transactions on the Polygon network going up.

The growing interest in Polygon’s network could be attributed to its NFT and DEX activity.

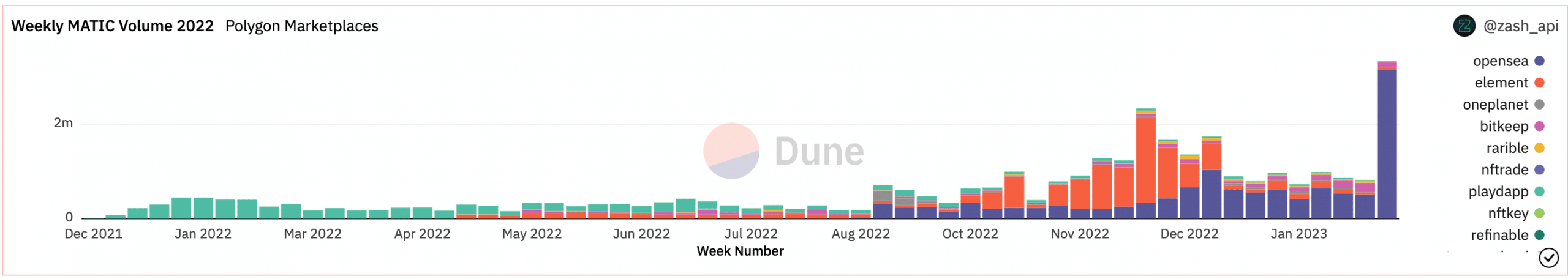

According to data provided by Dune Analytics, in fact, the NFT volume on Polygon’s network observed a huge spike. Thanks to the recent surge in interest in the overall NFT space and Polygon’s multiple collaborations and partnerships over the past year.

But it wasn’t just the NFT space that was driving users to the Polygon network, DEXes were also contributing. Based on Dune Analytics data, the volume of Polygon’s DEX increased from $69 million to $185 million in the span of two weeks.

Polygon’s dominance in the NFT and DEX space suggested that users had a lot of faith in its ecosystem.

Well, thankfully, these factors impacted the price of MATIC positively. Over the last week, MATIC’s price surged from $1.23 to $1.53.

Proceed with caution

However, there were few metrics that suggested that this bull run could come to an end soon.

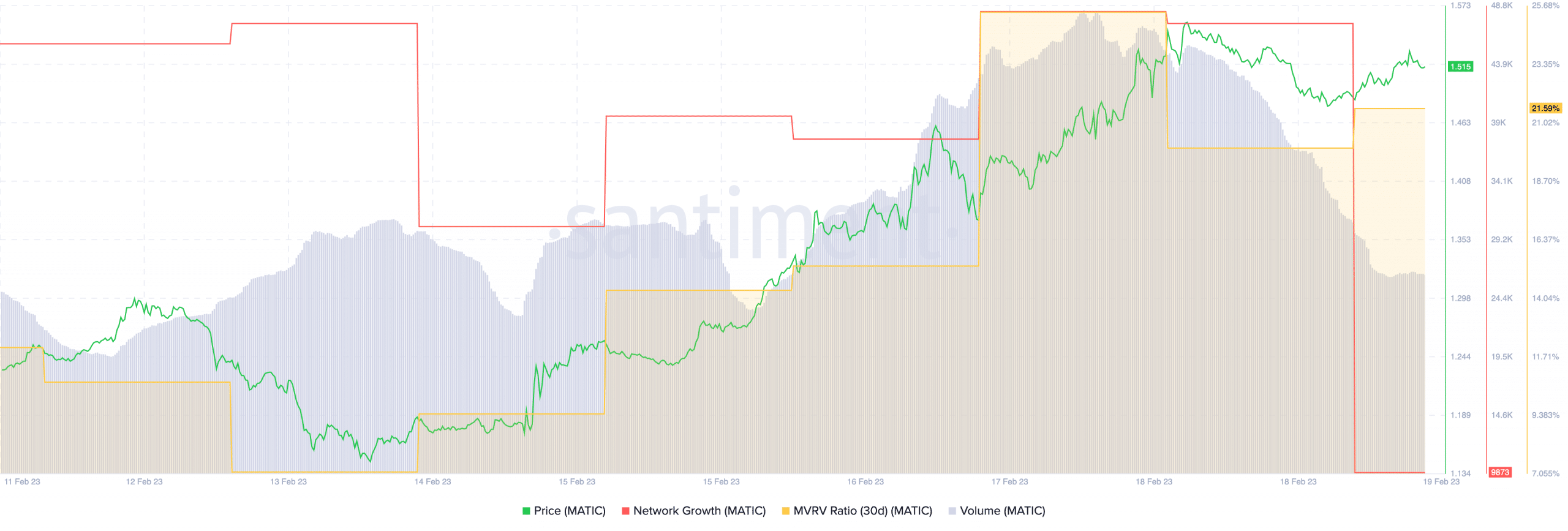

One of them was MATIC’s declining network growth. According to Santiment’s data, the overall network growth of the MATIC token has fallen considerably.

This implied that the number of new addresses transferring MATIC had reduced significantly. It goes without saying that a decline in interest from new addresses would impact the price of MATIC negatively, in the near future.

Moreover, MATIC’s MVRV ratio saw an increase. The high MVRV ratio meant that addresses could sell their holdings for a profit. This would, in turn, increase the selling pressure on MATIC holders.

How much is 1,10,100 MATIC worth today?

Another cause of concern for MATIC token holders can be the decline in its volume. Over the past few days, the overall volume declined from 1.4 billion to 616 million.

Furthermore, stakers were seen losing interest in MATIC during this period. According to data provided by Staking Rewards, the number of addresses staking MATIC reduced by 0.62% over the last 30 days.

The disinterest from stakers could signal a possible bearish outlook for Polygon in the future. However, if Polygon continues to show growth in its ecosystem, it could keep the MATIC selling pressure at bay for some time.