Polygon’s latest update spikes whale holdings, will MATIC pivot?

- A look at Polygon’s contribution to the blockchain mass adoption readiness in Japan.

- MATIC flashes signs that it is gaining bullish momentum after being due for a recovery.

Collaboration in the blockchain industry is always refreshing more so considering the unifying agenda. Polygon’s latest announcement underscores joint efforts that involve a ZK-related rollout.

Is your portfolio green? Check out the MATIC Profit Calculator

According to the announcement, Polygon teamed up with Japan’s largest blockchain, Astar Network. Polygon CKD will reportedly facilitate the deployment of a new ZK-powered layer 2 chain on Ethereum. The collaboration reportedly aims to boost the rollout of WEB3 strategies not only in Japan but across the world.

.@AstarNetwork, Japan’s leading blockchain, is launching a ZK powered L2 chain on Ethereum using Polygon CDK. The ZK-powered chain will enable businesses to implement web3 strategies with increased speed, scalability, and security in Japan and beyond. https://t.co/33V8L9ZYM0

— Polygon (Labs) (@0xPolygonLabs) September 13, 2023

The announcement comes at a time when the Japanese have been embracing blockchain technologies. The Polygon CDK-powered Astar zkEVM aims to boost blockchain adoption in multiple areas in Japan, including gaming and entertainment. This development underscores Polygon’s effort towards facilitating blockchain mass adoption.

MATIC bulls have another chance at dominance

While Polygon’s efforts highlight a move toward facilitating mass adoption and exodus to the blockchain, its native token also stood at a pivotal point. MATIC has been quite bearish over the last few weeks and it recently dipped below its June 2023 lows. In other words, it now has a new YTD low of $0.49 achieved on Monday (11 September).

Additionally, MATIC’s price action notably dipped into oversold territory during its recent lows, albeit briefly. It has since bounced back to a $0.51 press time price level, indicating that there was some accumulation which is reflected in its Money Flow Index (MFI)’s upside. This was the case with the Relative Strength Index’s (RSI) pivot as well.

MATIC’s price action also showed some divergence between the current price lows and the MFI and RSI lows. Both the MFI and RSI had higher lows than they did at their lowest point in August. This divergence could signify that the token was shifting toward a short-term bullish outlook.

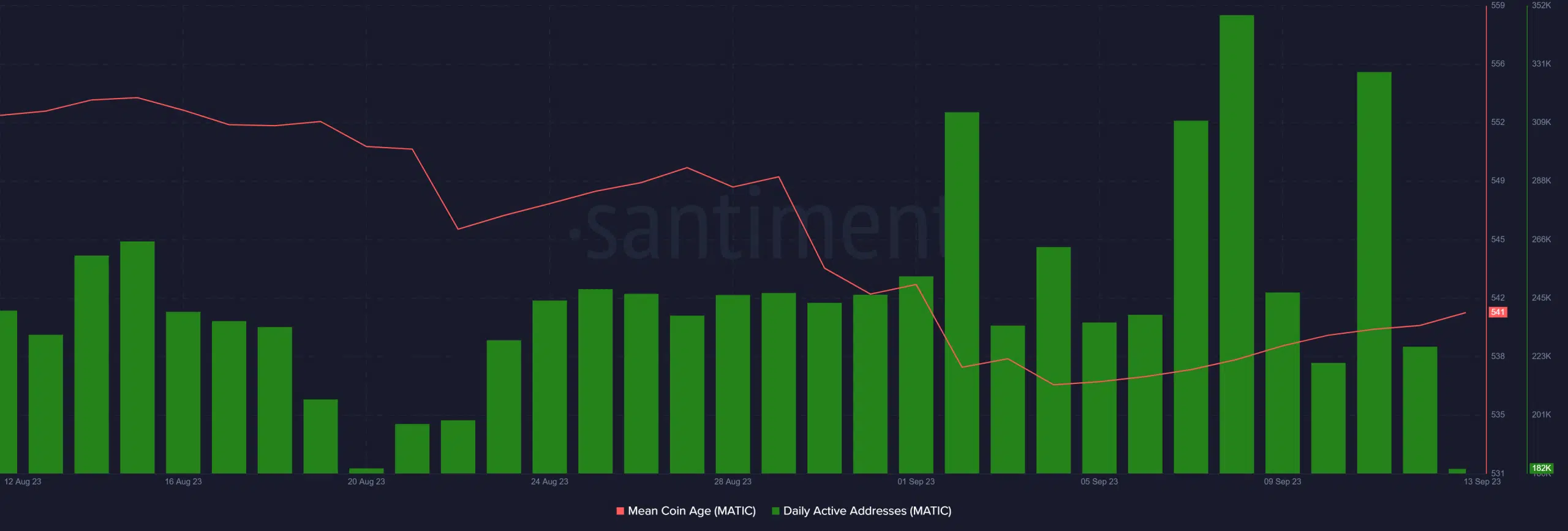

The bullish outlook was more plausible considering that MATIC’s mean coin age metric recently pivoted. This was after maintaining a downward streak that ended on 4 September. In addition, daily active addresses have been rising especially since the start of this month.

Read Polygon’s [MATIC] price prediction 2023-24

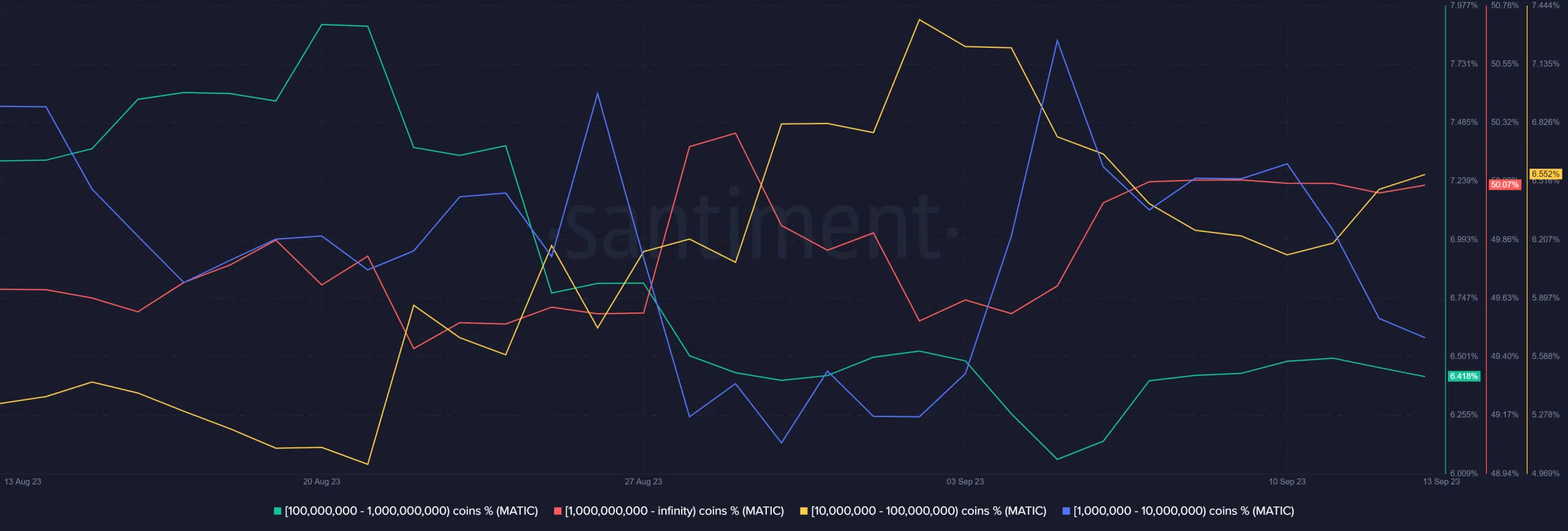

The above metrics combined with the recent dip to a new 12-month high suggested that MATIC may not experience much downside from its current level. Its supply distribution metric revealed that the largest whale category (addresses holding over 1 billion coins) has been accumulating lower price levels.

The same whale category (denoted in red), at press time, held just over 50% of MATIC’s circulating supply. The rest of the top whale categories hold single-digit percentages of the token’s supply.