Public Bitcoin miners release their January 2023 production update

We previously examined the state of Bitcoin mining, however, it’s also very important to take look at the new data that is now available.

This is courtesy of the public Bitcoin miners who recently published their productivity data for January 2023.

While we previously looked into Bitcoin mining from the perspective of reserves, the newly published data focus on production and hash rate.

These segments achieved noteworthy growth and expansion in January 2023, compared to December last year.

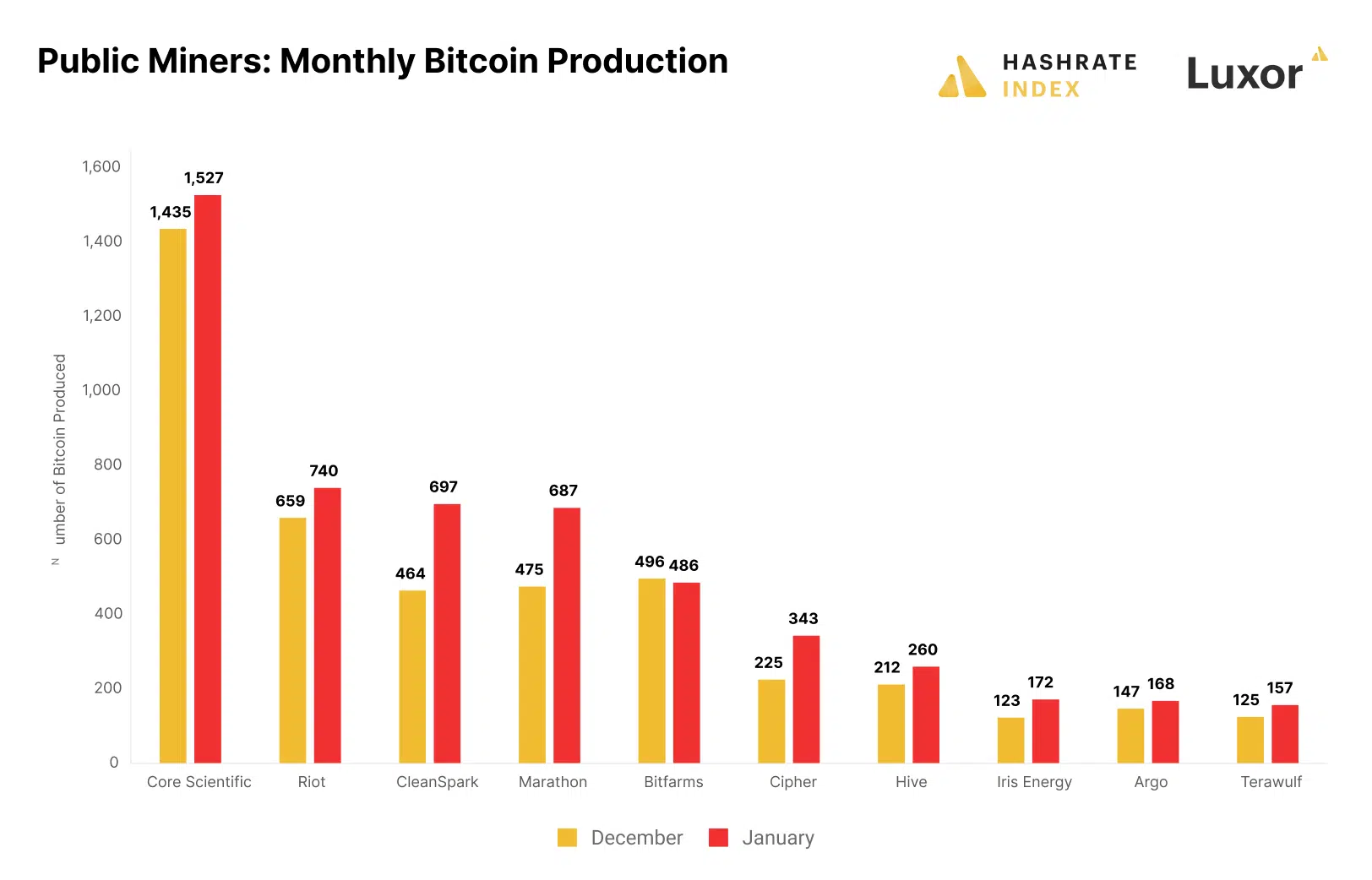

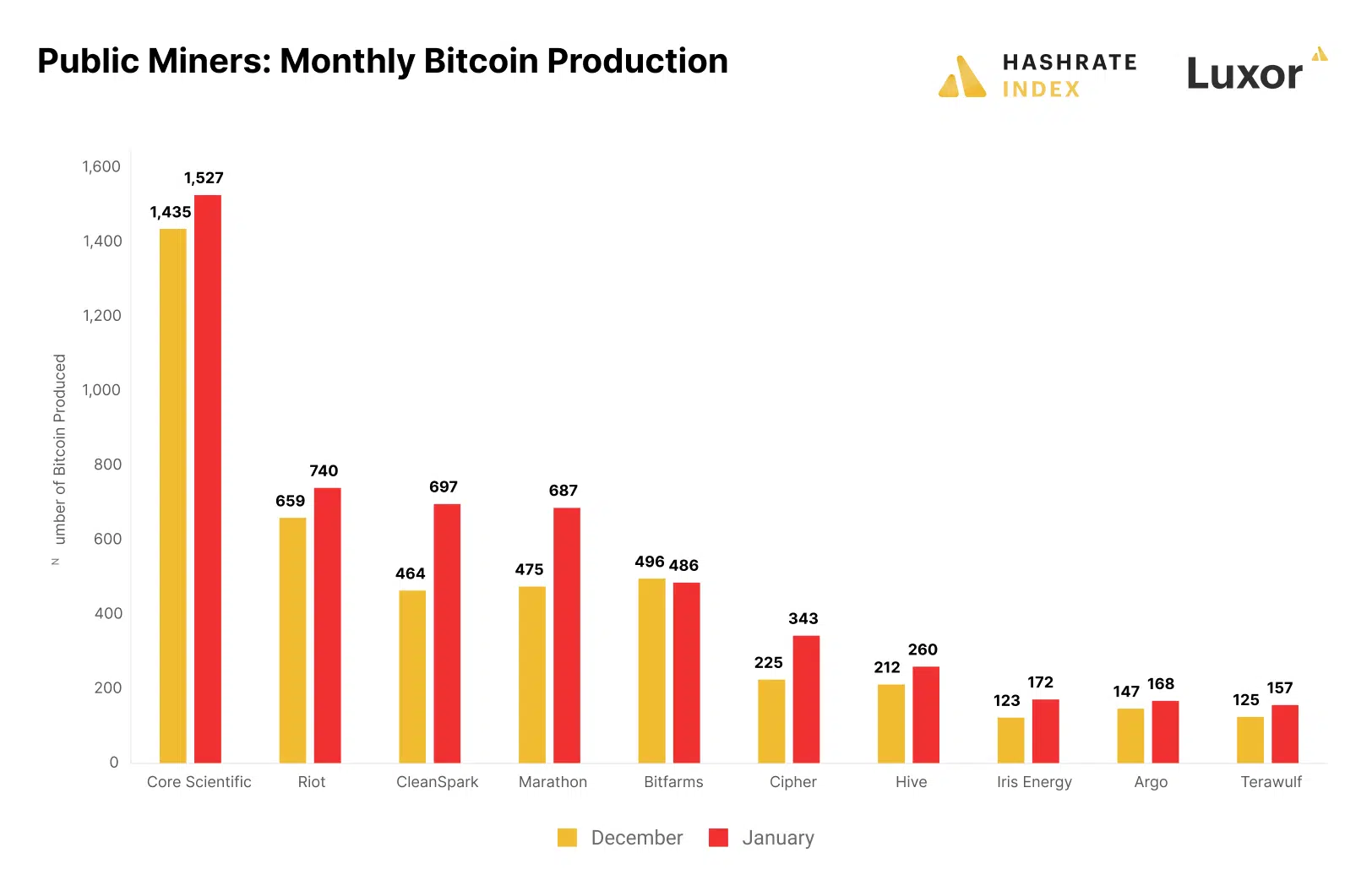

According to the report, 10 of the major public miners averaged higher Bitcoin production in January 2023, than in December 2022.

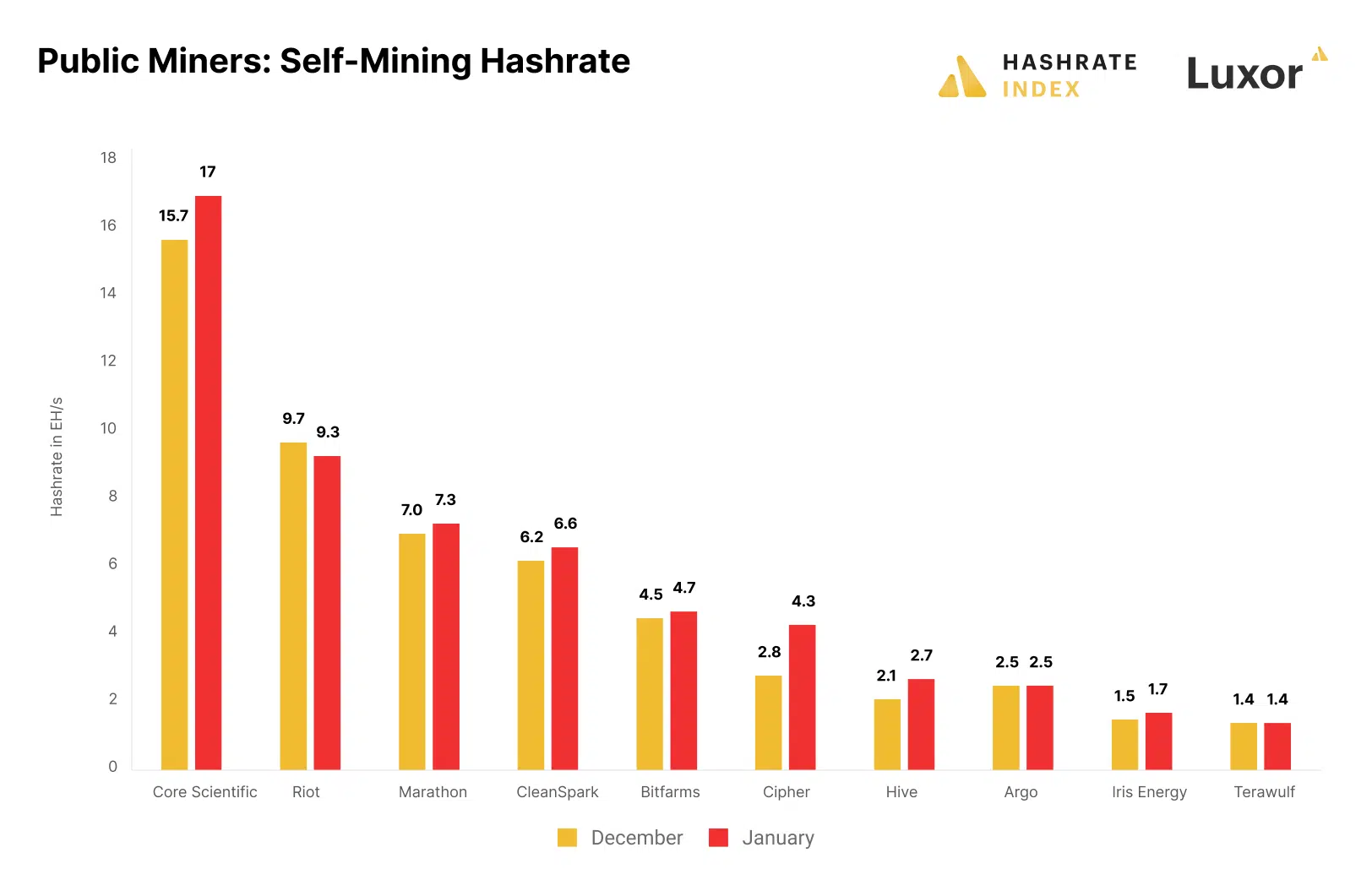

The hash rate findings also reveal an almost similar outcome. At least seven of the 10 public miners in the list had a higher self-mining hash rate in January compared to December.

There are multiple possibilities for the outcomes highlighted above. The main one is that Bitcoin bulls were dominant in January, contrary to the situation in December.

This means there was more market activity, hence more transactions. Miners may have adjusted or increased the number of mining rigs to try and meet the higher demand for Bitcoin in the market.

As for the hash rate, the report revealed that some of the mining company’s operations were affected by factors such as weather.

What about the overall Bitcoin hash rate performance?

A look at Bitcoin’s hash rate in the last 12 months reveals an upward trajectory. It went from as low as 164.47 TH/S in March 2022 to 310.87 TH/S in January 2023.

This also means that the Bitcoin network achieved higher levels of decentralization and efficiency last month.

How many are 1,10,100 BTCs worth today?

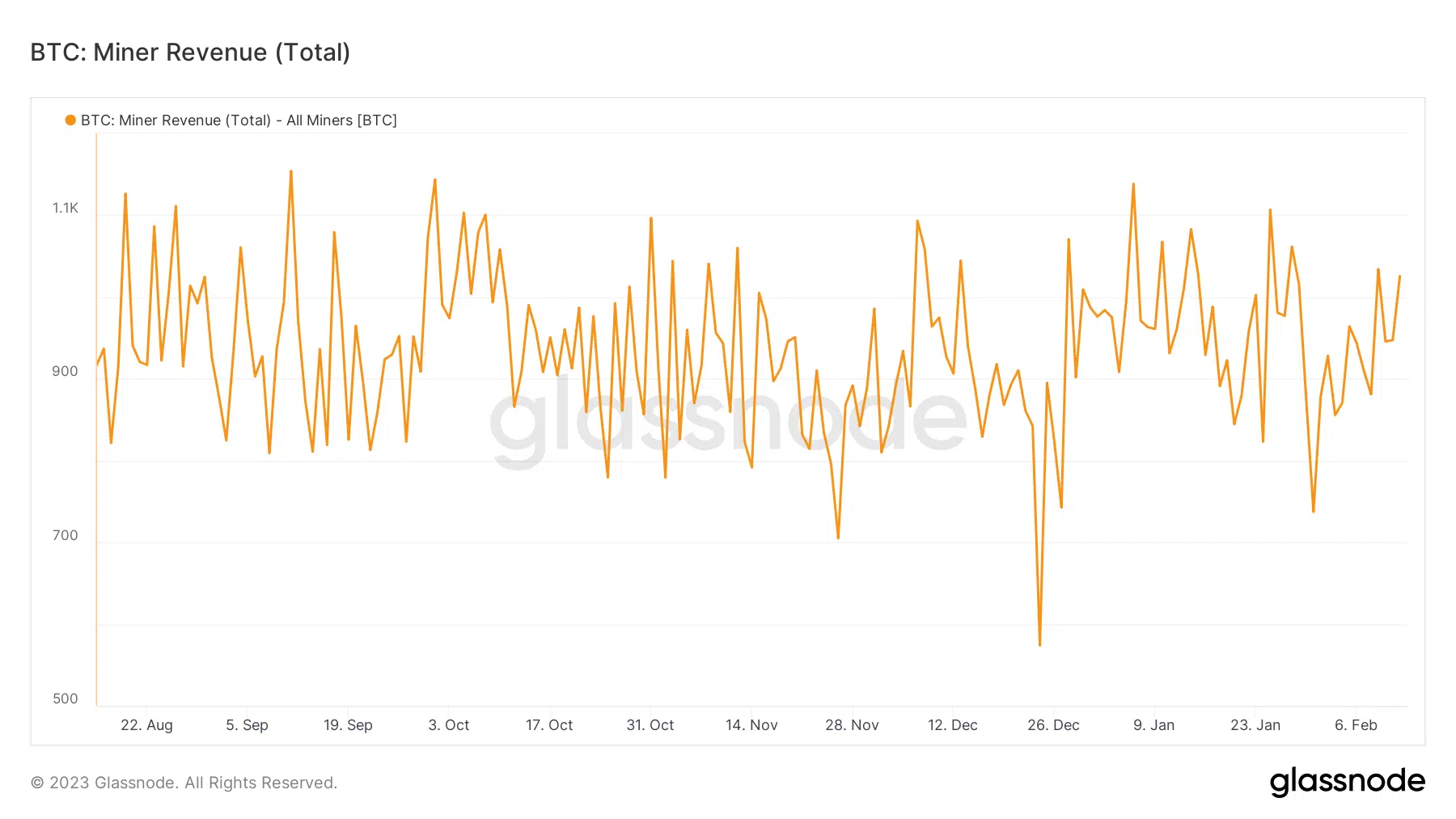

Miner revenue demonstrates an entirely different picture. The lowest miner revenue was recorded on 24 December last year.

This is around the holiday period during which the price hovered near its 2022 lowest levels. Miner revenue performance in January was also peculiar given that it dropped sharply during the month.

The decline in miner revenue in January may have a lot to do with the hash rate.

The latter increased during the month, as more miners went live to capitalize on the bulls. Fees are bound to be lower with more competition as more Bitcoin miners come on board.