Quant [QNT] traders, watch out for this before you get burned

According to data from the cryptocurrency analytics platform CoinMarketCap, Quant [QNT] has been a top performer in the last few weeks.

Ranked as the #30 largest cryptocurrency with a market capitalization of $2.07 billion, its price has rallied by 81% in the last six weeks.

The current spike in QNT’s price represents a move against the general cryptocurrency market. Per information from CoinGecko, the global cryptocurrency market capitalization has gone down by 6% within the last six weeks.

QNT holders laughing at the bank

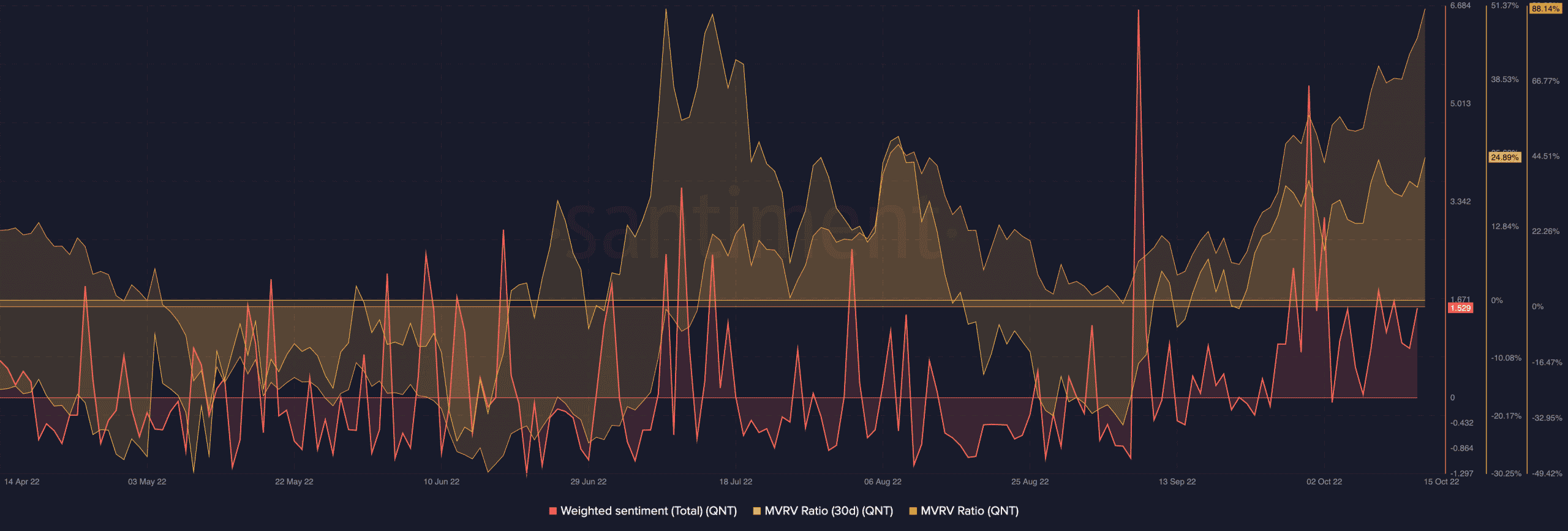

The recent rally in the QNT’s price has caused many of its holders to see gains in their investments. Data from the on-chain analytics platform Santiment showed the asset’s market-value-to-realized-value (MVRV) to be at its highest position in the last six months.

At press time, this was 88.14%, indicating that several QNT holders registered gains on their investments. On a 30-day moving average, the MVRV as of this writing was 24.89%.

As a result of the price rally and the resulting profitability of QNT holdings, the token has enjoyed a positive bias from its holders in the past few weeks.

According to data from Santiment, the asset’s weighted sentiment has been above zero since the end of September. At press time, this was 1.529.

Furthermore, due to the surge in QNT’s price, it has enjoyed enormous social coloration in the past few weeks. Since the end of September, QNT’s social volume has spiked to its highest levels in the last three months.

Look out for the cautionary signals

Well, the altcoin recorded a sharp decline in its supply held by top exchange addresses in the past two days. Between 20 July and 13 October, the QNT’s supply held by top exchange addresses had been 1.2 million.

This metric, however, declined sharply by 14 October to be pegged at 1.03 million. It indicated that whales took to profit taking in the past two days. A further decline in this metric might mean the commencement of a retracement after QNT’s rally.

In addition, observed on a daily chart, QNT was overbought at press time. The Relative Strength Index (RSI) was 77.02. The Money Flow Index was also pegged at 74, as of this writing. These are highs that buyers typically find impossible to hold for long, hence a retracement might follow.

Moreso, the rally in QNT’s price has led to a formation of a rising wedge which is usually followed by a bearish breakout. Hence caution is advised.