Reliability of Arbitrum comes into question following this incident

- The Arbitrum scanner showed a pause in production for around 15 minutes.

- ARB price and TVL trend have declined in the past few weeks.

Arbitrum [ARB] emerged as a promising Layer 2 (L2) solution, gaining widespread recognition since its initial launch. Nonetheless, its reliability came under scrutiny due to the occasional outages it faced. However, a recent post has hinted at yet another downtime episode, reigniting concerns about its stability.

How much are 1,10,100 ARBs worth today

The Arbitrum outage

On 25 July, a notable incident was reported regarding Arbitrum. It seemingly halted block production for approximately 15 minutes. The information was observed through the Arbitrum scanner. However, whether the issue originated from the scanner or the network had stopped producing blocks remained unclear.

looks like Arbitrum was down for ~15min a little bit ago?

or arbiscan rugging again idk pic.twitter.com/h1evcO6wIP

— Spreek (@spreekaway) July 25, 2023

This occurrence was not the first for Arbitrum, as it had experienced previous outages, including one in January that prompted Offchain Labs to issue a statement. During that incident, the network faced downtime due to problems with its Sequencer. The root cause was a hardware failure in the main Sequencer node which caused the network to be temporarily unavailable.

Also, around June, the Sequencer encountered another challenge when it ran out of Ether. This resulted in the inability to pay gas fees, consequently bringing Arbitrum’s operations to a standstill.

The current state of the Arbitrum network

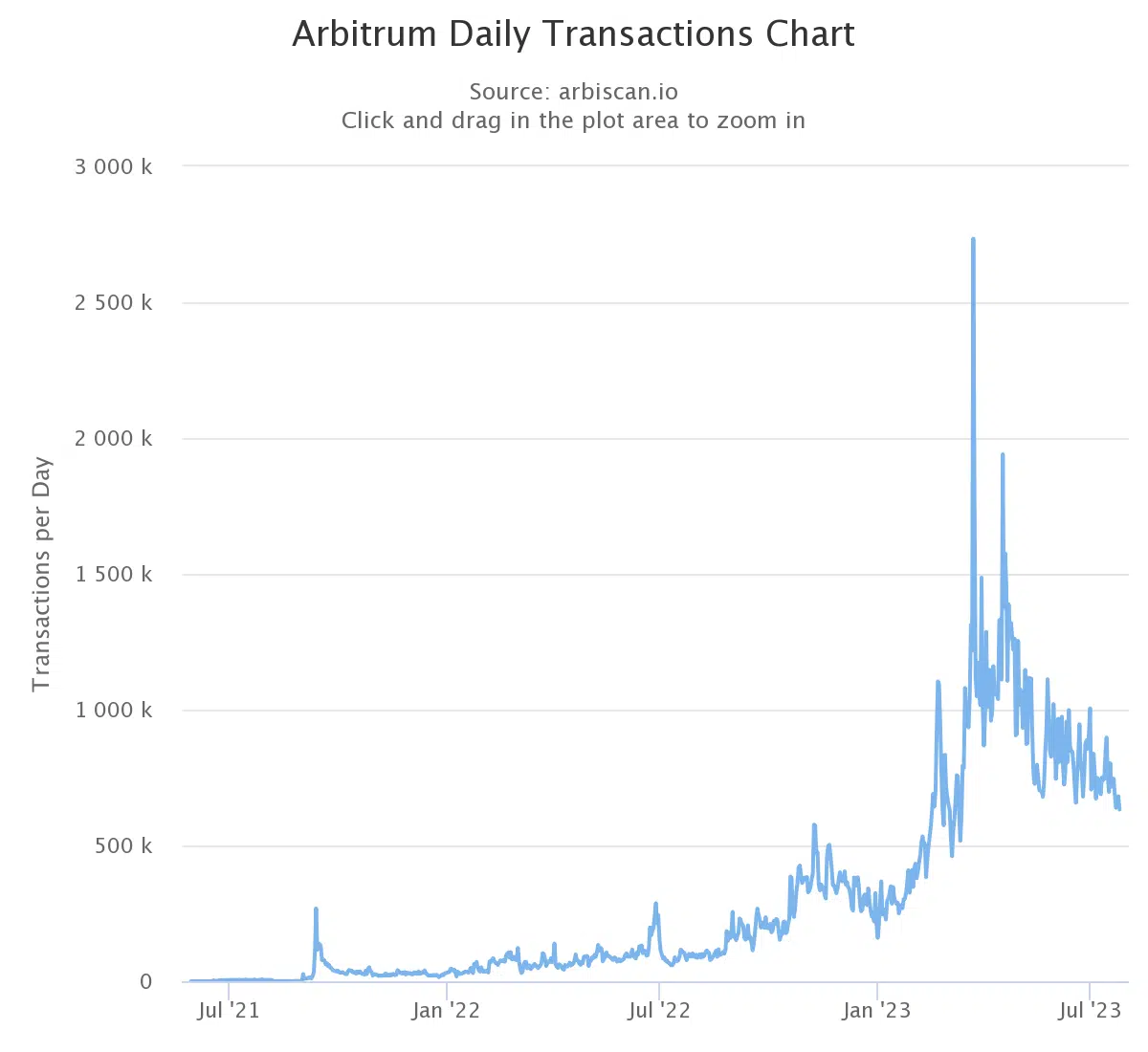

At present, normal block production has been restored, according to the data from Arbiscan. However, a glance at the transaction chart revealed a slight decline in the daily transaction volume. As of this writing, the daily transactions were approximately 632,000. Comparing this to the previous figures before the decline, the daily transactions were typically 700,000 to 800,000.

While there were no reported outages in July, it remains uncertain whether the recent decline in transaction volume is directly linked to the previous outages or if other factors were at play.

ARB fights sell pressure

According to DefiLlama data, the Total Value Locked (TVL) on Arbitrum experienced a slight decline over the past few weeks. While it was still above the significant threshold of $2 billion, the overall value has decreased. As of this writing, the TVL was approximately $2.10 billion.

Additionally, a close examination of ARB’s performance on a daily timeframe revealed that it has not seen favorable movement either.

Source: TradingView

Read Arbitrum (ARB) Price Prediction 2023-24

Over the past three days, ARB has lost more than 6% in value. As of this writing, it was trading at around $1.1, with an ongoing battle between buyers and sellers to establish dominance.

Also, the trend was currently bearish, as evidenced by the Relative Strength Index (RSI) indicator. This suggests that the market sentiment is leaning towards a negative outlook.