Report: Avalanche ends 2021 with a triumph, but here’s the flip side

As coins and tokens cautiously step back into greener pastures, it’s time to take a look at a network that saw a great deal of growth and interest in 2021. To that end, Messari Research’s report on the state of Avalanche [AVAX] in the final quarter of 2021 comes with fascinating insights and statistics.

The snowball effect

According to the report, Avalanche didn’t just see one all-time-high, but recorded ATHs in terms of active addresses, transactions, market cap, and total value locked.

The report stated,

“On aggregate, Avalanche finished Q4 averaging about 475k transactions per day, a number that is almost 40% of Ethereum’s roughly 1.25 million average transactions per day.”

Messari’s report went on to add that Avalanche seemed to be attracting users who wanted Ethereum Virtual Machine [EVM] compatibility without losing their cash to Ethereum’s high gas fees.

For a second opinion, investment analyst and professor Adam Cochran too acknowledged AVAX’s growth. Cochran felt that AVAX could outperform other L1 coins, and expressed his faith in Avalanche’s ability to scale.

Coming to Avalanche’s DeFi scene, there is plenty to take in. Messari reported that Avalanche’s TVL grew faster than most of its L1 and L2 competitors. What’s more, a large part of its DeFi milestones was thanks to Aave and Curve. However, Avalanche has a long way to go before its TVL can threaten Ethereum’s TVL dominance of more than 50%.

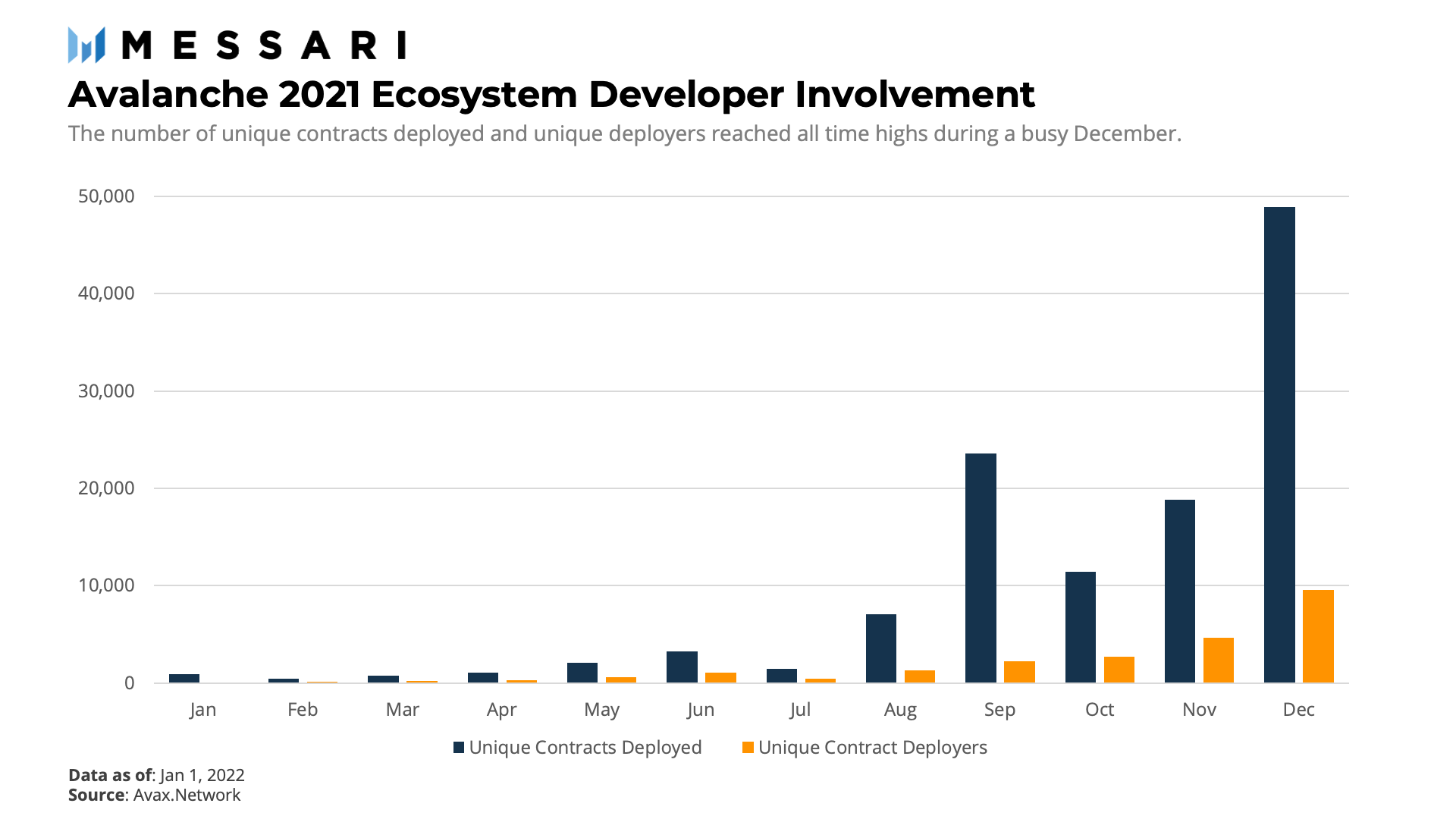

Another area of interest was Avalanche’s developer activity. The number of unique contracts deployed shot up by more than 20,000 between November and December 2021.

Source: Messari.io

A major reason might have been the introduction of Avalanche subnets in December 2021, which allow users to create their own EVM-compatible blockchains.

That said, there are challenges. The growth in users and transactions has led to surging fees. However, regular Ethereum users might be surprised to find out this meant an average of $3 per request. Even so, Messari concluded,

“The higher fees may have been a signal that the network wasn’t quite ready for the growth it experienced over Q4…”

Do you want to build a snowman?

At press time, AVAX was worth $69.45. With a market cap ranking of 12, the coin rose by 9.93% in the last 24 hours, and by 15.8% in the last seven days. Meanwhile, its all time high price was $146.22.

On Coinbase, the average holding time for AVAX was 21 days.