Republican senators say CBDCs ‘will infringe on your freedom’ – Why?

- Republican senators oppose CBDCs over concerns of government surveillance and control over finances.

- Bitcoin’s immunity to inflation and government manipulation can make it a viable alternative.

Senator Ted Cruz-led Republicans have shared their opinion on Central Bank Digital Currencies (CBDCs) recently. These digital forms of fiat currencies, which are being considered by numerous countries, including the United States, are seen by some as a double-edged sword.

Critics argue they also offer governments unprecedented control over financial transactions and the ability to surveil citizens’ financial activities.

Republicans protest against CBDCs

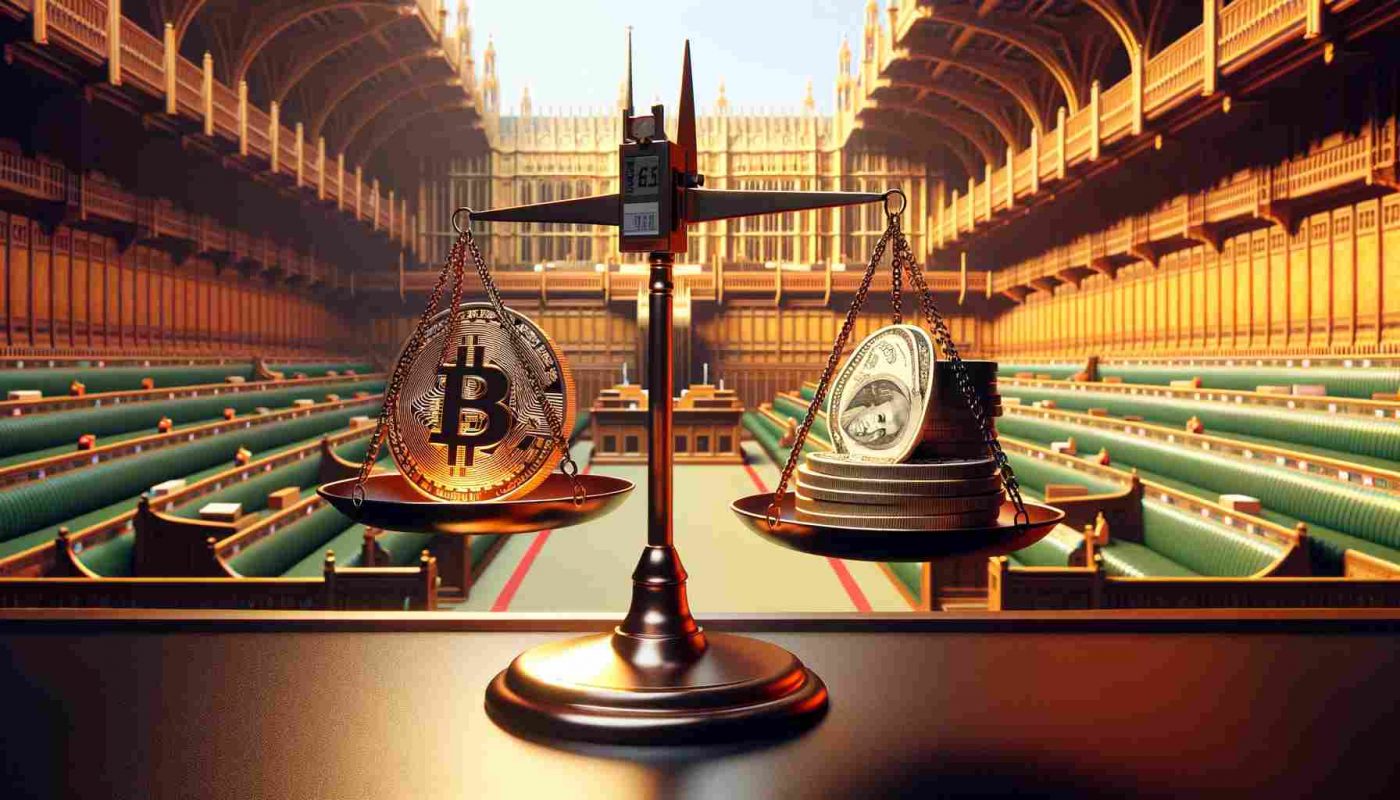

The rallying cry against CBDCs is not just a matter of financial privacy but a fundamental question about the balance of power between the state and the individual.

The heart of the controversy lies in the centralized nature of CBDCs. By design, a CBDC would be issued and regulated by a country’s central bank, granting it potential access to a trove of personal financial data and the ability to censor or restrict transactions.

In an interview with Fox Business, Cruz mentioned,

“The Biden administration salivates at the prospect of emulating China’s use of CBDCs, infringing on our freedom and intruding on the privacy of citizens to surveil their personal spending habits, which is why Congress must clarify that the Federal Reserve has no authority to implement a CBDC.”

Bitcoin as an alternative to CBDC?

Bitcoin [BTC] offers a compelling alternative to the concerns surrounding CBDCs. Transactions on the Bitcoin network are verified by a global consortium of miners, making it virtually impossible for any single party to control or manipulate the network for nefarious purposes.

This decentralization not only reduces the risk of censorship but also significantly diminishes the potential for financial surveillance by governments or central banks.

Furthermore, Bitcoin’s fixed supply cap of 21 million coins addresses another significant concern with CBDCs – Inflation.

By having a predetermined maximum supply, Bitcoin remains protected against inflationary policies that can erode purchasing power when central banks decide to print more money.

This feature makes Bitcoin not just a currency but a store of value, akin to digital gold, offering a hedge against the inflationary tendencies of fiat currencies.

Fueling security via Bitcoin

People have been reacting to this ongoing argument against CBDCs. With the recent institutional adoption of BTC, followed by its price spike to $56,000 at press time, most people are willing to bet on this digital asset.

SimplyBitcoin, a Bitcoin news provider, took to X to comment in favor of BTC.

“CBDCs will enslave you, Bitcoin will free you.”

As debates around financial privacy, autonomy, and governmental control continue to evolve, Bitcoin stands out not just as an alternative to cash but as a beacon for financial freedom and privacy in the digital age.