- Ripple gains the upper hand after the judge rules against sealing Hinman’s documents.

- The decision renewed excitement in the XRP community.

Ripple’s native cryptocurrency XRP is finally seeing a return of bullish excitement. This reaction was triggered by a favorable judicial decision in the lengthy legal battle between Ripple and the SEC.

Is your portfolio green? Check out the Ripple Profit Calculator

According to recent announcements, the judge presiding over the case recently shot down the SEC’s motion to seal the Hinman documents.

The latter relates to a speech made by William Hinman in 2018. He was the SEC director of Corporate Finance back then. Hinman stated in the speech that he did not view Ethereum’s ETH as a security.

BREAKING: $XRP price surges after Judge Torres denies SEC's Motion to Seal the Hinman documents, and holds off on #Ripple vs. #SEC verdict, awaits Congress for a regulatory roadmap. pic.twitter.com/JlS0JGBCVR

— WhaleWire (@WhaleWire) May 16, 2023

So why are investors getting excited about the statement which does not necessarily touch directly on XRP?

Well, that is because the former SEC exec’s opinion on XRP might lend favor to Ripple. This is because the court may use Hinman’s opinion to determine the eventual outcome of the case. Especially, since the SEC has seemingly been undecided about crypto’s categorization.

XRP maxis believe that Judge Torres’ decision to deny the SEC’s motion to seal the documents might offer insights into the case’s potential outcome.

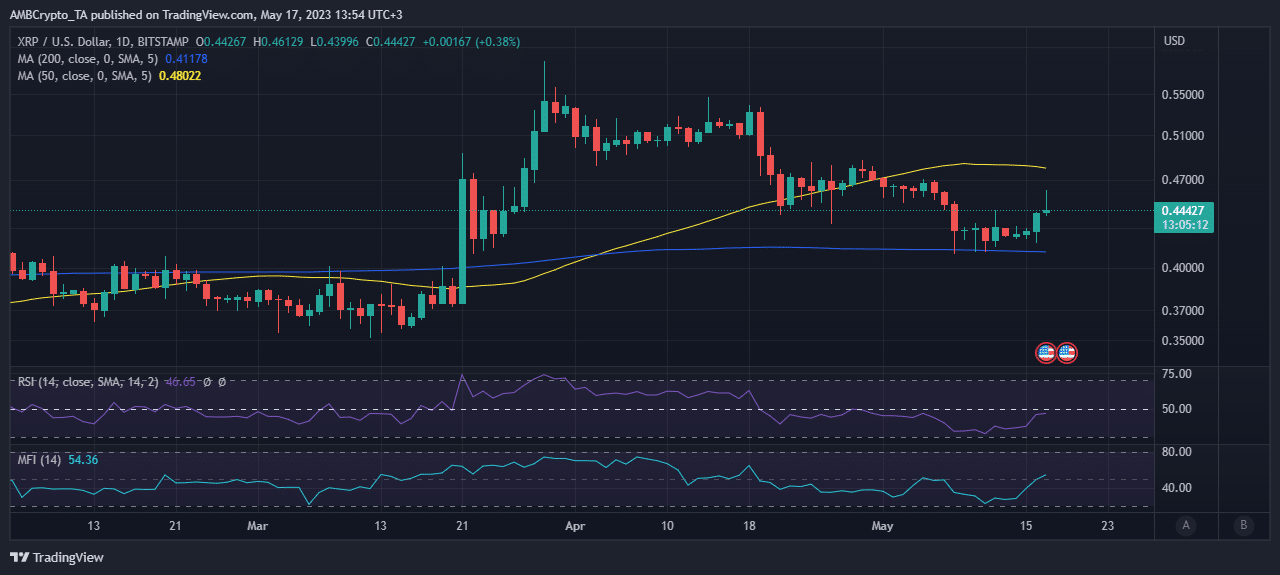

It explains the latest excitement in XRP’s price action. The cryptocurrency rallied by over 9% in the last two days after previously struggling to overcome sideways movement for multiple days.

XRP’s MFI indicator showed that there was significant accumulation in the last few days. At press time, the indicator was back above its mid-level.

The cryptocurrency gained relative strength. And the leading indicator RSI was heading towards a 50% level, at the time of publication.

Read about XRP’s price prediction for 2023-2024

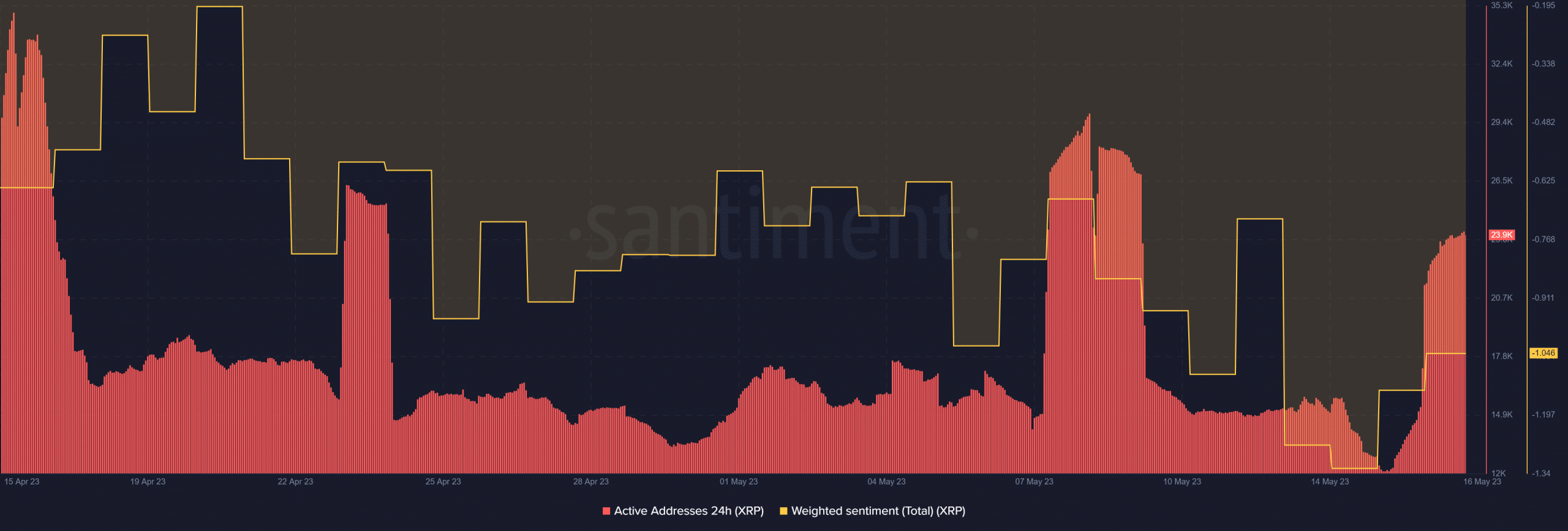

On-chain data revealed that XRP’s rally in the last two days was backed by a shift in investors’ sentiment.

The weighted sentiment metric fell to a 4-week low on 14 May but has bounced back slightly since. This bounce back was accompanied by a spike in the number of daily addresses.

Can XRP deliver an extended rally?

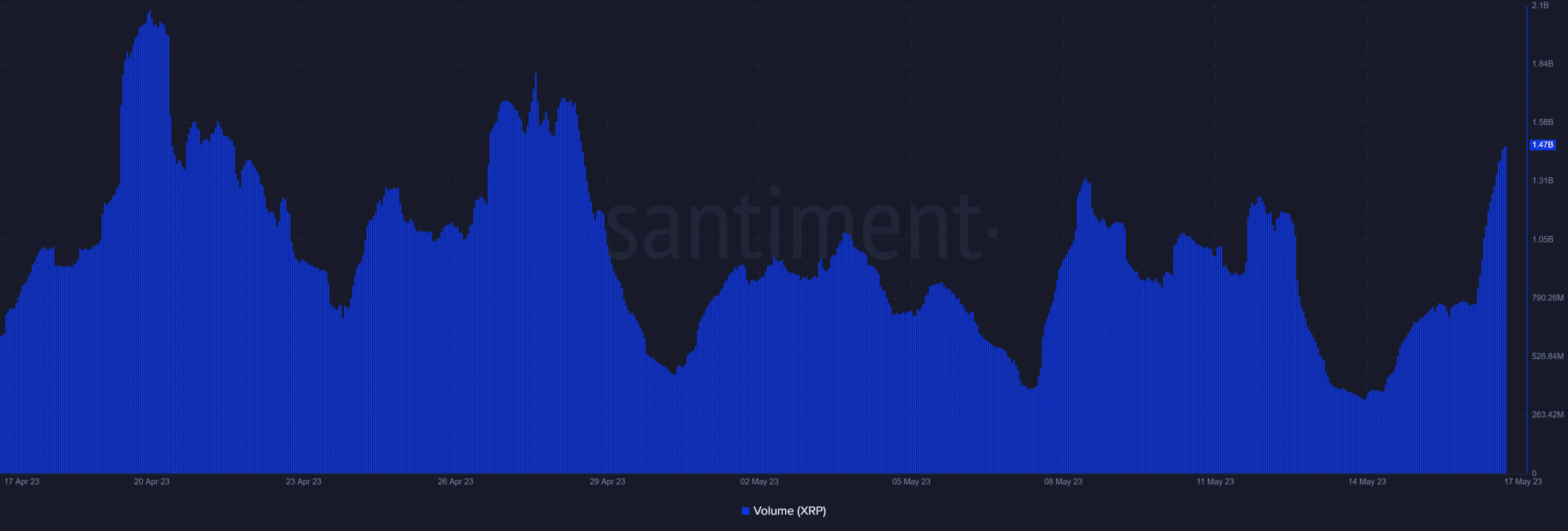

XRP’s on-chain volume has certainly made a splash after the court blocked the SEC’s filed motion.

The metric bounced to its highest level so far this month. Thus, confirming that the latest news about the Ripple v. SEC legal battle triggered a substantial reaction.

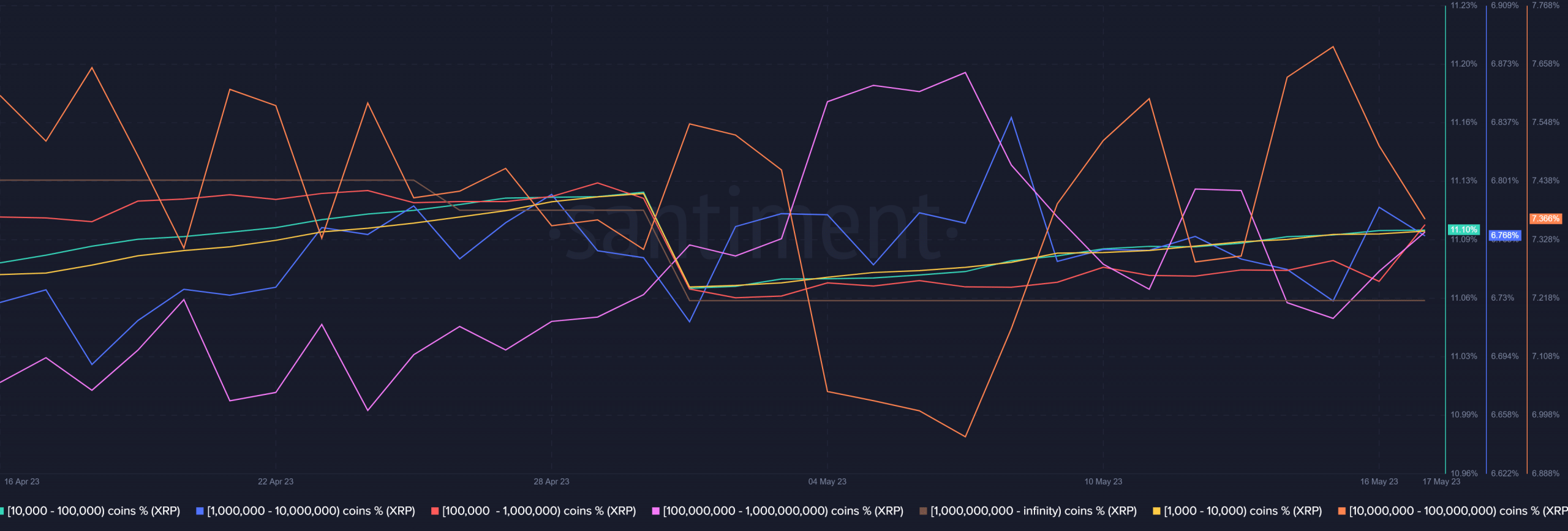

On the other hand, XRP’s supply distribution confirmed that whales were involved in the current rally.

Consider this- most addresses holding between 100,000 and 1 billion XRP have been buying in the last two days. However, some addresses within the same category have been contributing to the selling pressure.

The latter was more prominent among whales in the 10 million to 100 million category.

The final ruling is yet to be made, which means the current rally may not necessarily extend for long. The latest judicial decision is also not a guarantee that the final outcome will favor Ripple.