Rocket Pool whales take profit, form a local top: What’s next for RPL?

- Rocket Pool’s recent all-time high saw whales taking profits and forming a local top.

- Current metrics show a decline in value, a bearish trend forming, and a surge in exchange activity.

Rocket Pool [RPL] recently reached an unprecedented all-time high, which led to some significant players in the market, known as “whales,” taking their profits and creating a local peak. Now that the price has undergone a correction, it raises the question: what is the current state of whale activities and other related metrics?

– Realistic or not, here’s RPL market cap in BTC’s terms

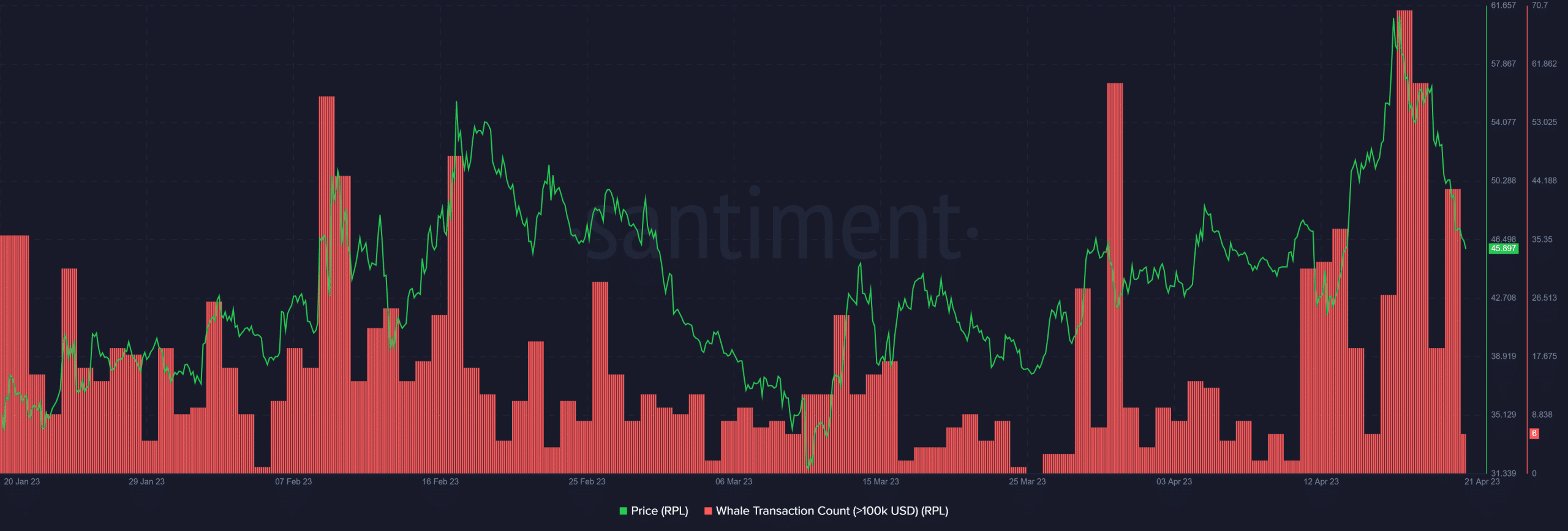

Rocket Pool whales transactions form a local top

According to Santiment, on 17 April, the number of whale transactions on the Rocket Pool platform (transactions over $100,000) increased significantly. The number reached its second-highest level.

Furthermore, the transaction count rose to approximately 70. This coincided with the platform’s local peak, where the token reached an all-time high.

On 8 November 2021, a similar trend was observed in whale transactions on the Rocket Pool platform. Transactions over $100,000 increased sharply to 111, and at the same time, the price of RPL reached its all-time high of $59.7.

Despite a brief drop in activity, whale transactions remained steady as of 20 April with 43 transactions recorded. However, as of the time of writing, the number of transactions had dropped significantly to around 6.

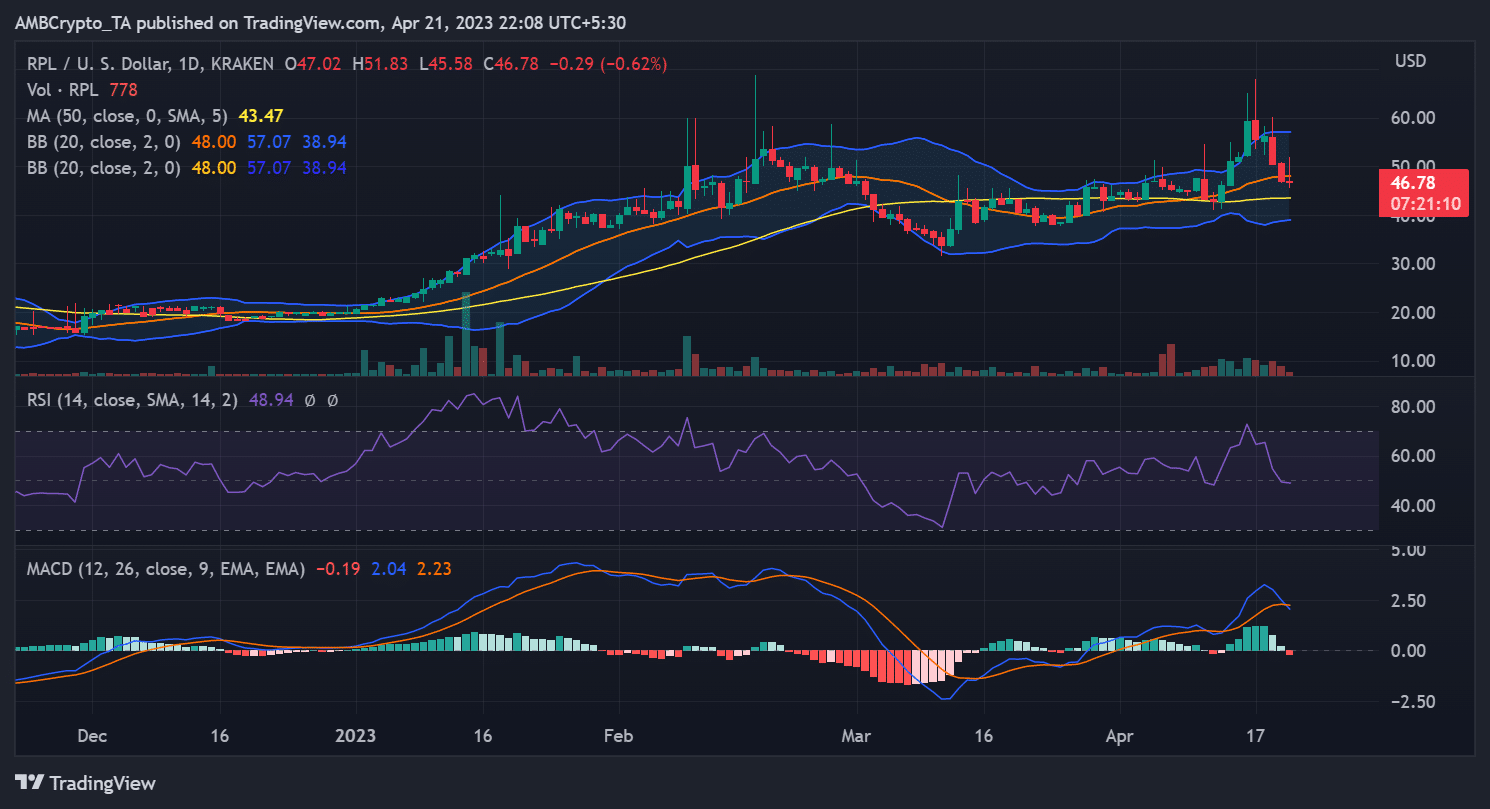

Rocket Pool on a daily timeframe

Upon examining the daily timeframe chart of Rocket Pool, a decline in value was observed. As of the time of writing, the token was trading at approximately $46.7, representing a loss of close to 1%. Furthermore, the recent decline in value resulted in a drop of almost 18% in the value of RPL.

Also, the Relative Strength Index (RSI) revealed that the token had entered a slightly bearish trend, with the RSI line dipping slightly below the neutral line. Additionally, the Moving Average Convergence Divergence (MACD) indicator correlated with the RSI, with its current position below zero, to confirm the bearish trend of RPL.

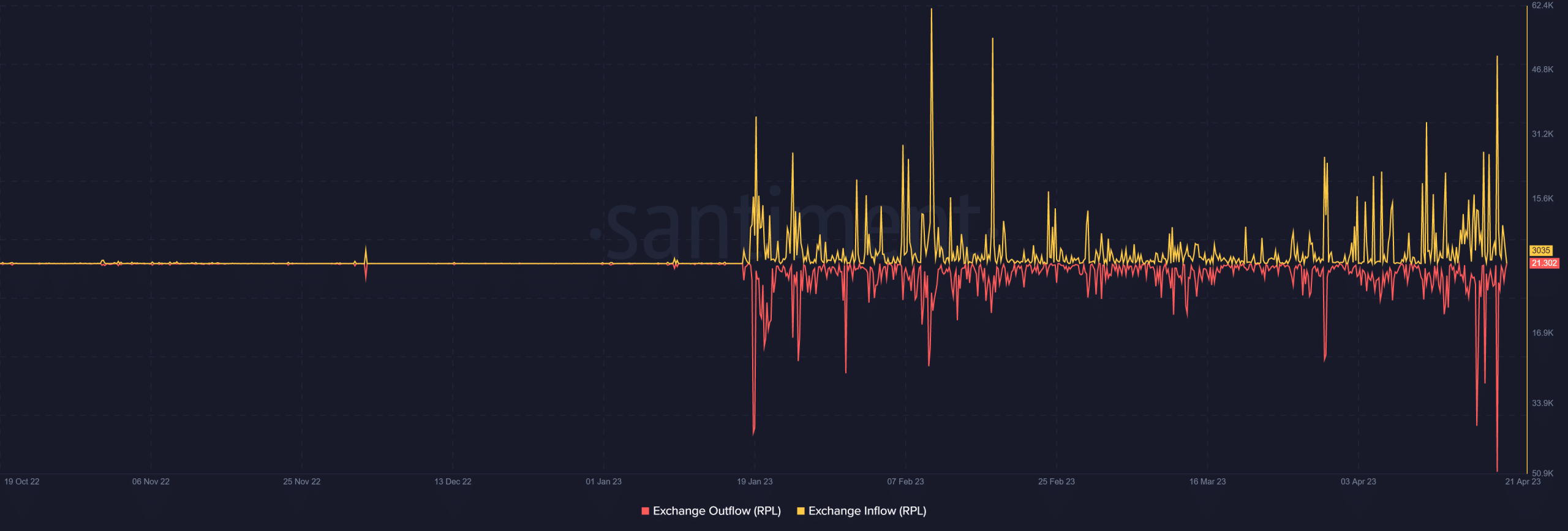

Inflow and outflow spikes

Santiment’s exchange inflow and outflow data for Rocket Pool also revealed a recent surge in activity. On 20 April, the inflow metric recorded over 50,000, while the outflow metric also showed over 50,000.

Upon closer inspection, it was noted that the outflow exceeded the inflow by a few hundred. The spikes in both metrics were the highest recorded in several months.

– Is your portfolio green? Check out the Rocket Pool Profit Calculator

It is yet to be determined if Rocket Pool will experience another surge in whale transactions. Furthermore, it remains uncertain if the subsequent spike in whale transactions will form another local market peak.