RWAs beckon Arbitrum, Base: Which L2 has an edge?

- Arbitrum and Base entered the RWA lending space with new collaborations.

- Activity on both protocols remained stable.

In the past month, Optimism [OP] took over the spotlight due to its rapid expansion efforts. Now, the stage is set for Arbitrum [ARB] and Coinbase [BASE] to make their moves in the crypto space, specifically in the realm of Real-World Assets (RWAs).

Realistic or not, here’s ARB’s market cap in BTC’s terms

RWAs get integrated

Centrifuge, a prominent player in the world of RWA lending, recently unveiled its deployment on Base and Arbitrum. This strategic move is expected to have a profound impact on both platforms.

.@Centrifuge, the leading player in RWA lending, has recently announced their deployment on @BuildOnBase and @Arbitrum.

The introduction of liquidity pools has the potential to bring billions of liquidity to these L2s with institutional-grade assets and tokenized assets. pic.twitter.com/Ib7FqMOxkz

— Emperor Osmo? (@Flowslikeosmo) September 20, 2023

The introduction of liquidity pools is poised to inject massive liquidity into these Layer-2 (L2) solutions. These pools focus on bringing institutional-grade assets and tokenized assets into the fold.

This development could be a game-changer for Arbitrum and Base, opening up new opportunities and attracting a broader range of users and investors.

A tough battle

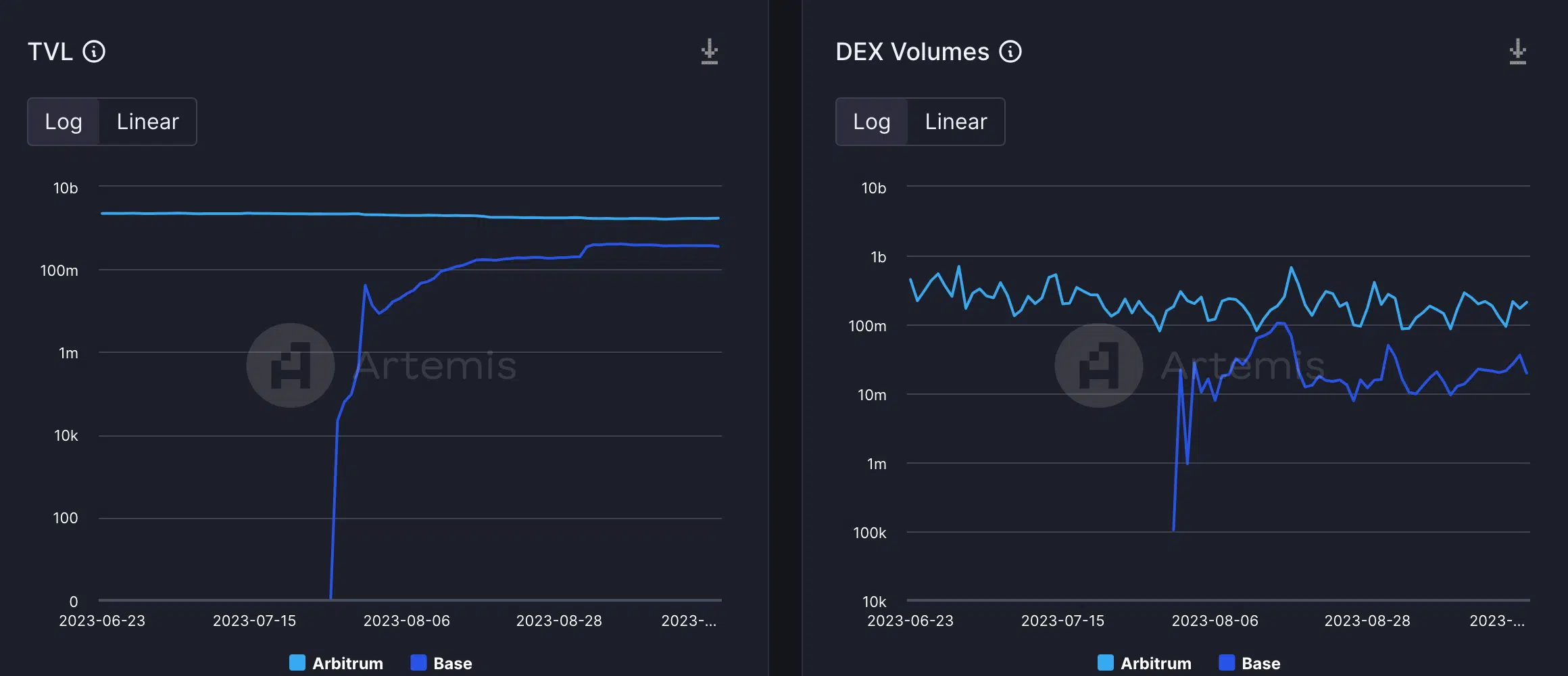

Both protocols showed promise in terms of activity. Arbitrum, particularly, thrived with a strong and active user base on the network. However, Base excelled in the number of transactions taking place, indicating a higher level of utilization.

When it came to the decentralized finance (DeFi) sector, Arbitrum was the undisputed champion. It led in both Total Value Locked (TVL) and Decentralized Exchange (DEX) volumes, consistently showing growth.

Base was still playing catch-up in this arena at press time, but the entrance of RWA lending could be a significant step forward.

New proposals

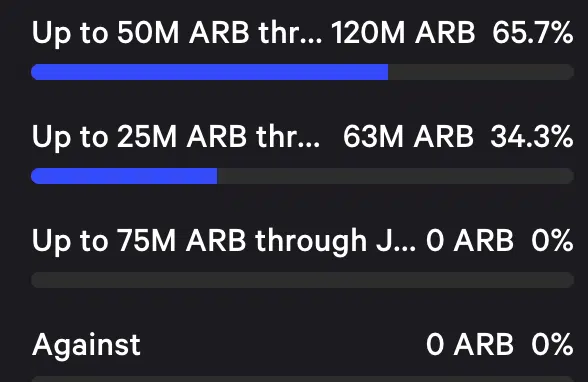

Arbitrum’s dominance enabled it to make continual enhancements to its protocols through governance proposals. A recent proposal regarding incentives in governance gained approval with significant community support.

This proposal outlined a community-created program aimed at distributing up to 75,000,000 ARB tokens from the DAO treasury, which would be used to incentivize active Arbitrum protocols.

Read Arbitrum’s [ARB] Price Prediction 2023-2024

Impressively, the proposal garnered 65% of the votes in its favor.

ARB sees green

In terms of price, ARB was trading at $0.838 at press time. Over recent weeks, its price has experienced an upswing, indicating renewed market interest. Additionally, trading volume for the token surged during this period, rising from 71 million to 128 million at the time of writing.