SAND treads water above a demand zone, can another wave of buying commence next week?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

The Sandbox has seen some demand for its token SAND over the past month. Bitcoin saw a decent bounce in July. However, SAND was in an upward trend on lower timeframes since the last week of June, as the buyers initiated a recovery from the drop to $0.7. Since then, the $0.96 and $1.27 resistance levels were both flipped to support. Could the momentum continue, or has demand dried up?

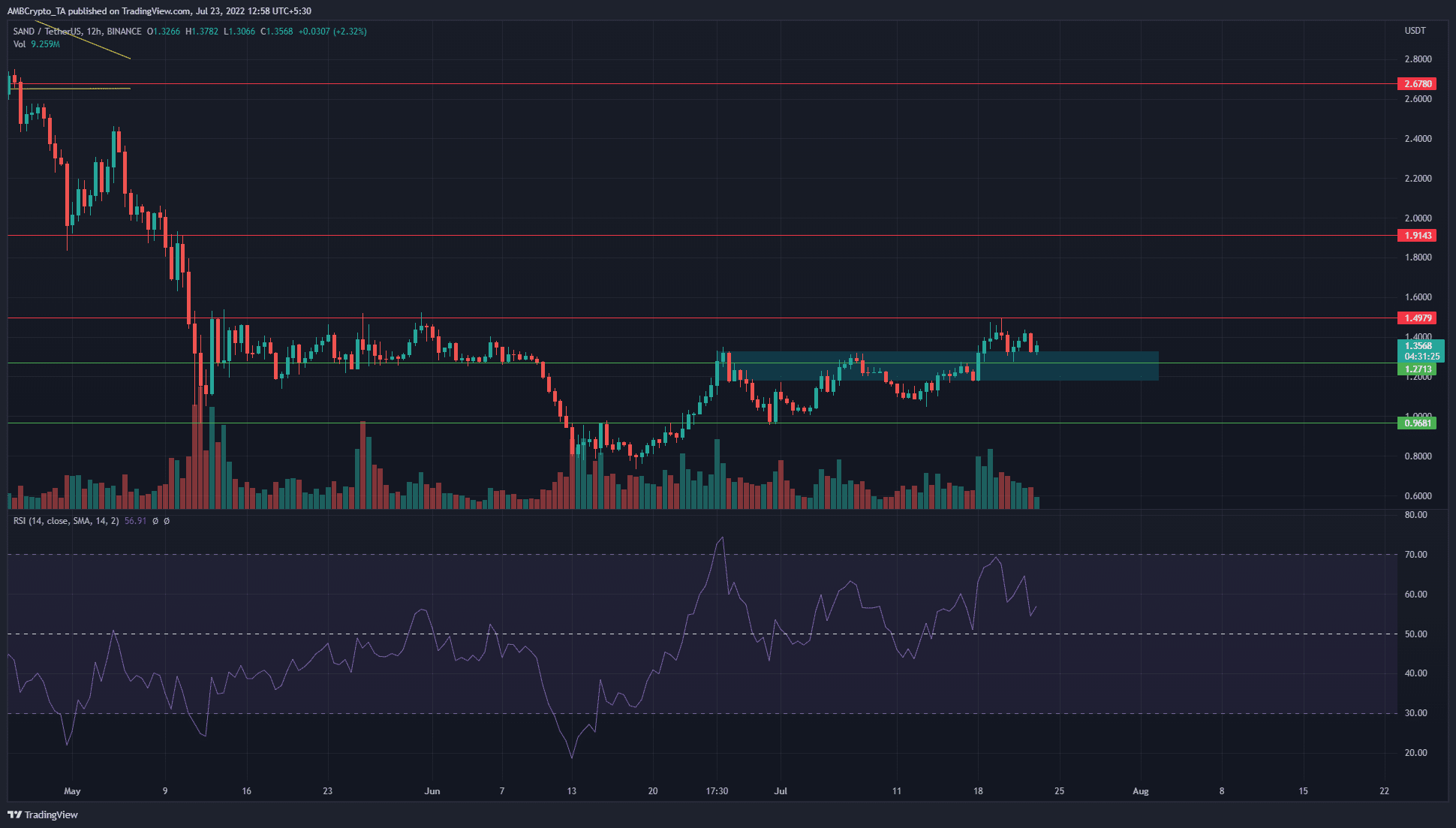

SAND- 12-Hour Chart

In May, SAND held on to the $1.27 support level and established it as an important level for the bulls. Thereafter the price fell beneath it in June, but a couple of weeks into July SAND has already been hauled back above the same level.

In late June, the cyan area at $1.2 highlighted a bearish order block, which has since been flipped to a demand zone. The higher timeframe Relative Strength Index (RSI) has also been above neutral 50 for the past three weeks.

Taken together, the momentum was concluded to favor the bulls over the past month and a half. In terms of price action as well, the price has set a series of higher lows and higher highs since mid-June.

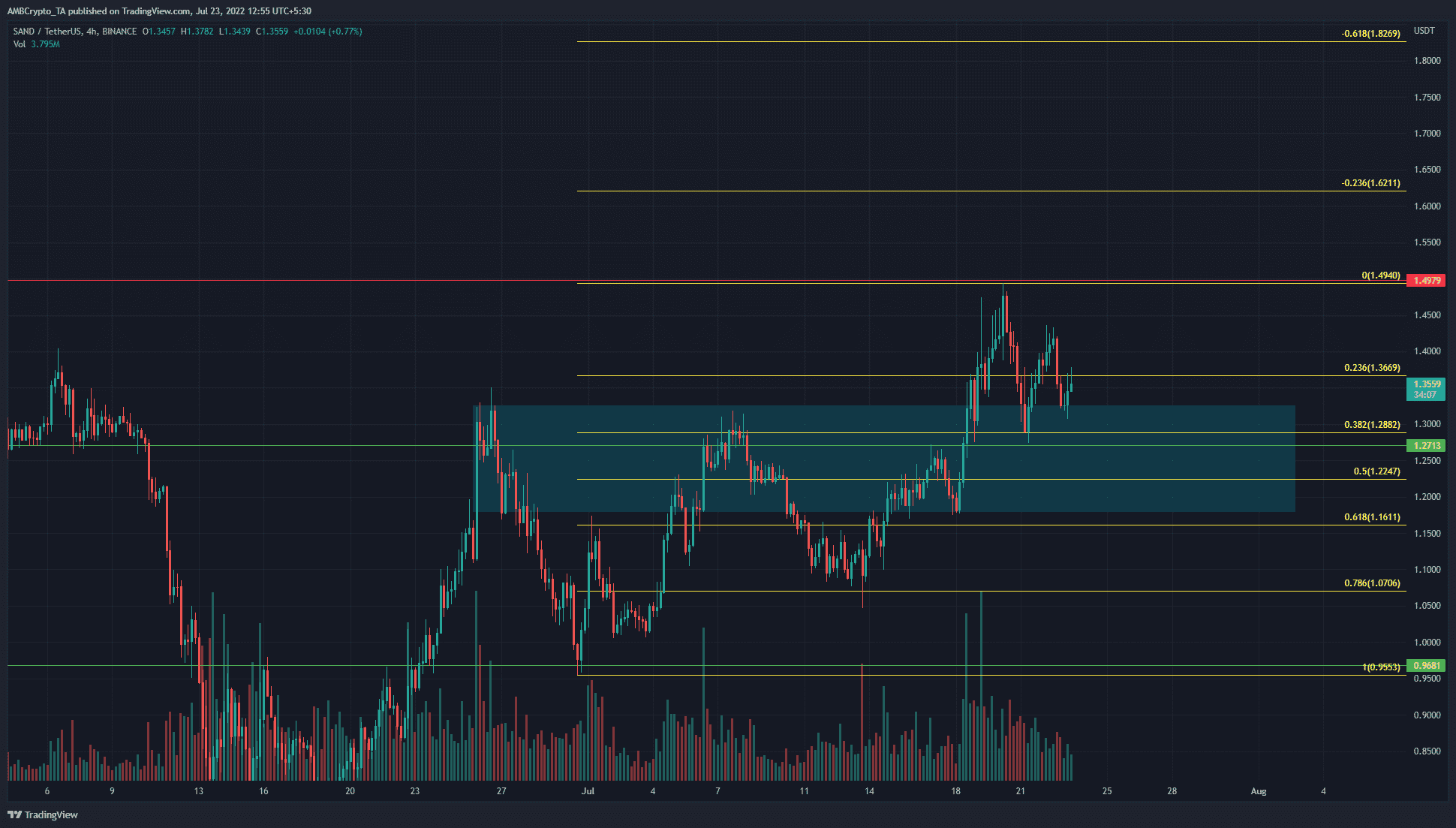

SAND- 4-Hour Chart

Zooming in on the four-hour timeframe, we can see two waves upward for SAND from mid-June. One rally took SAND from $0.8 to $1.3, and a subsequent pullback to $0.95. Another push higher was from $0.95 to $1.49.

Based on the latter move, a set of Fibonacci retracement levels was plotted. The 38.2% retracement level sat at $1.288 and had confluence with the cyan demand zone, as well as the $1.27 support level from May.

Indeed, SAND has respected the 38.2% level as support thus far. However, it has also formed a lower high over the past few days. On a lower timeframe, this suggested weakening buying pressure. However, on the four-hour timeframe, the bulls can be considered to hold sway so long as the $1.27-$1.25 area was defended.

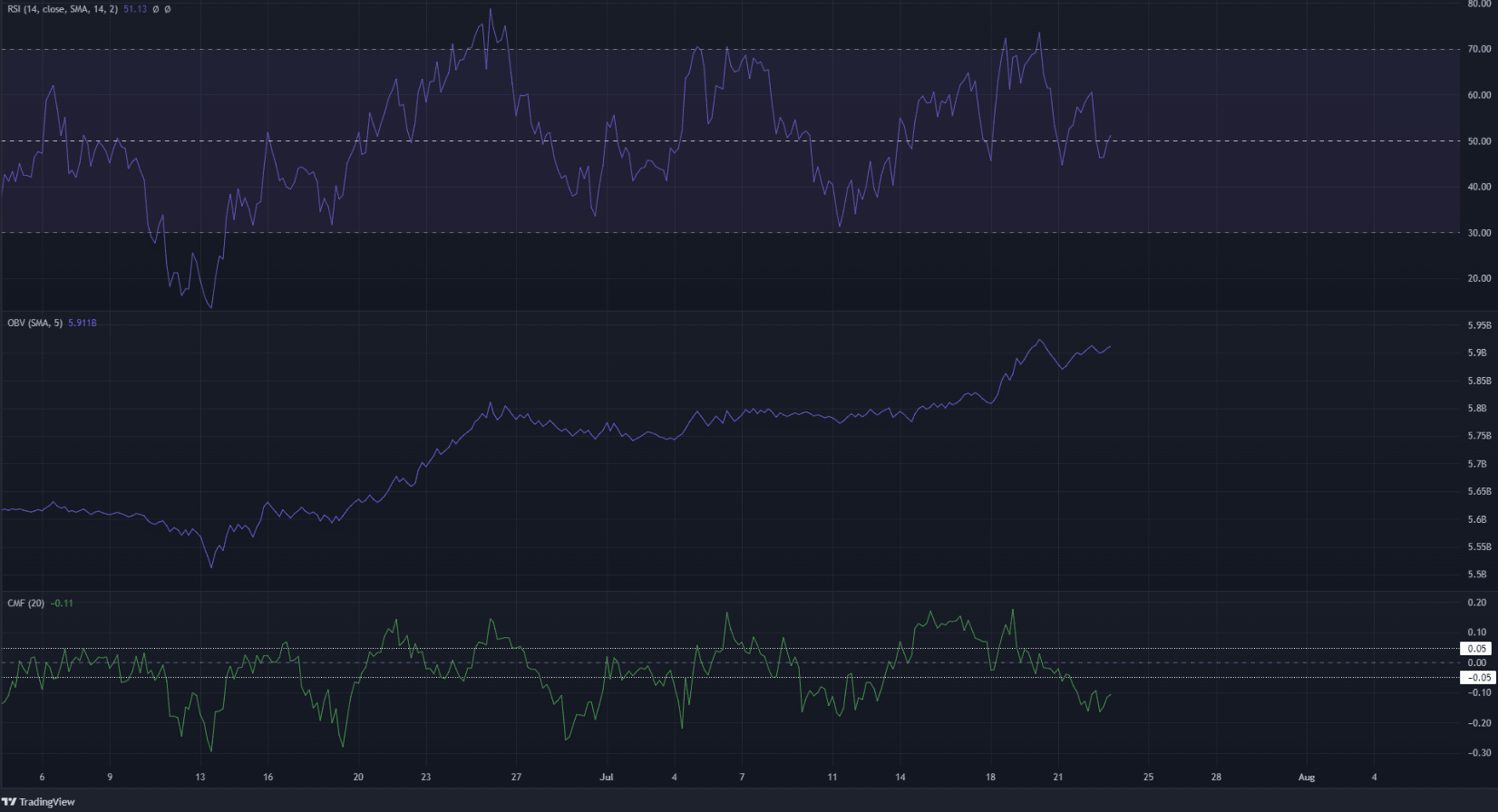

The indicators also leaned in favor of the bulls. The RSI has been above neutral 50 over the past ten days, while the On-Balance Volume (OBV) saw a massive surge upward a few days ago. The RSI showed the momentum to be bullish, although it stood in neutral territory at press time.

The OBV also reflected significant buying volume in the past few days. However, the Chaikin Money Flow (CMF) was in disagreement. The CMF dipped sharply below the -0.05 mark to show hefty capital flow out of the market.

Conclusion

The price action highlighted the $1.27 support level to be critical. Bitcoin has faced rejection at $24.2k. If it can defend the $22k area and form a higher low, it could likely continue to push higher. This in turn would positively affect The Sandbox native token SAND.