Shiba Inu bears force another plunge in prices after retesting of resistance

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The resistance that was retested in recent days was important back in December.

- The development of a bullish divergence suggested that a minor bounce was possible for Shiba Inu.

Shiba Inu [SHIB] bulls did not have a pleasant ride over the past two months. The range formation in March and April was followed by a severe downtrend in the latter half of April, and the bulls were unable to put up a real fight.

Read Shiba Inu’s [SHIB] Price Prediction 2023-24

On-chain data and price action implied different directions for Shiba Inu. This could mean that, while unlikely, there was a chance Shiba Inu could recover quickly if the sentiment across the market leaned bullishly.

The next support zone lay a further 8% below current market prices

The price action on the 12-hour chart left little evidence in support of the bulls. The trend has been downward since mid-April, after the rejection at the $0.0000117 resistance.

The bulls tried to make a stand at the $0.0000099 area, where a bullish order block from March existed.

Their attempts were futile and the bears were able to crush bullish hopes. In May, SHIB posted losses of close to 15.5% at the time of writing, with more red to follow.

Over the past two days, Shiba Inu fell beneath the lower timeframe support at $0.000009 and retested it as resistance.

At press time, a bullish divergence was forming between the RSI and the price. The RSI was in oversold territory but formed a higher low while SHIB formed a lower low.

This could see a minor bounce in prices. If this were to happen, a hidden bearish divergence could develop later on and would signal the continuation of the downtrend.

Another bullish order block on the H12 timeframe was present at $0.000008. The downtrend and the falling OBV showed that bearish pressure was bound to drive another leg southward.

Exchange address supply’s fall suggests SHIB outflow

Source: Santiment

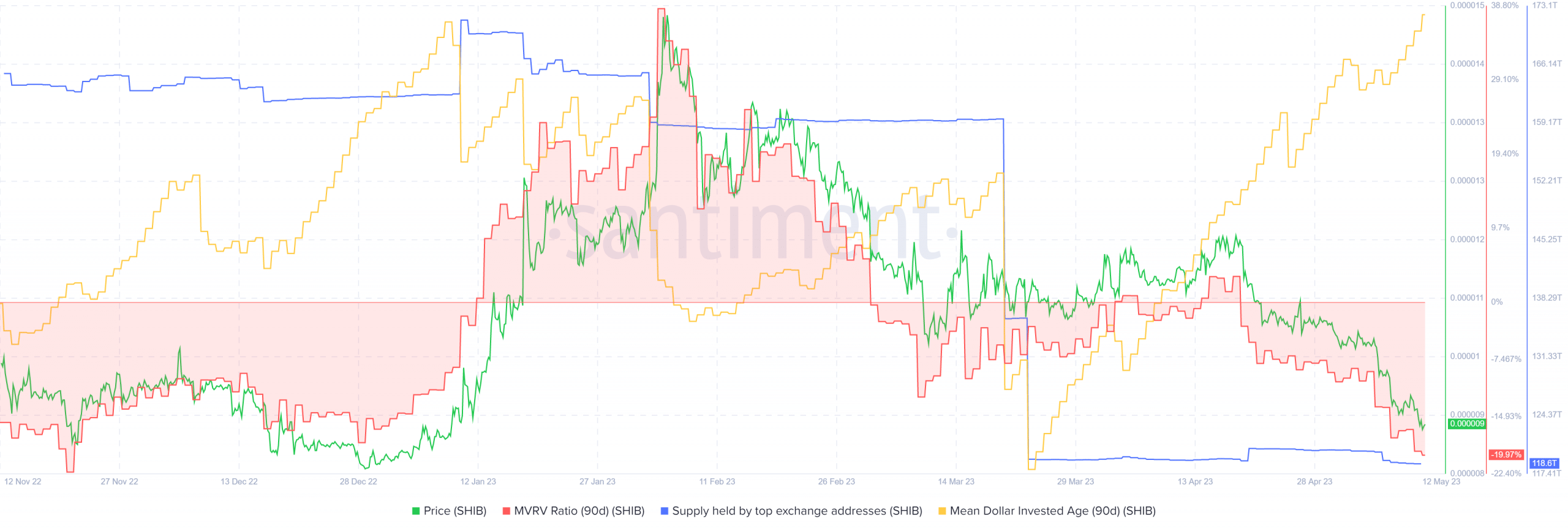

The data from Santiment showed that the mean dollar invested age was on the rise since late March. At the same time, the supply held by top exchange addresses also plummeted. Together they likely showed accumulation by the bulls.

Yet the price has been on a strong downtrend after the bearish market structure shift in mid-April. The 90-day MVRV also showed an enormously undervalued asset.

Is your portfolio green? Check the Shiba Inu Profit Calculator

The last time the MVRV dropped to these levels was in November. However, this does not rule out further losses.

The formation of a bullish divergence gave the Shiba Inu bulls some hope, but it was unlikely to reverse recent losses.