Shiba Inu’s burn rate is >1000% but SHIB is under $0.001- Here’s why

Two-thirds, that’s how much of the value of Shiba Inu disappeared so far in 2022. Even the biggest fans of the meme coin aren’t woofing it up much these days.

However, there’s at least one reason for hope. Notably, more Shiba Inu holders are burning their tokens. But the question is- Can Shiba Inu even burn its way to $0.001?

Pup on fire

At the time of writing, SHIB struggled to reclaim the lost possession as it suffered a fresh 4% correction on CoinMarketCap. At the time of writing, it traded at the $0.0000109 mark.

The price didn’t look much praiseworthy but SHIB’s community left no stone unturned in burning SHIB’s supply.

Shiba Inu’s burn rate reached triple digits and stood at 1,031% at one moment as highlighted in the tweet below.

JUST IN: The burn rate for $SHIB is up 1031% today?

— Shiba Archives (@ShibaArchives) September 25, 2022

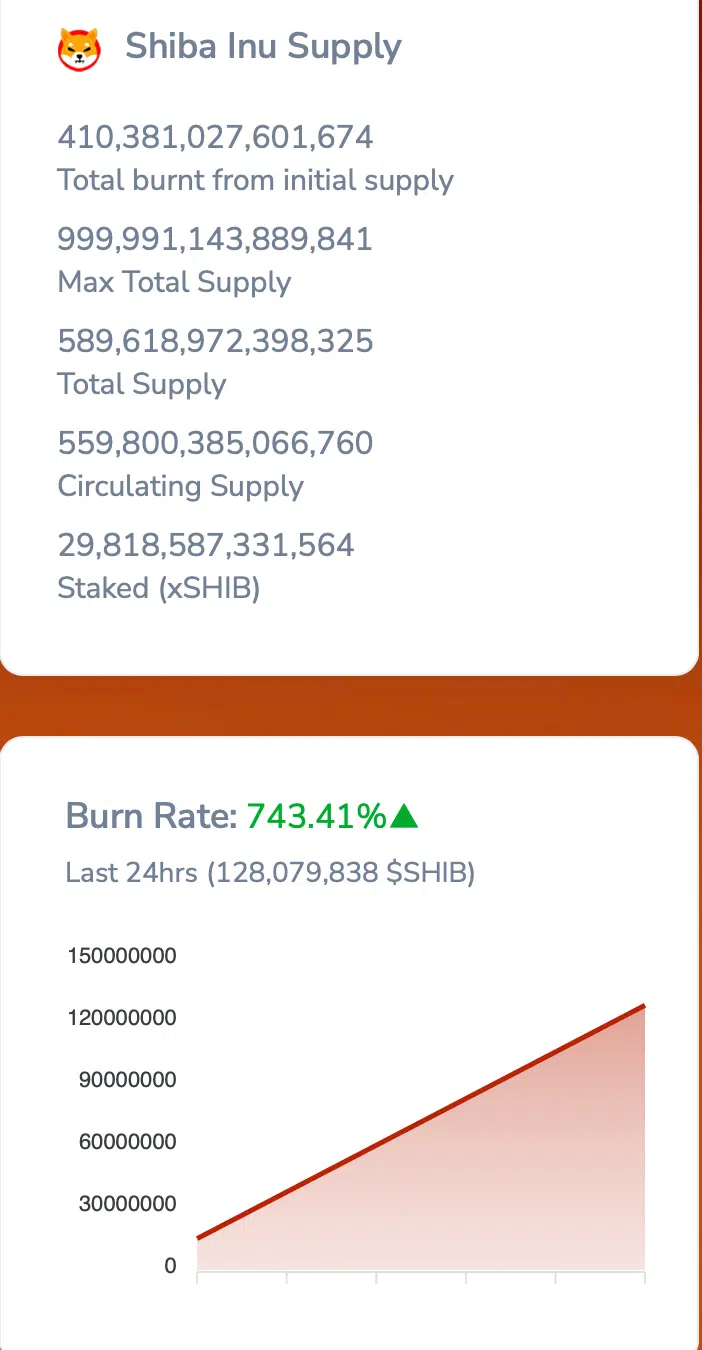

At the time of writing, as per SHIBburn’s official website, the burning rate stood somewhere near the 800% mark. Despite the decrease, such an unprecedented burning rate still created headlines in the crypto community.

Notably, burning reduces the supply of Shiba Inu tokens in circulation. Assuming the demand for the cryptocurrency doesn’t fall, continued burning would sooner or later push SHIB’s price. But you might ask, how much burning would it take?

Well, there’s still a lot left to burn before SHIB could reach its burning epitome. The number of SHIB burned has resulted in a rather small figure of 129.4 million SHIB, equivalent to $1,430.

Over the past week, however, 318.7 million SHIB, equivalent to $3,511 were sent to “dead addresses.”

In fact, just two weeks ago, SHIB witnessed its renowned token-burning campaign hit a new burn rate high in the 48-hour timeline. The token burned close to 200 million coins following which the burn rate spiked by nearly 3,000%.

Then why?

You might ask, why isn’t the price increasing? Well, the increase in the burn rate still didn’t allow more than 10.4 billion SHIB, equivalent to $115,000, to be burned in these three months.

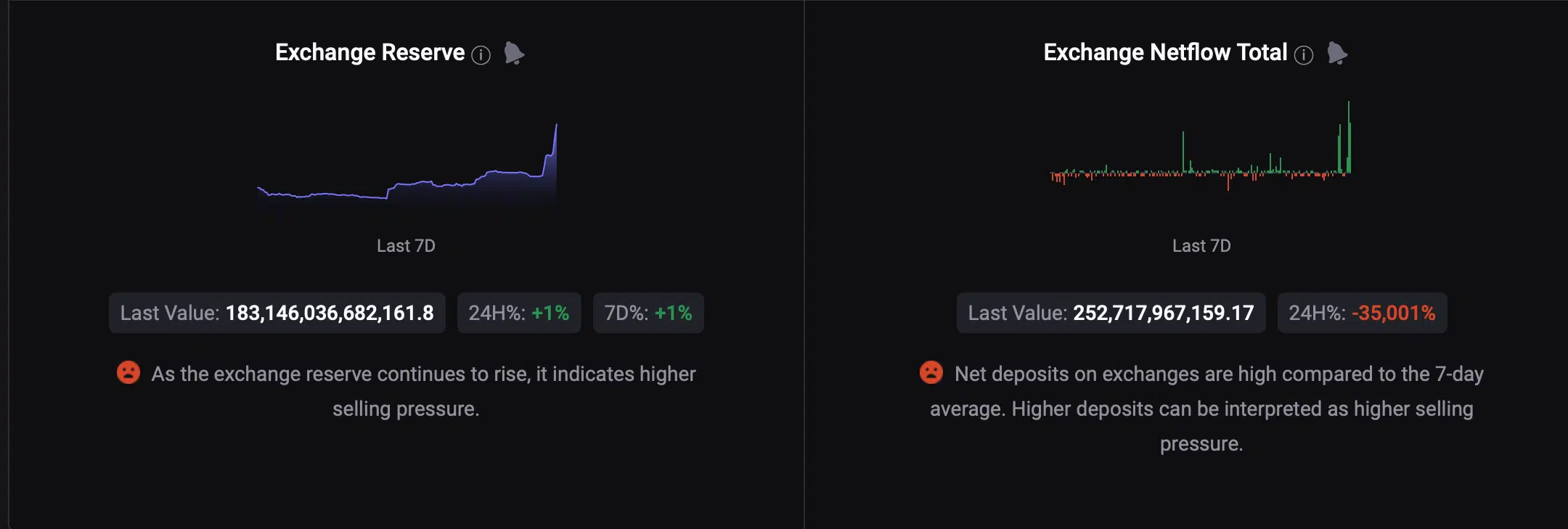

In addition to this, net deposits on exchanges stood high compared to the seven-day average as per data from CryptoQuant.

This can be interpreted as higher selling pressure in the market. One of the main reasons why the price kept declining.