Short or Long – Where do the Bitcoin, Ethereum derivatives markets stand

Bitcoin and Ethereum accumulation continues in the spot market as the focus now shifts towards the derivatives market. Here, some interesting observations can be made, each of which shows us how Futures and Options have been affecting the spot market. And vice-versa. Those looking for profits in Bitcoin and Ethereum might find the derivatives market as an alluring opportunity.

How does the market look?

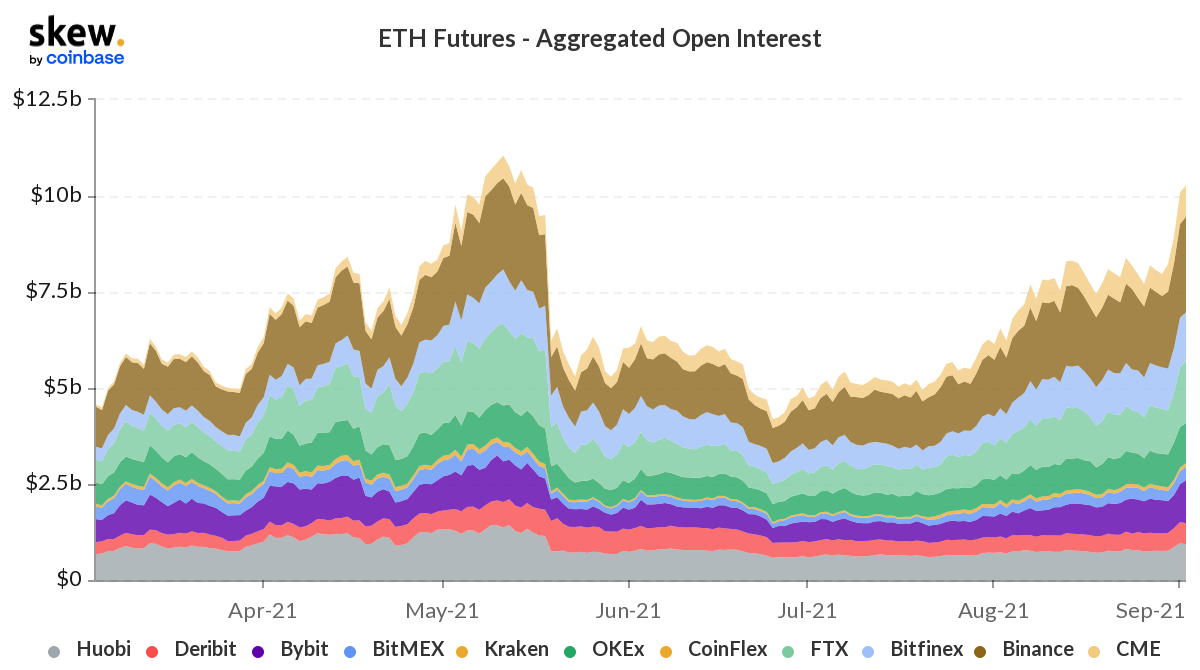

At the moment, the market is at its best in a long time. Both Bitcoin and Ethereum investors are in a solid spot as the Open Interest [OI] hit new highs today. Futures OI for BTC seemed to be at a 4-month high of $17 billion. The same was the case for ETH, with the OI standing at $14 billion.

Ethereum Futures OI | Source: Skew – AMBCrypto

That being said, it’s worth noting that the ETH market is in a much different position than the BTC market, varying in many ways.

ETH market has been hyper bullish

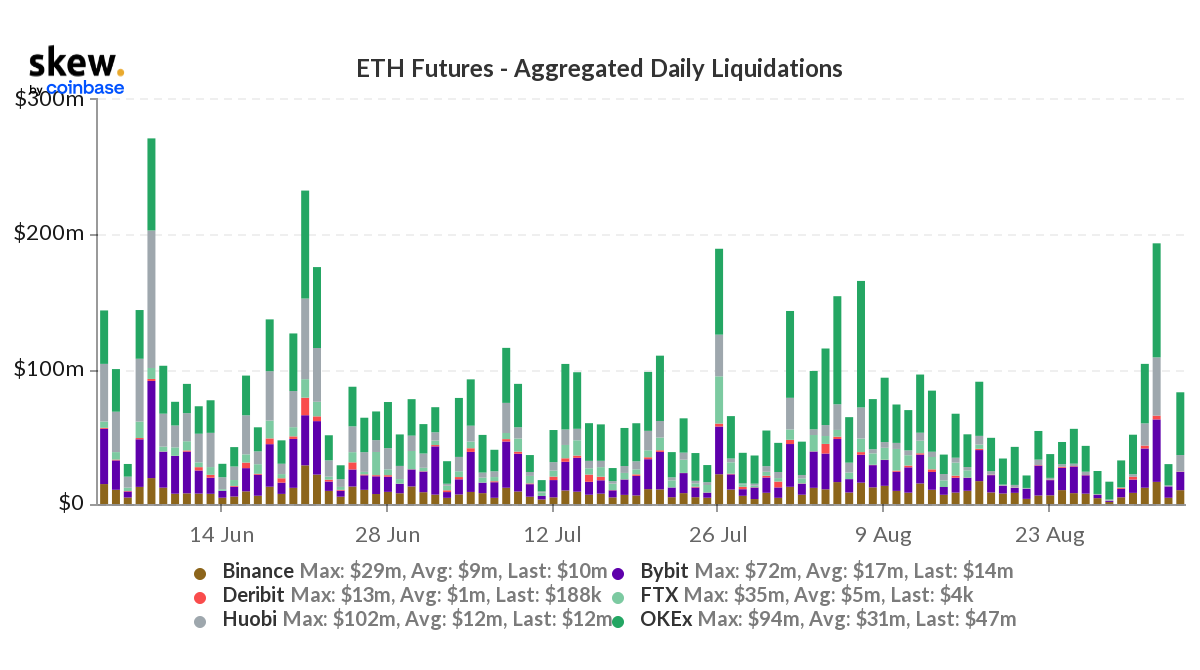

Volumes on 31 August and 1 September were almost close to Bitcoin’s levels of $41 billion. These volumes aren’t usual for ETH as the same mostly remain within the range of $30 billion. Plus, over the same time frame, when ETH volumes were close to BTC’s, daily liquidations touched a 3-month high of $194 million.

Ethereum Futures daily liquidations | Source: Skew – AMBCrypto

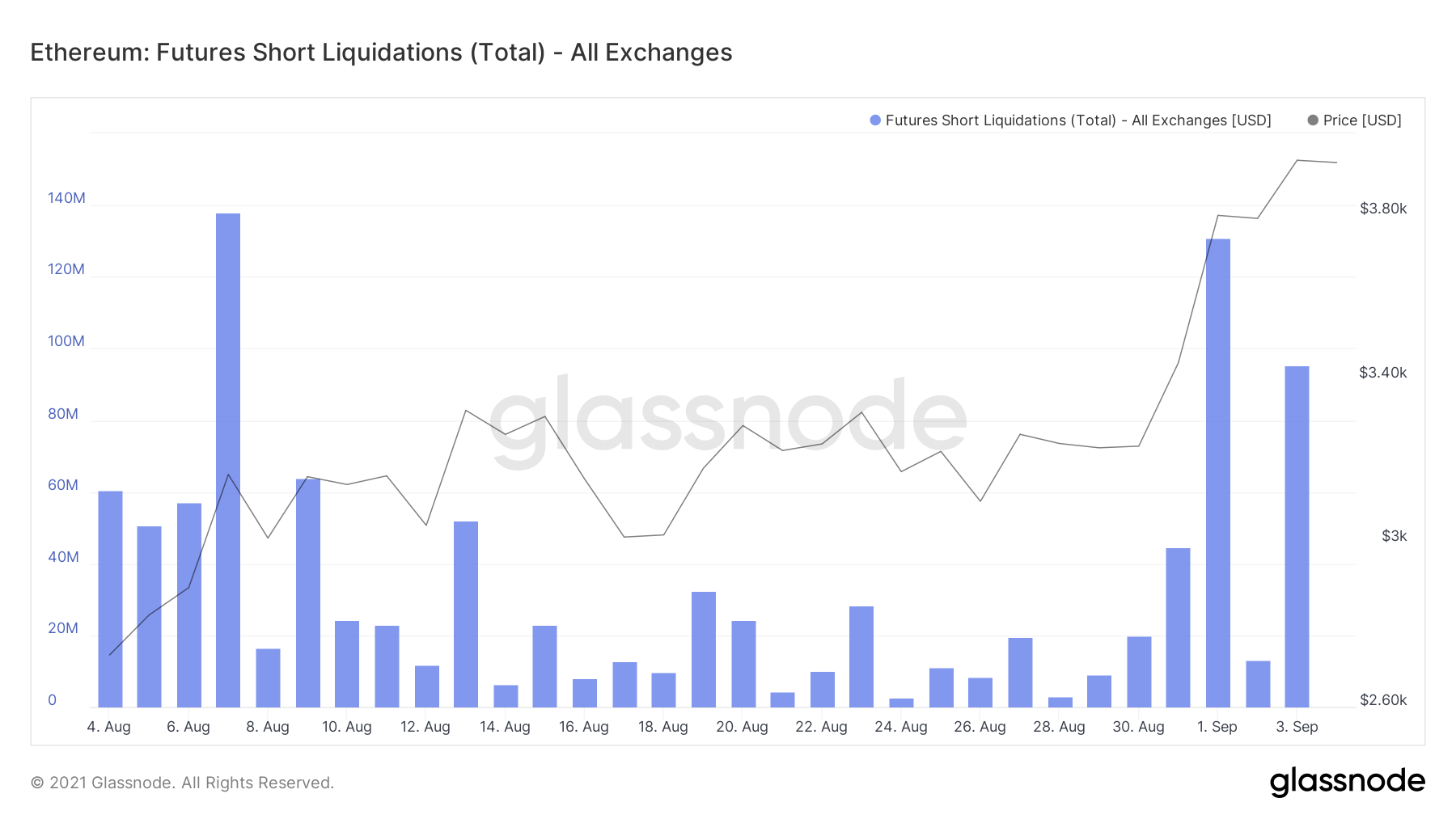

However, if you take a closer look, you’ll observe that most of these liquidations came from short contracts. Short liquidations for Ethereum rose to a monthly high of $130 million.

This transpired primarily because of ETH’s rally over the last 2 days, a period during which ETH went up by 18.81%. Right now, people are demanding stability from Ethereum’s market.

Ethereum Short liquidations | Source: Glassnode – AMBCrypto

BTC market has been steadily bullish

At the time of this report, daily volumes were still within the normal range of $100 million. Bitcoin OI in Perpetual Futures contracts also hit an 18-month high of $14.157 billion.

These are good figures for a market that has been bullish for over a month now. Even the Implied Volatility to Realized Volatility spread seemed to be at its highest level of 0.9%, a level last seen on 30 May.

Bitcoin IV-RV spread | Source: Skew – AMBCrypto

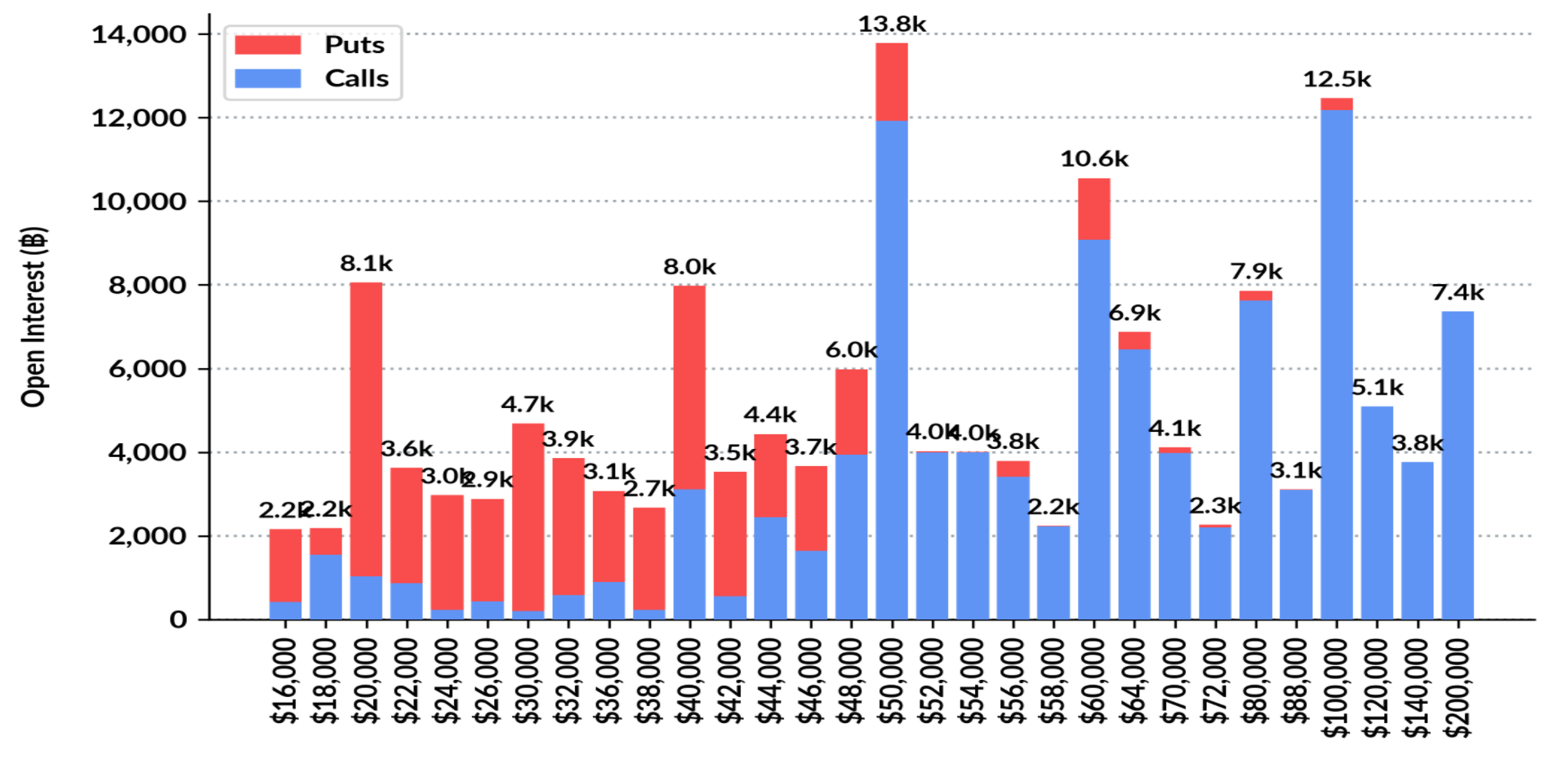

A huge reason behind this is because the BTC spot market has been rising gradually, with a hike of “just” 4.83% in the last 4 days. Plus, with Bitcoin crossing $50k again, the OI by Strike’s 12k Call contracts for $50k seems to be turning profitable as the 24 September expiry inches closer.

BTC OI by strike shows bets for $50k | Source: Skew – AMBCrypto

All in all, the derivatives market is in a really profitable state right now.