‘Slow’ Polygon’s growth will have this impact on MATIC’s price action

The broader crypto-market is at an indecisive point right now. The valuation of most top coins has neither risen nor fallen dramatically for quite some time.

Such has been the case with MATIC too. Interestingly, this alt’s price pumped by 5% over the past week, but managed to shed the same value in a 24-hour window. So, is the downtrend set to continue for the next few days or can one expect the alt’s price to rise?

Evaluating the network’s performance

When compared to other L2 scaling solutions, Polygon has not been able to fare that well. Now, even though the network’s revenue has increased by 60.92% week-over-week, the latest engagement and monetization numbers do not seem to be very appealing.

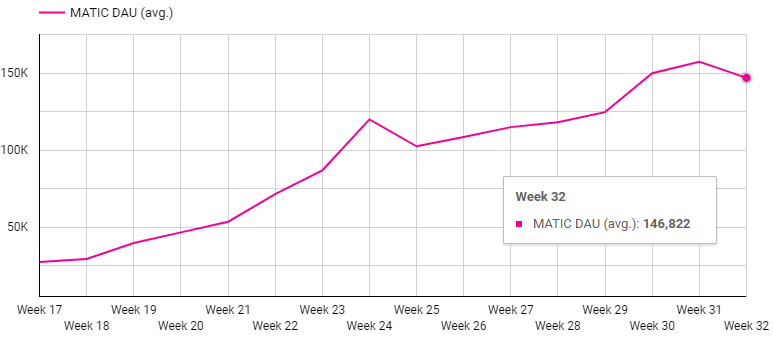

For instance, daily active users dropped for the first time in seven weeks (down by 6.67%). However, it should be noted that Polygon still posted its third-highest user count of 146,822 last week.

The growth in the number of daily active users would be quite restricted this month because the recent cohorts are experiencing lower retention. It would fairly take some time for the retention to rebound and only when that happens, one can expect the DAU to rise.

Source: Twitter

Even though user numbers have been diminishing, the transaction count bounced above its 13-week low. A hike in this metric can be attributed to the alt’s recent price actions.

Notably, 14/15 of the top dApps on the Polygon network are from the DeFi space and have been performing fairly well. Furthermore, projects that use the Polygon protocol, like AAVE, ApeSwap, QuickSwap, and 1inch, have seen considerable growth in their number of users. This has indirectly turned out to be a boon for Polygon.

Turning a blind eye towards the gaming sector, at this stage, would not be fair. Consumer demand in play-to-earn games is on the rise and major projects like Ember Sword, Chain Guardians, and Revv Racing have been thriving on the Polygon network. Gaming is all set to usher in a fresh wave of blockchain users. Ergo, in retrospect, Polygon stands to be the primary beneficiary.

As the network grows in size, one can expect MATIC’s valuation to parallelly hit new highs as well.

What about the short-term?

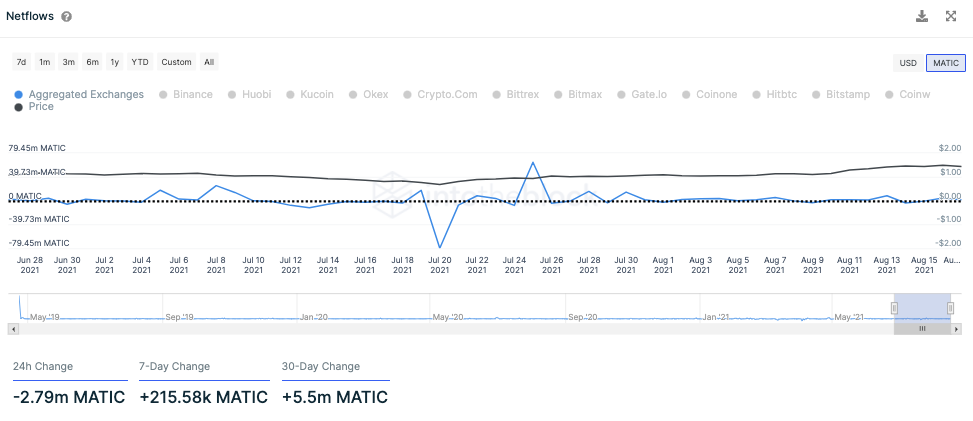

The general sentiment with respect to MATIC on IntoTheBlock is bullish. However, it should be noted that exchange netflows have mostly remained positive over the past month. Thus, it can be inferred that a fair share of people has been selling their MATIC. This has led to a rise in the exchange inflow volume. Furthermore, the token’s trading volume has shrunk from 2.2 billion to 1.2 billion in just a week.

At this stage, MATIC’s price faces strong resistance at the $1.5 and $1.7 levels. In fact, it was rejected at the former level on 16 August. It has not been able to climb back above since.

Hence, the odds of MATIC’s price breaking above the aforementioned resistance levels in the next couple of days aren’t great.

Source: IntoTheBlock