Solana: As SOL hits its second major downtime of 2022, should investors be worried

Yesterday was not a remarkable day for the owners of the native token for the “Ethereum Killer”. The team announced that Solana suffered a major outage which led to over a seven-hour downtime on its Network.

According to the team, the downtime was caused by an “enormous amount of inbound transactions” from NFT minting bots. Standing at $96 before the downtime, the network’ s native token SOL quickly declined by 5% leaving it at $89.86 at the time of this press. What do we know about the coin’s performance in the past 24 hours?

Worrying statistics…

Following the prolonged downtime on the Network, the price of SOL went on a downward trend shedding 5% in the last 24 hours. This represented a 65.44% from an ATH of $260.06 which it recorded last November. In the early hours of today, the RSI also slipped into the oversold region at 20.52 indicative of increased distribution.

This could have been skeptical investors exiting their positions in the face of the uncertainty brought about by the downtime. At the time of this press, the RSI stood at 38 indicating a reversal and a push towards the 50-neutral region.

Increased bearish activity that plagued the token was also confirmed by the position of the 50 EMA. This stood above the price and had since been since the price 22 April.

Further, the last 24 hours was also marked with a sharp decline in the market capitalization for the native token. SOL’s market cap suffered a significant decline from $30 billion to $27.74 billion a few hours into the downtime.

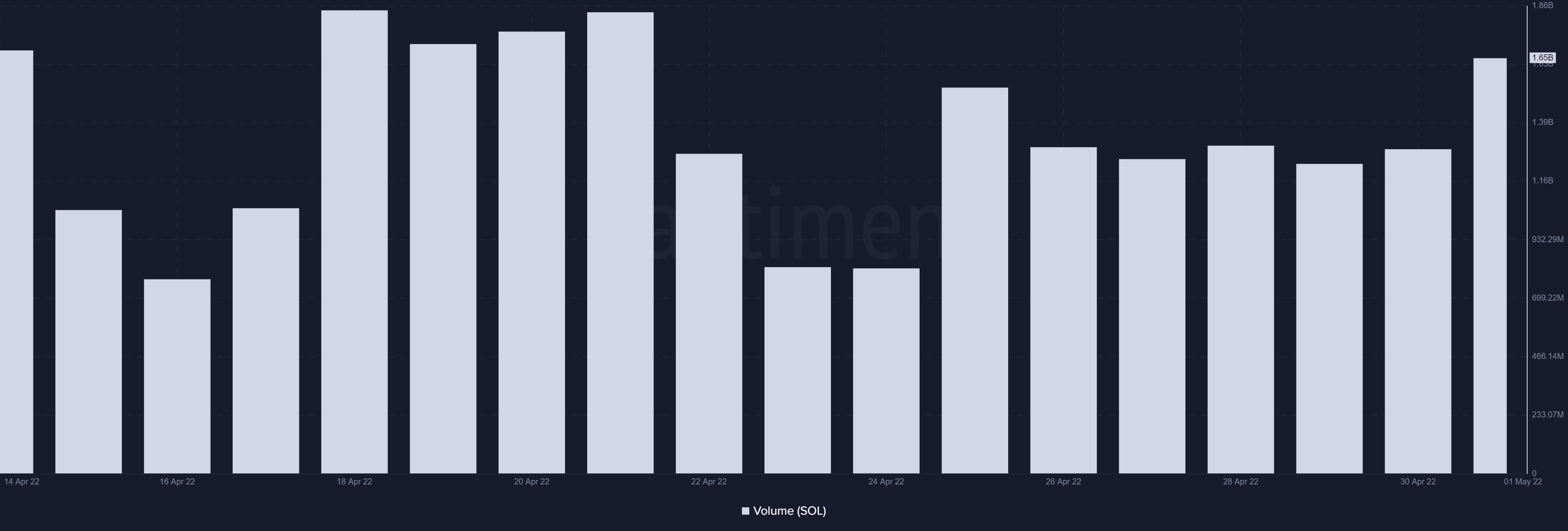

However, this has since been corrected as the market cap regained its losses and stood at around $30 billion at the time of this press. Also, the volume of transactions appeared to have grown in the last 24 hours. At the time of this press, this stood at 1.66b, a 22% spike from the 1.29 billion recorded yesterday.

These might mean that investors are back trading the token. This might be as a result of Solana’s announcement of attempts to restore client services over the next several hours.

On the chain…

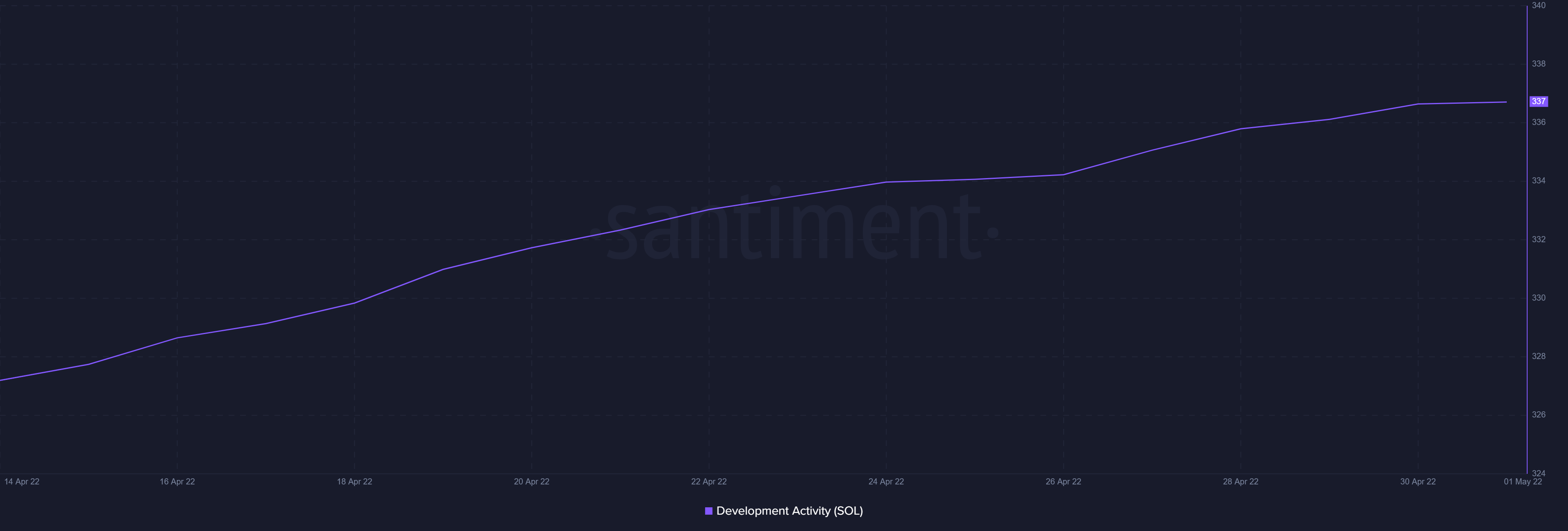

At 337 at the time of this writing, Development Activity for the SOL token appeared to have taken on a steady increase last month. Even following the downtime, no sharp decline in Development Activity was recorded.

The last few months have been marked with increased increased adoption of the Solana’s mainnet beta network. This was confirmed by the rising index for the Development Activity for the Network’s native token, SOL.

However, on a social front, the token lost some traction in the last 24 hours. The Social Dominance for the token fell by a slight 1% from 4.06 to 3.993 in the last 24 hours. Also, at a Social Volume of 955 at the time of this writing, a 70% decline was recorded on this front in the last 24 hours.

Is SOL really an “Ethereum-Killer”?

Solana Network in the past few months has been plagued by network congestion caused by increased adoption. This has frustrated user transactions. With over 2 downtimes recorded this year alone, the network appears to have a long way to go to really live up to its tag as the “Ethereum Killer”.

![Sonic [S] sees $1.4 billion liquidity surge as network upgrade sparks investor interest](https://ambcrypto.com/wp-content/uploads/2025/03/F0D8CF78-0B88-471B-BD85-84A9F049FDBA-400x240.webp)