Solana-based JUP hikes 30% as market falls: Do predictions say more gains?

- JUP’s price followed SOL’s direction, and hit $0.97 at press time.

- Social volume increased, indicating that traders might consider being bullish.

An amazing 84.42% 30-day increase ensured that Jupiter [JUP], the token developed on the Solana [SOL] blockchain, almost hit $1. On the 14th of March, JUP broke out, and rallied to $0.97. This value meant that the cryptocurrency hit a new All-Time High (ATH).

Interestingly, this happened when most assets in the market retraced. However, Jupiter’s bullish momentum had decelerated at press time. As of this writing, AMBCrypto confirmed that the value had decreased to $0.93.

More gains in store for the new planet

Our assessment of the token also showed that JUP was in its price discovery stage. JUP launched on the 31st of January, 2024 as the native tokens of Jupiter Exchange, a Solana-based aggregator. Since it launched, JUP struggled to breakout as it traded below $0.60 for a while.

Therefore, the recent breakout suggest that buyers and sellers are agreeing that the true value of the asset should be higher. Though the cryptocurrency’s performance was impressive, being in price discovery meant it could break the new ATH within a short period.

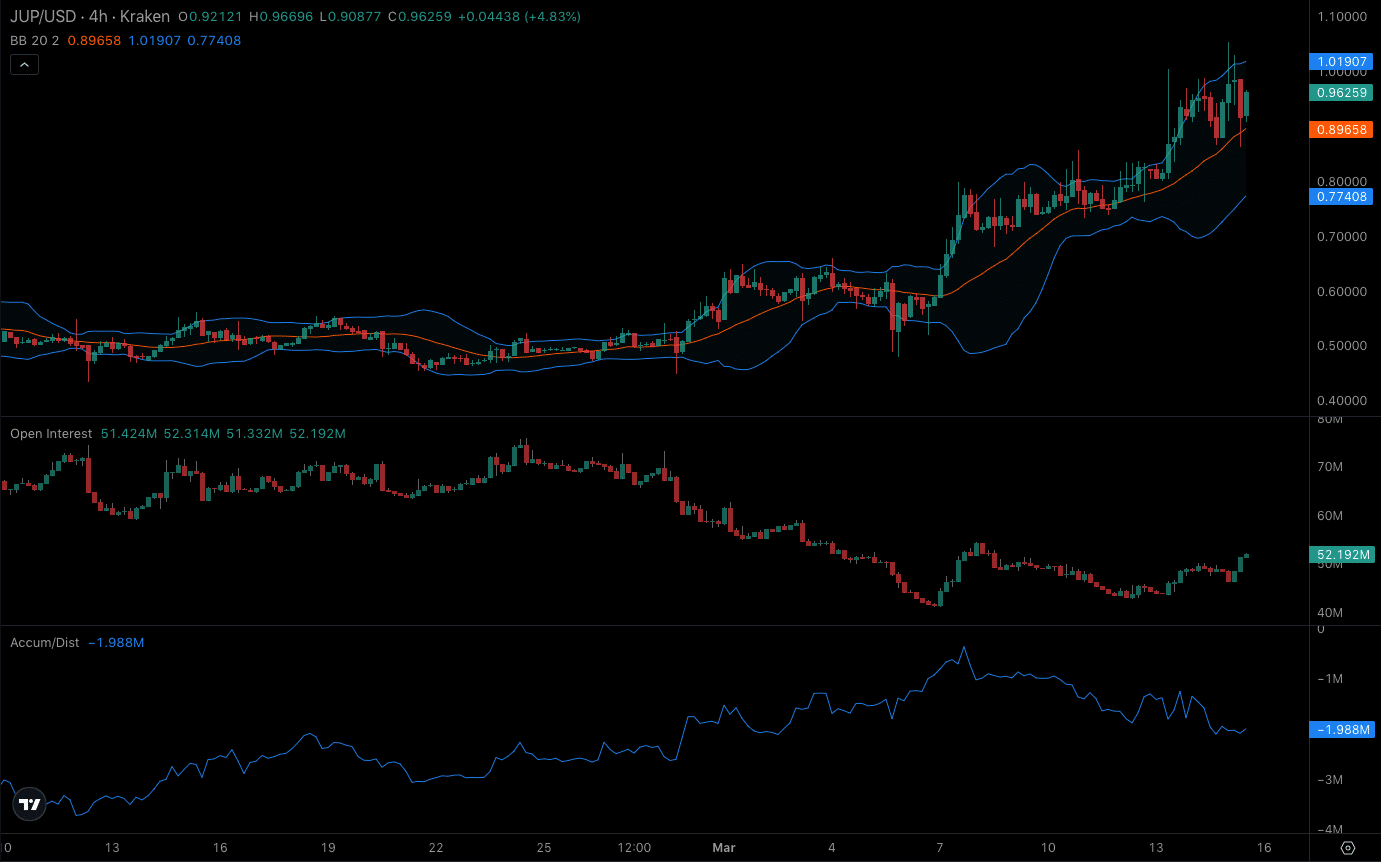

From a technical perspective, the 4-hour chart showed that volatility around the token was high. In this instance, the price of JUP could extend higher that $1.

At the same time, the display indicated by the Bollinger Bands (BB), revealed that selling pressure could force a significant correction.

Furthermore, the Accumulation/Distribution (A/D) suggested that JUP might find it difficult to break through $1 in the short term.

Can the sentiment change?

As of this writing, the A/D had decreased, suggesting that traders were booking profits. If this continues, JUP’s price might slip below $0.90. However, Open Interest (OI) around the cryptocurrency climbed to $52.10 million.

OI is the sum of all open positions in a contract. Thus, the hike suggested that traders were actively involved in trying to make gains from JUP’s price movement.

If the buying pressure continues, the price of the cryptocurrency might break through the $1 mark. Another factor that could play a role in JUP’s performance is SOL.

For some days, JUP had formed a strong correlation with the Solana native token. Therefore, it is likely that a price pump for SOL might lead to surge in the price of JUP.

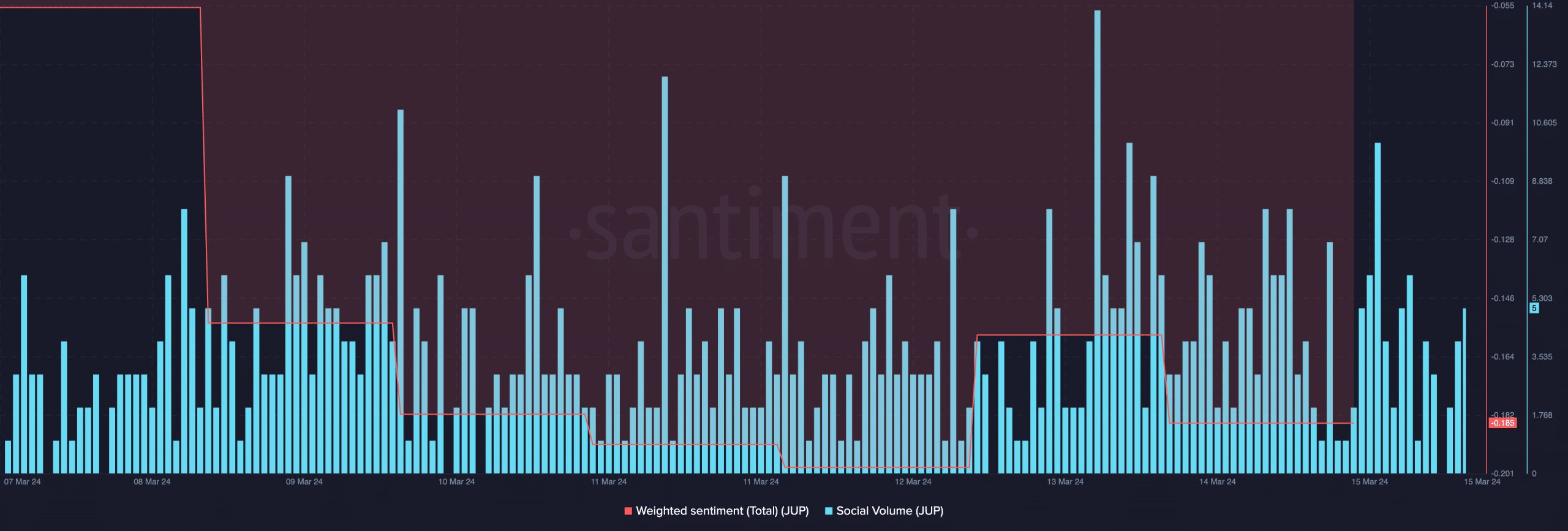

In defiance of the cryptocurrency’s rally, market participants have remained pessimistic about the project. AMBCrypto came to this conclusion after analyzing on-chain data from Santiment.

How much are 1,10,100 JUPs worth today?

At press time, the Weighted Sentiment was negative, indicating that most comments about Jupiter was bleak. Nevertheless, the social volume jumped. As of this writing, the metric was one of its highest within the last two days.

This surge implies that JUP was getting attention from the broader market. If it keeps up this recent performance, the sentiment might become completely bullish.