Solana – Good news after $128? All about SOL’s latest decline-rally cycle

- SOL recently retreated from a strong resistance line, with the crypto approaching nearest support at press time

- On-chain metrics, including liquidation data, pointed to a bearish market bias

In recent times, Solana (SOL) has shown limited signs of rallying, gaining by just over 3% in the past month. At the time of writing too, SOL was down by 5.29% on the daily charts.

As expected then, the prevailing market sentiment remains bearish. And, traders are likely to continue driving SOL’s price south.

Further decline expected to rock SOL

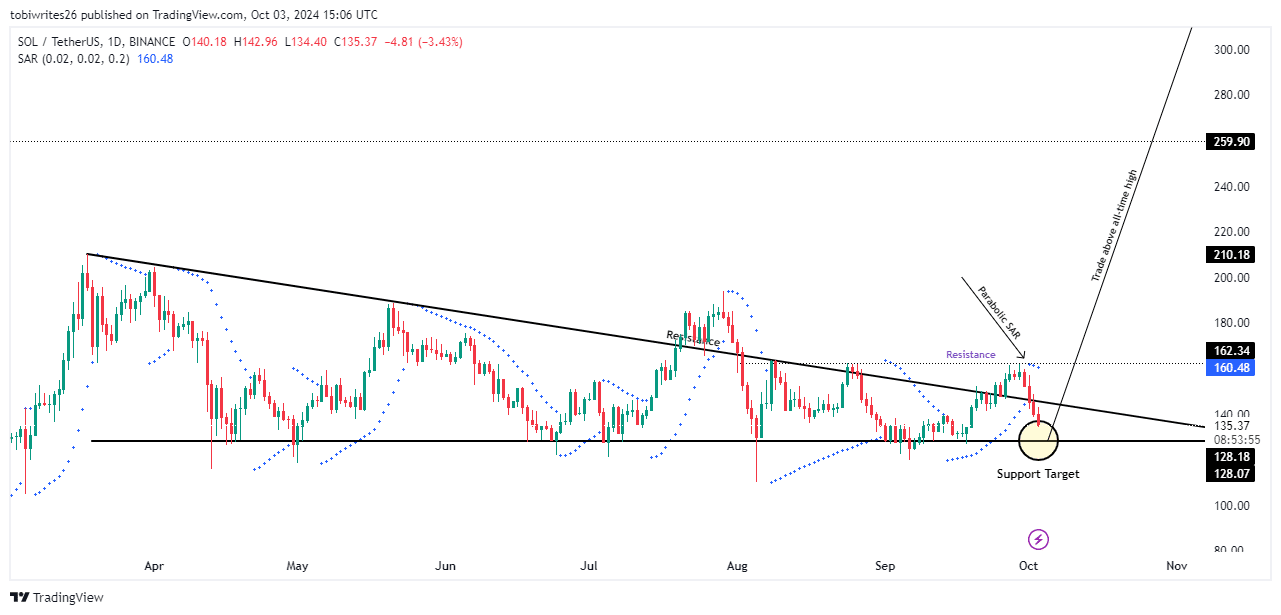

SOL’s recent drop has been associated with its trade-off from the resistance zone at $160.09, part of a consolidation pattern. This led to a further decline in its price on the charts.

At press time, the decline seemed to be ongoing, with SOL seeking support at $128.18. This level is where it is expected to stabilize temporarily, before market dynamics establish the next move.

The anticipated drop to this support level at $128.18 can be further validated by market sentiment and the Parabolic SAR (Stop and Reverse) indicator. This is a sign of continuation of the fall when the price remains below the indicator’s dots.

And yet, AMBCrypto found that SOL could be gearing up for a major rally, based on its historical patterns.

Fall as a precursor to major rally for SOL

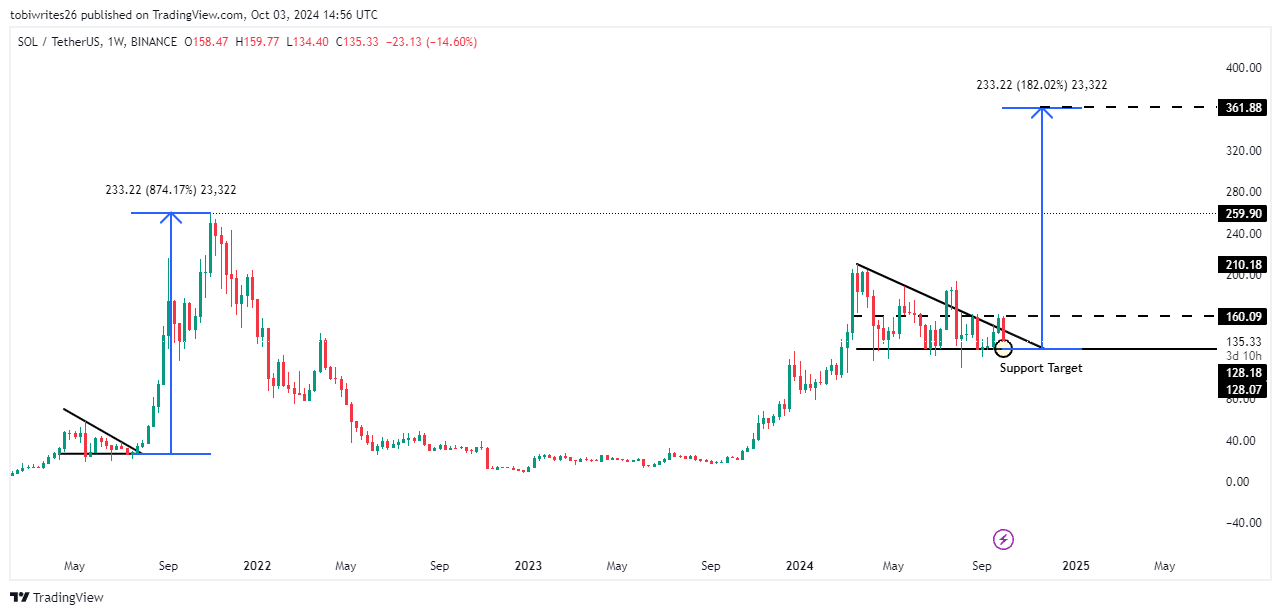

AMBCrypto observed that SOL’s current movements mirror those of 2021, which preceded its all-time high. This pattern means that SOL may currently be in an accumulation phase, similar to the one it saw in the past.

An accumulation phase is a period during which traders gradually increase their holdings of SOL in anticipation of a rally. In doing so, they position themselves to benefit more significantly from potential price hikes.

If this trend continues, there is a strong possibility that SOL could achieve gains of up to 182.02% reaching $361.88.

Declining interest fuels SOL’s price drop and heavy losses

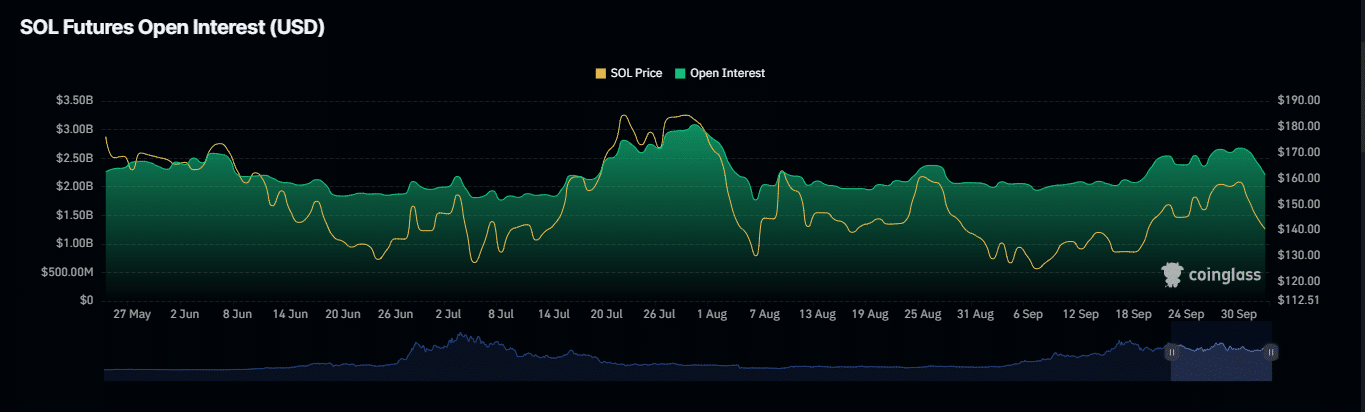

Finally, recent data from Coinglass indicated that a noticeable lack of market interest has been driving SOL’s recent price decline.

This was supported by a significant reduction in Open Interest, which measures unsettled derivative contracts and is important for assessing market sentiment. In fact, the Open Interest fell sharply by 8.24%, with the same valued at $2.19 billion at press time.

Additionally, traders who previously anticipated a hike in SOL’s price have been forced out of the market, with liquidations totaling $10.88 million.

These developments, together, mean that bearish forces are firmly in control. These will likely push SOL towards the critical support level at 128.18 on the charts.