Solana nears an important resistance, but here’s why bulls can prevail

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- The H4 market structure was bearish, but the higher timeframe bias was bullish for Solana.

- A move below $21.3 would invalidate the bullish idea.

Solana [SOL] struggled to breach the $22.4 resistance level in the past five days. In late April, the prices faced rejection at the $23.5 resistance. At the time of writing, the market structure was bearish on the 4-hour chart.

Read Solana’s [SOL] Price Prediction 2023-24

Bitcoin [BTC] was able to defend the $27.8k support level on 1 May and has since bounced to reach $29.2k at press time. If BTC continued to climb higher, it would likely have a positive impact on the sentiment behind SOL.

Volume Profile tool highlighted an intense battle raging at $22.4

The H4 market structure was bearish after the higher low at $22.9, formed on 29 April and broken on 1 May. Since then, SOL bulls were unable to break the recent lower high.

If Solana can see a 4-hour trading session close above $22.49, it would indicate a shift in market structure to bullish once again.

The bearish bias on H4 was outweighed by the bullish market structure on the daily timeframe. Yet, in order to initiate a rally, the bulls must consume all the sell orders placed at the $22.4 resistance zone.

The Visible Range Volume Profile tool showed that the Point of Control (red) was at $22.18, which demarcated the level where the highest amount of trading in the past five weeks has taken place. Therefore, the bears will likely put up a stiff fight.

The OBV was flat in May, and the MACD formed a bullish crossover beneath the zero line. When combined, they showed that momentum was weakly bearish, but neither bulls nor bears were dominant.

Hence, traders can wait for a breakout past $22.4 and a subsequent retest before buying SOL, targeting the Value Area High at $23.7 to take profits.

Is your portfolio green? Check the Solana Profit Calculator

Speculators were bullish once again after the rejection at POC

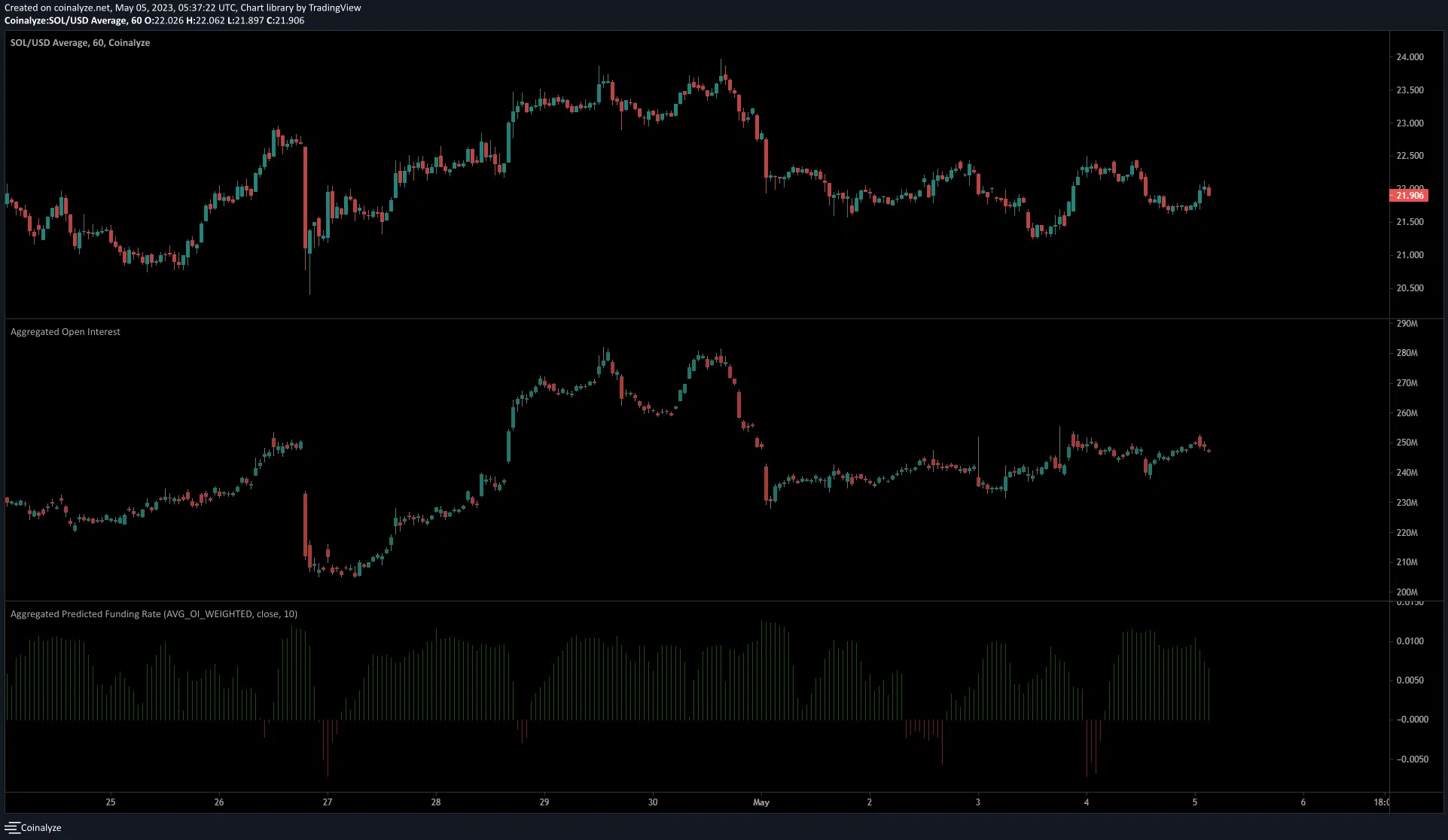

Source: Coinalyze

Over the past 24 hours, Solana dipped from $22 to $21.5, before bouncing to $22.1 again. During this time, its Open Interest began to climb higher. This suggested that speculators were willing to bid. Meanwhile, the funding rate was found to be positive as well.

However, on 4 May, the funding rate went into negative region and the OI rose slightly when SOL prices saw a rejection from the $22.4 resistance. This suggested that bears still controlled that region, and highlighted the significance that a session close above $22.4 would represent.