Solana NFT sales – The how, why, and where to of it all

The broader market’s correlation with the DeFi space is well-known. With most of the top altcoins, including Solana, failing to make a decisive move on the charts, their DeFi front is also taking a hit.

Solana and NFTs

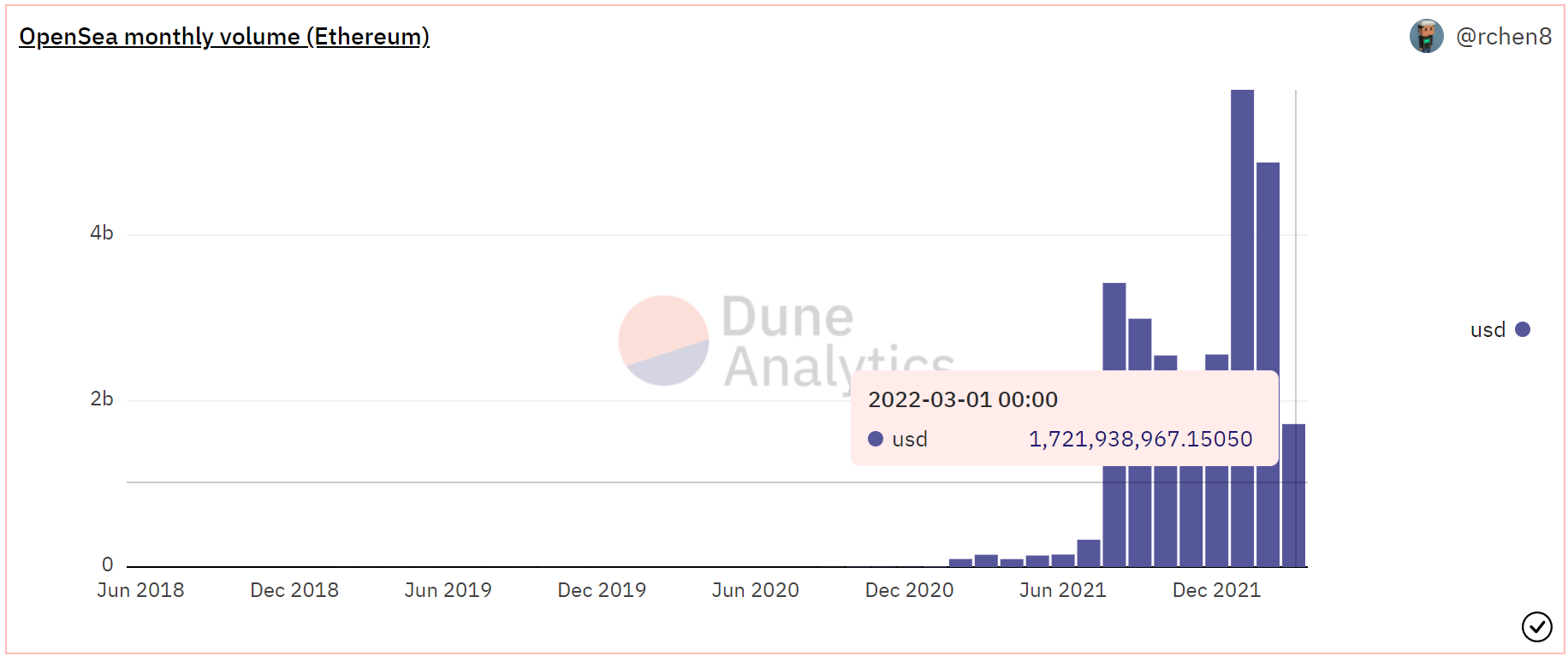

NFTs were the first in line to be shot as sales on Ethereum and other chains’ marketplaces began falling last month.

Back in January, NFT sales were at their peak. The same fell by 15% in February while the total sales volume this month stood at $1.7 billion, at press time.

This is a 64% decrease in sales. In fact, unless the market recovers, the chances of sales crossing the $2 billion mark by month-end are remote.

Opensea NFT sales | Source: Dune – AMBCrypto

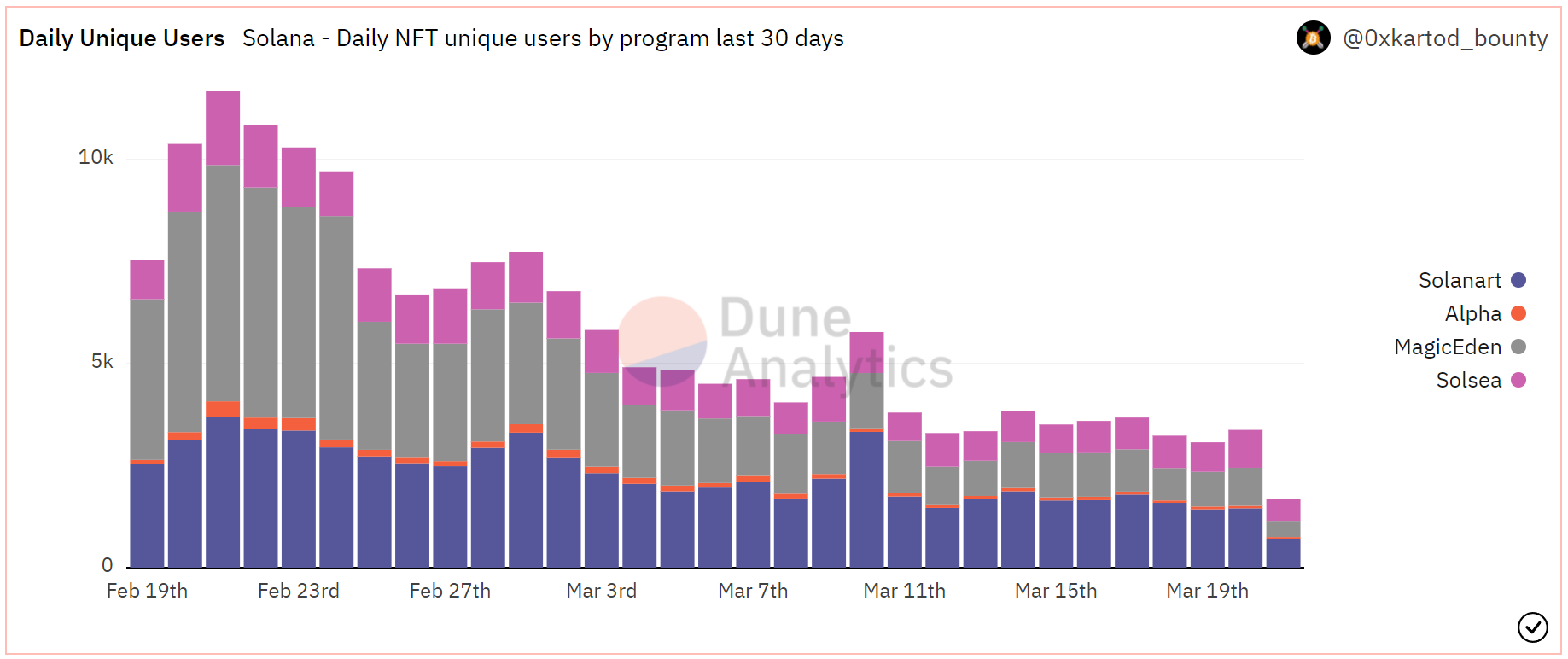

Similarly, on Solana, the daily NFT sales figures have plunged from 27k to 7k.

Solanart, Solsea, and Magic Eden, which combined account for 81% of all NFT transactions, have seen users exit the marketplace. Consequently, daily unique users have been reduced to less than 2k.

Solana NFT users | Source: Dune – AMBCrypto

Beyond NFTs, however, other 60+ protocols on Solana aren’t bringing much to the table either. The TVL, at press time, was at the same level as it was towards the end of February. Although a spike was observed yesterday, a spike which pushed TVL to $7.4B, it came down today to return to the average of $6.9 billion.

Despite being the fifth-biggest DeFi chain, Solana is failing to make any significant progress.

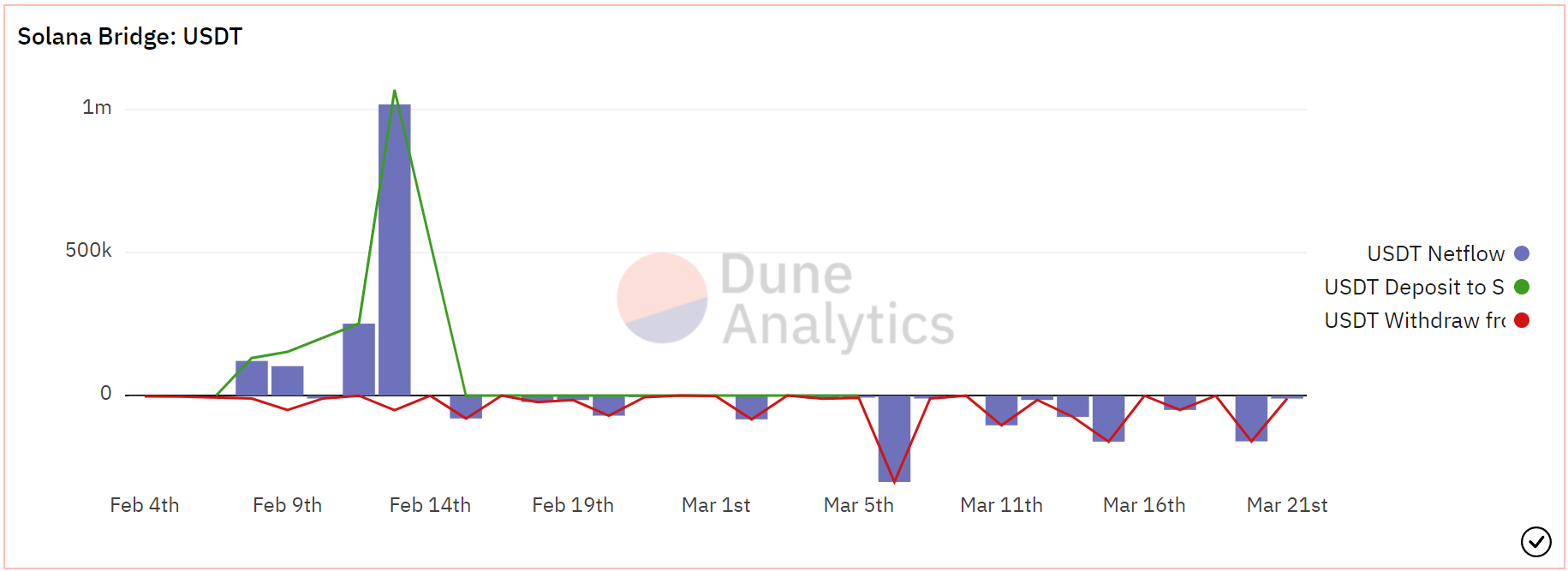

This is because the spot market isn’t moving much at the moment. Transactions on the Solana bridge have been primarily registering outflows instead of inflows.

USDT, which dominates about 30% of all transfer volumes, has been noting about $70,000 worth of withdrawals from Solana on average. In fact, the outflows even spiked to $301k earlier this month.

Solana bridge USDT transfers | Source: Dune – AMBCrypto

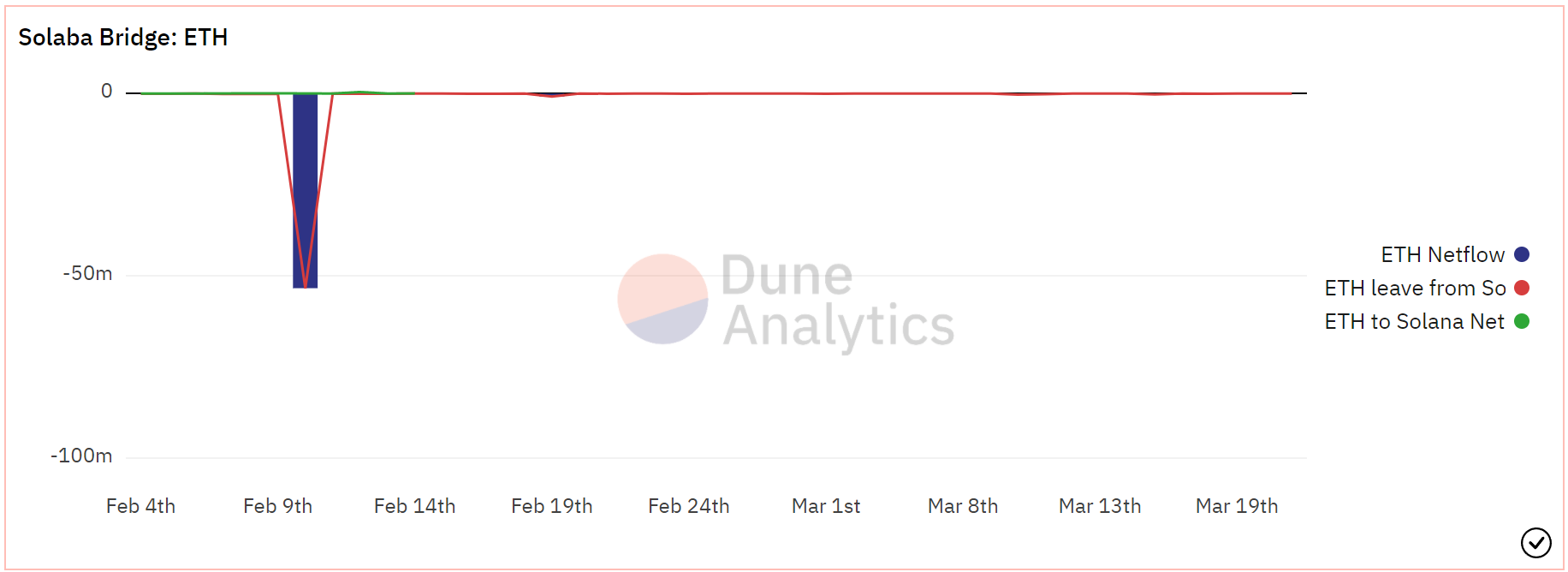

The case is the same for Ethereum as well – The highest transferred asset (52.8%) – observing outflows worth anywhere between $5k to $250k.

At its peak, Ethereum outflows crossed $53.3 million on 10 February.

Solana bridge Ethereum transfers | Source: Dune – AMBCrypto

Ergo, for this to end, Solana might have to look towards registering a sustainable rally soon. Especially since the last few days have been flashing the opposite kind of sentiment.

![Aptos [APT]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-12-1-400x240.webp)