Solana price halts near $115: Do predictions see a pullback?

- SOL showed no strong signs of exhaustion on the higher timeframe charts

- There were attractive pockets of liquidity around the $100 mark that Solana could retest

Solana [SOL] continued to rally during the festive season, giving holders an additional reason to celebrate. Measured from the low on the 19th of December at $71.78, SOL has gained just over 57% in under six days.

AMBCrypto noted in an earlier analysis that the $96.45 resistance would be a good place to book profits, and that $103-$106 could serve as resistance.

SOL bulls have blown these expectations out of the water in the past week by driving a rally to $115.

The psychological $100 could be important again

The 200% Fibonacci extension level was tested as resistance in the past 24 hours. It was unclear if SOL would be forced to pull back from here.

The RSI on the 12-hour chart is at 81 but has not formed a bearish divergence on the 12-hour or one-day timeframes yet.

On the other hand, the 4-hour charts saw such a divergence develop in the past 24 hours, but it does not guarantee a bearish reversal in the next few days.

Since the trend of SOL was firmly bullish, buyers can wait for a dip before entering long positions. The OBV was also trending upward to indicate buyers were in control.

The $96 region, marked in cyan, served as a lower timeframe consolidation zone on the 23rd of December. It was also close to the $100 psychological level. Hence, a dip into this area before a continuation of the rally was a possibility.

The bulls could be overextended

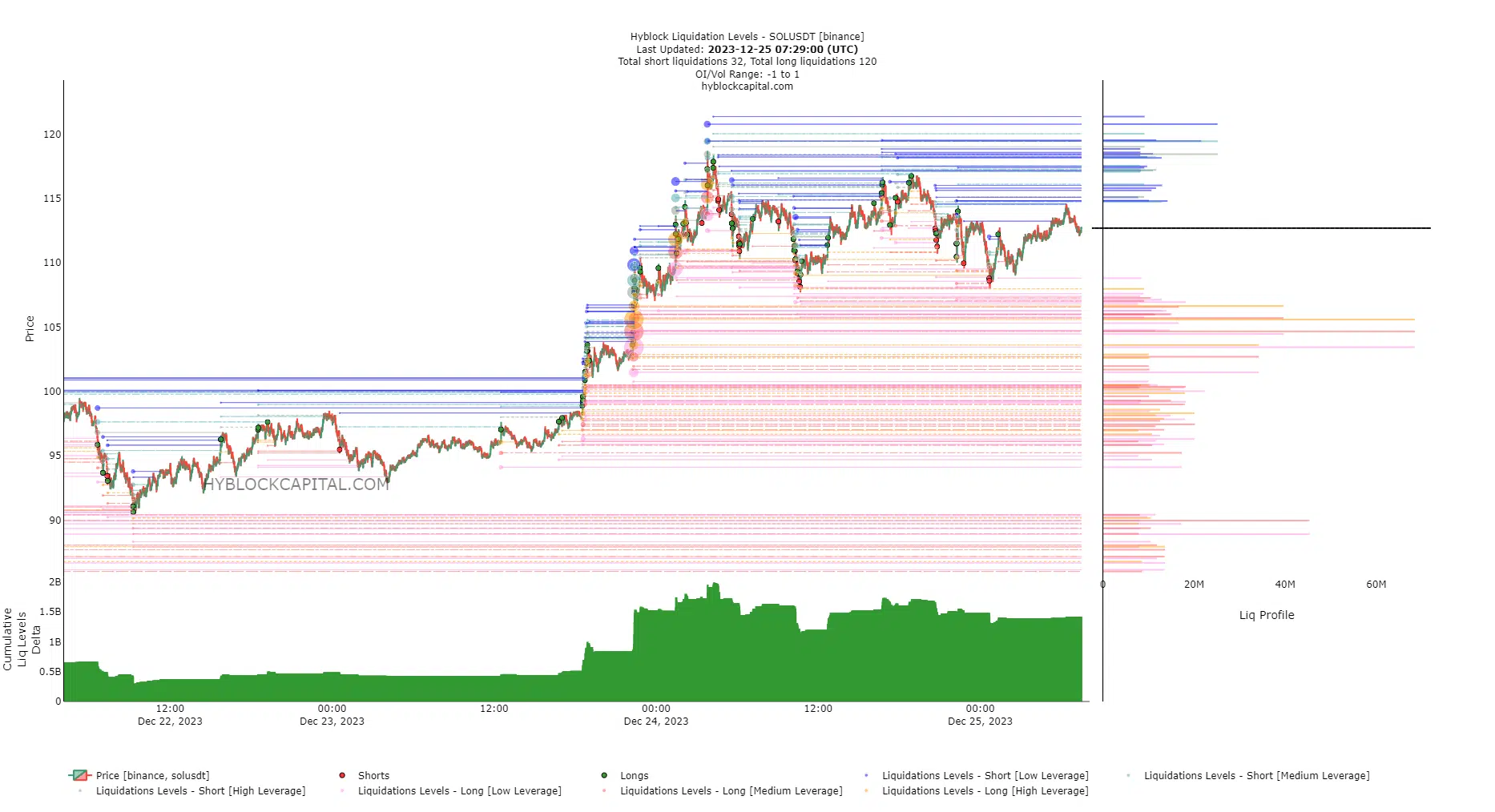

Source: Hyblock

In the past 48 hours, SOL has formed a short-term range that extended from $109 to $116.8. During this time, the Cumulative Liq Levels Delta was extremely high.

The inference is that bulls anticipated more gains and a majority of the market was in long positions.

This meant that triggering their liquidations during a price dip could provide SOL with a lot of liquidity to power its next move upward.

AMBCrypto’s analysis suggested that the $103-$106 area was important, on both the technical chart and from the Liq Levels perspective.

Read Solana’s [SOL] Price Prediction 2023-24

It has multiple long positions whose liquidations are estimated to amount to $60M or more. Similarly, the $97-$100 was also estimated to have multiple $20M+ liquidation levels.

Hence, a dip into these regions, while not guaranteed, could provide a buying opportunity.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.