Solana [SOL]: Bulls out to defend the $21 support – Will they prevail?

![Solana [SOL]: Bulls out to defend the $21 support - Will they prevail?](https://ambcrypto.com/wp-content/uploads/2023/04/image-1200x800-21.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Bulls concerted efforts to defend the 61.8% Fib support level of $21.

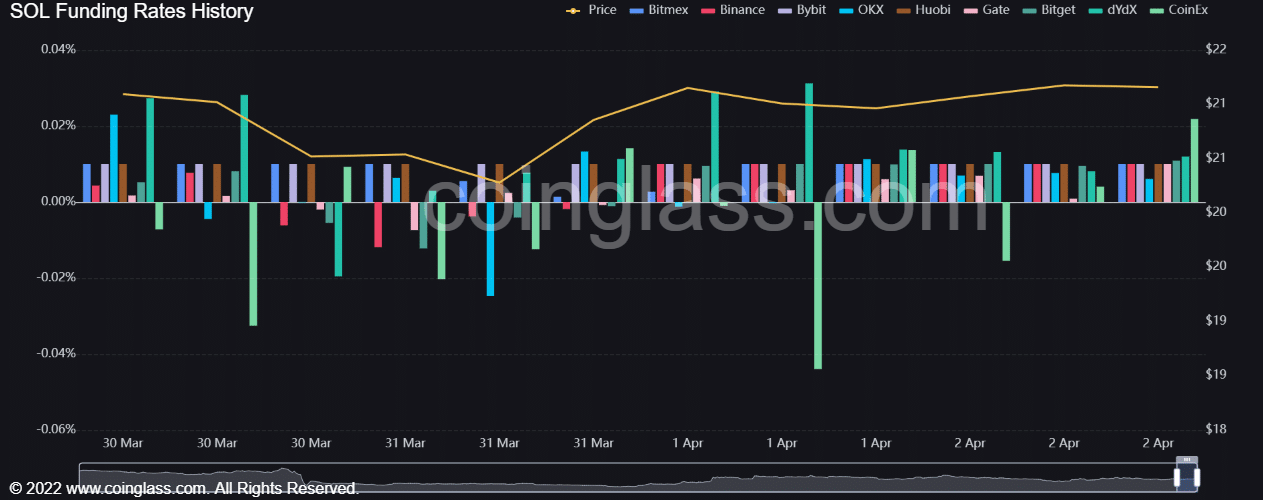

- The funding rate was positive, but sellers had little leverage based on the long/short ratio.

Solana [SOL] took a cue from Bitcoin [BTC]. It consolidated within the $20 – $22 range as BTC traded within $26.8K – $28.8K in the past few days.

It shows a bullish sentiment as bulls hold on to their position as they anticipate a potential rally. A bullish BTC could tip SOL bulls to target a former price ceiling level.

Read Solana [SOL] Price Prediction 2023-24

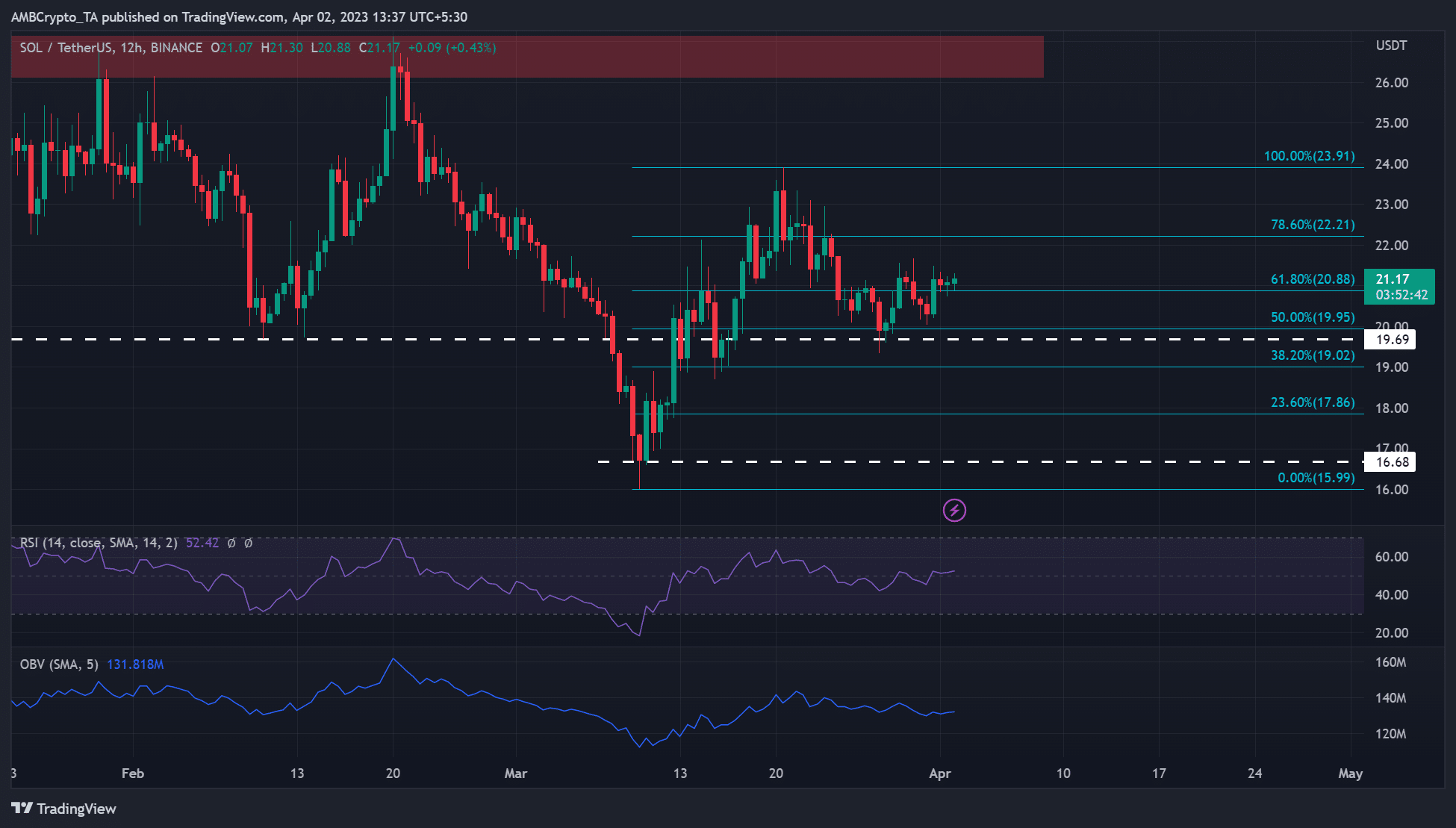

Will the 61.8% Fib level remain steady for bulls?

SOL plummeted by over 15% after hitting the $23.91 price ceiling. But the $20 support prevented further price dump, boosting bulls to attempt a recovery.

Bears thwarted the recovery, and a retracement saw SOL hit the 50% Fib level ($19.95). At press time, bulls had inflicted another recovery attempt and concerted efforts to keep SOL above the 61.8% Fib level ($20.88).

If BTC goes beyond $28K and reclaims the $29K price zone, SOL could defend the 61.8% Fib level ($21) support. SOL could move to retest the 76.8% Fib level ($22.21) or the overhead resistance level of $23.91. A hit on the supply zone of $26 could attract increased selling pressure.

A close below the 61.8% Fib level ($20.88) could also attract another round of selling pressure. But the $20, $19, or $18 support levels could slow the drop. Thus these levels can act as selling targets in the event of a sharp downswing, especially if BTC drops below $28K.

The RSI (Relative Strength Index) and OBV (On Balance Volume) moved sideways at the time of writing, reinforcing the consolidation phase underway at press time. Since it was a weekend, a more definite price direction could be shaped from Monday (April 3).

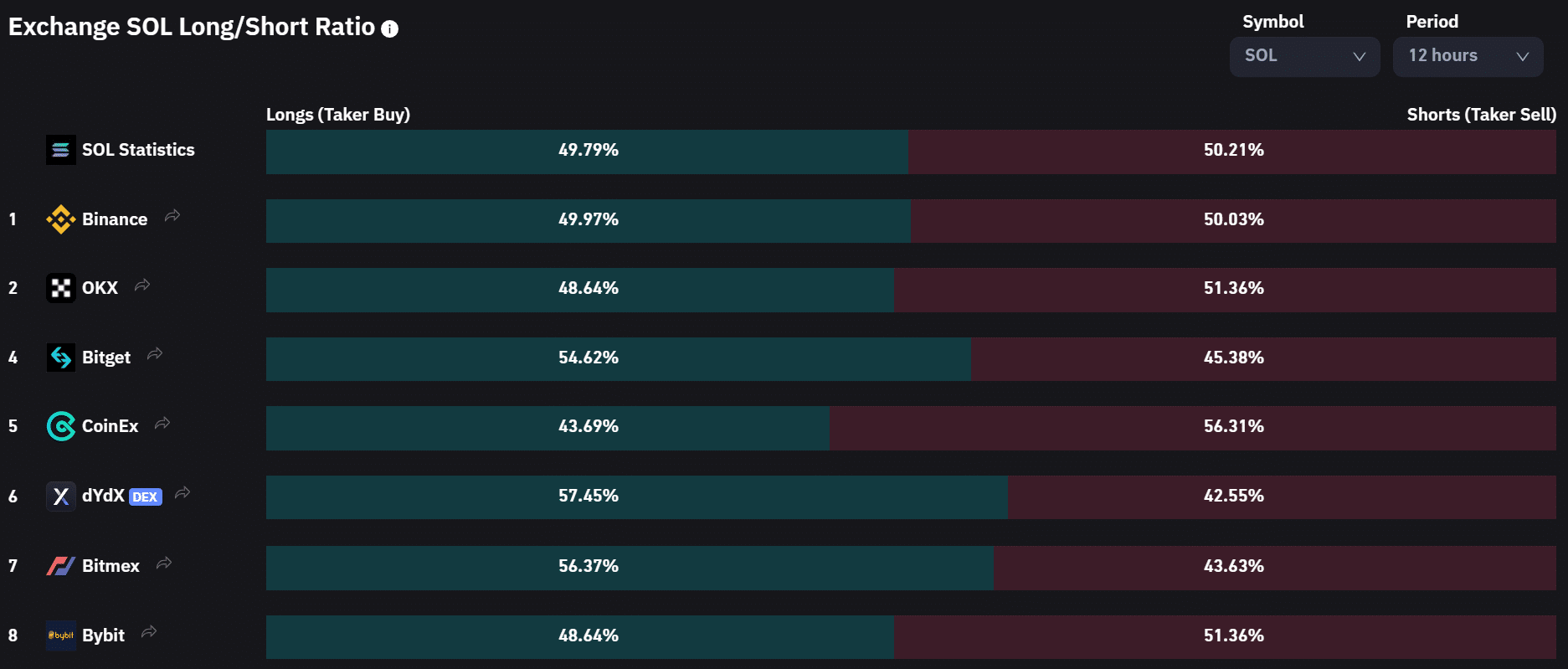

Shorts dominated longs by a small margin

According to Coinglass, the long/short ratio was slightly skewed towards sellers at press time. It means sellers could potentially breach the 61.8% Fib level and attract even more selling pressure.

Is your portfolio green? Check out the SOL Profit Calculator

Nevertheless, the funding history has been positive for the past few days, denoting the underlying bullish sentiment. Despite the hopes for a further rally, investors should wait and track BTC price action to make better moves.