Solana’s NFT ecosystem stands at the forefront; can SOL claim the same

- Solana NFTs market share stood at 13% in terms of sales volume. Sales reached its all time high in November

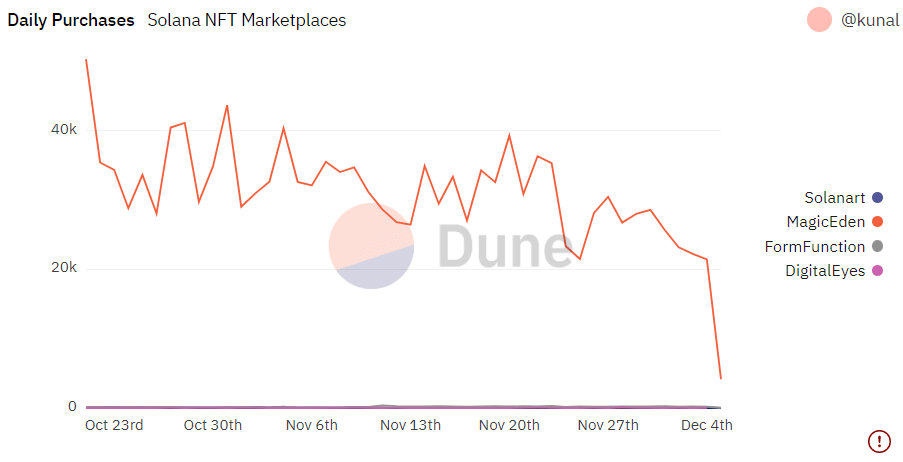

- According to Dune, daily purchases on Solana NFT marketplaces registered a decline

Solana’s [SOL] NFT ecosystem gained the attention of many over the last few weeks as it achieved quite a few milestones that looked promising for the network. One of these accomplishments was Solana’s NFT sales reaching an all-time high of 6.7 million in November.

2.

In November 2022, Solana NFTs Sales has reached new ATH in SOL volume.

5/2022: 5.6M $SOL

11/2022: 6.7M $SOLSolana's cash flow strongly returns to the NFTs segment.

Data: @tiexohq pic.twitter.com/Kd6Y0RsKpW

— Solana Daily (@solana_daily) December 6, 2022

Read Solana’s [SOL] Price Prediction 2023-2420

Wait…there is more.!!!

Not only this, but several updates that were released on the Solana ecosystem, also added much value to the blockchain. For instance, as of November, Solana NFT’s market share was currently 13% in terms of sales volume among top blockchains.

Furthermore, Magic Eden remained the main player in the space with a 90% market share of transactions on Solana. An interesting development was also noted as Solana NFT’s Blue Chip experienced a sharp rise in its price and trading volume following the FTX episode, which shook the entire cryptocurrency market.

As per DappRadar’s data, over the last 30 days, the y00ts collection was traded the most, and its sales increased by nearly 280%. Furthermore, y00ts also made it to the list of the top 10 NFT collections by volume in the past month.

⚡️Top 10 #NFT Collections by Volume (30d)

5 December 2022#BAYC #CryptoPunks #MAYC $GODS $APE #y00ts #CloneX pic.twitter.com/eMj0nnOG0e— ?? CryptoDep #StandWithUkraine ?? (@Crypto_Dep) December 5, 2022

Though all these updates were positive, data from Dune Analytics revealed a setback for Solana’s NFT ecosystem. According to Dune, daily purchases on Solana NFT marketplaces registered a decline over the last few months, which did not look good.

SOL might be affected too!

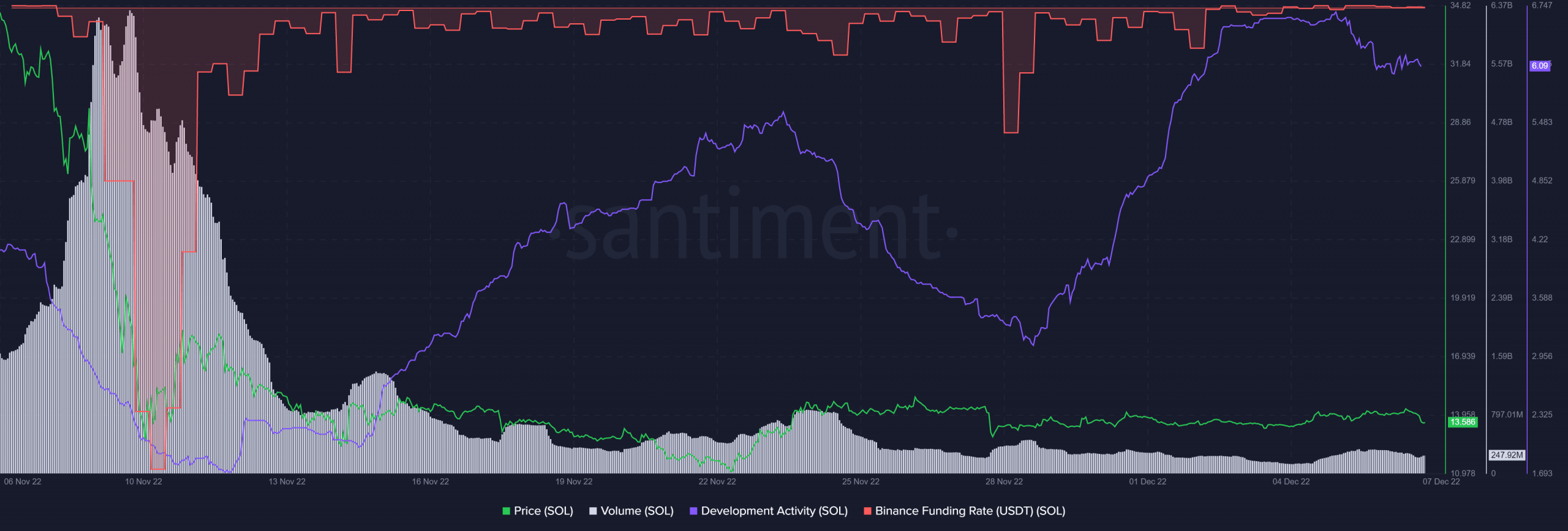

While all these developments happened, SOL’s price did not show much of an impact as its price continued to decline. According to CoinMarketCap, SOL registered more than 3% negative growth and, at press time, was trading at $13.59 with a market capitalization of over $4.95 billion.

Solana’s volume also decreased substantially over the last month, which was another negative signal. Nonetheless, Santiment’s chart suggested that things might get better for Solana soon, as a few of the on-chain metrics were supportive of a price hike.

Solana received quite some interest from the derivatives market as its Binance funding rate went up over the past 30 days. Not only that, but its development activity also increased, which was by and large a green flag.