Spot trading Ethereum or Shorting Ethereum, is there no in-between?

Ethereum is currently trading at the $2000 level based on the price data from coinmarketcap.com. ETH’s price was increasing steadily; it is up over 8% in the past 24 hours. The transaction volume has increased in the past 24 hours but on-chain sentiment is currently bearish based on intotheblock data.

Since the beginning of 2021, and in the current bull season, traders either trade Ethereum on spot exchanges, or short Ethereum on derivatives exchanges. This argument is supported by the fact that the volume of shorts on Ethereum is currently higher than longs, based on Skew data. So what is the impact of going long on Ethereum or HODLing it in the long term?

Currently, 85% of HODLers are profitable on the Ethereum network, and the concentration by large HODLers has increased to 42% in the past two weeks, following a rise since the flash crash of May 2021. It is likely that these positions may be more profitable than spot trading and shorting in the short term.

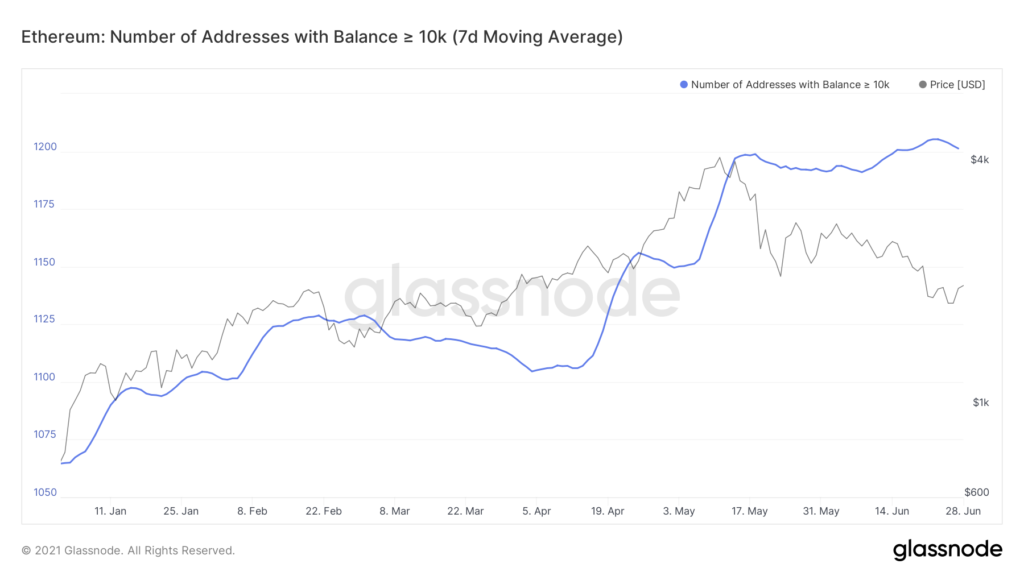

Metrics supporting this are ETH number of non-zero/ active addresses. This metric was up in the past two weeks based on the following chart from Glassnode. What’s more interesting is the number of wallets with a balance of over 10k ETH is up, it has increased over 10% since the beginning of 2021.

Number of addresses with a balance above 10k ETH || Source: Glassnode

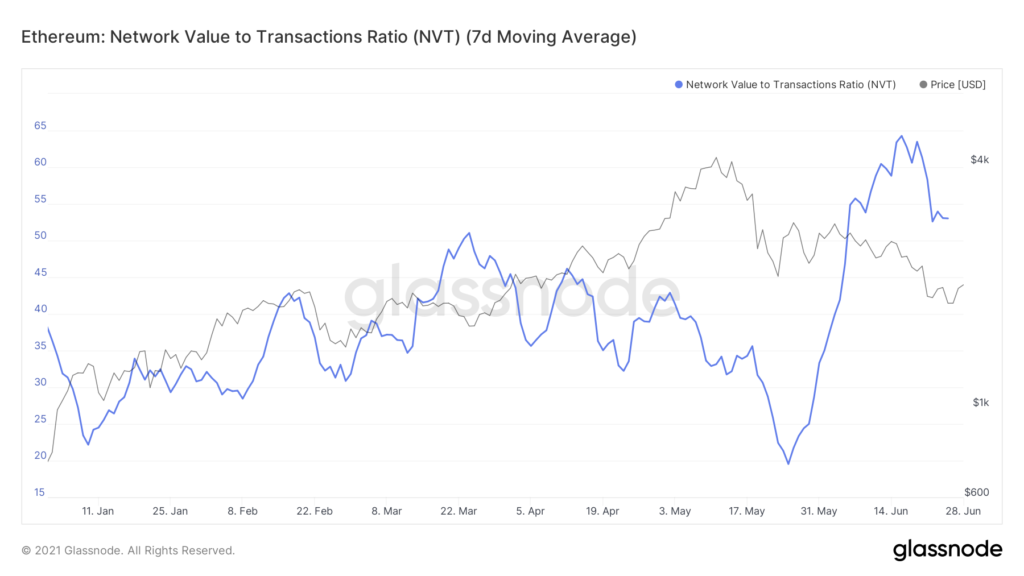

Another metric that supports this is the NVT ratio. The value of NVT ratio is currently 53. This is not as high as the peak witnessed when ETH’s price hit the $4300 level 2 months ago.

NVT Ratio ETH || Source: Glassnode

Based on the current value of the NVT signal, the network is relatively undervalued. So there is scope for the price to rally, there is profitability in HODLing and in going long Ethereum. Additionally, though it may seem that way to new traders on crypto Twitter, ETH maximalism is not the opposite of BTC maximalism.

So traders long on BTC (waiting for the price to cross the local high or the recent ATH from over two months ago) should likely consider going long on ETH as well, given the high correlation between the two assets and ETH’s metrics.