Stablecoins are on the up and this is what it means for the market

- Transactions worth more than $7 trillion were settled using stablecoins last year

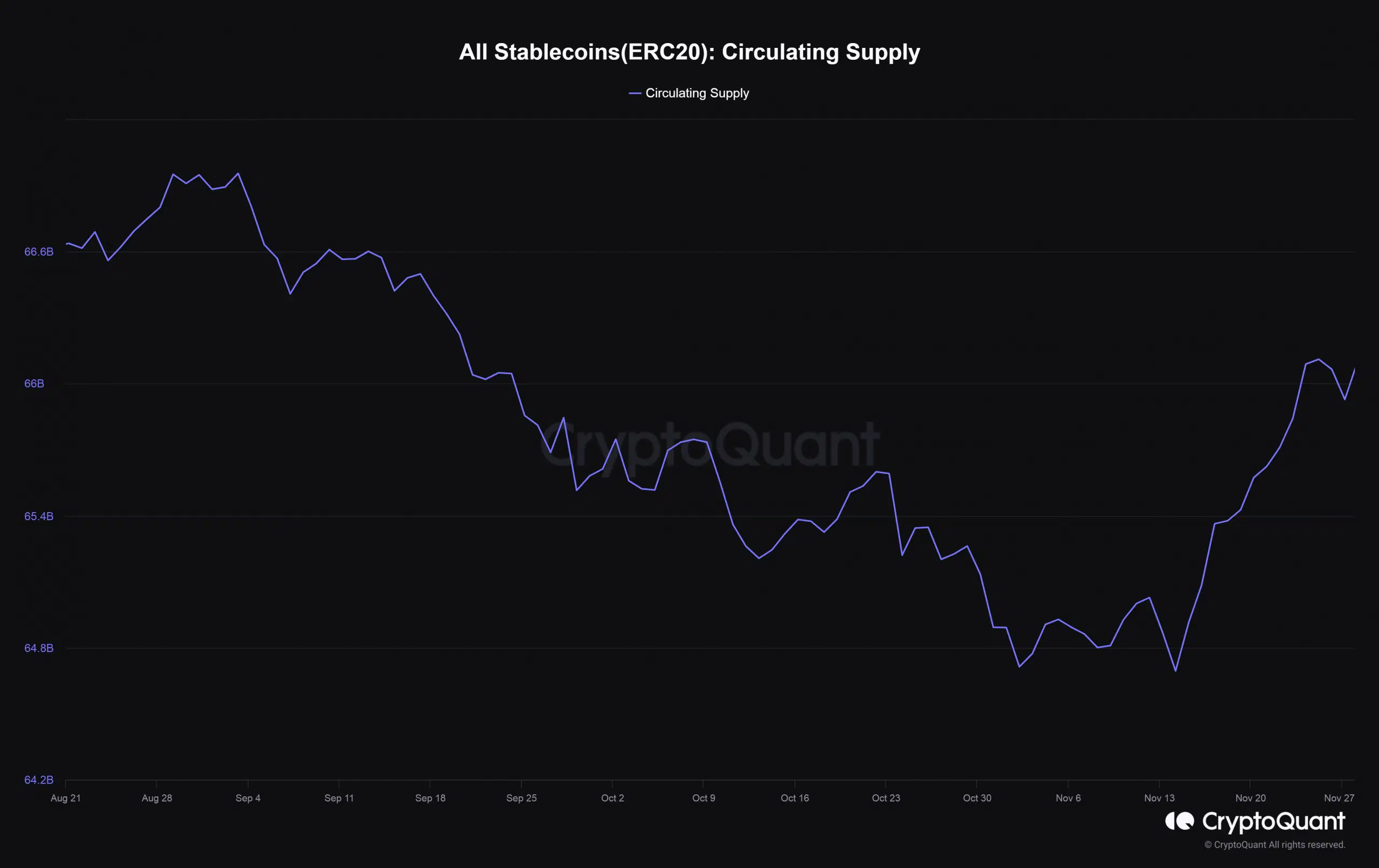

- Circulating supply of ERC-20 stablecoins saw a noticeable hike lately

Slowly but surely, stablecoins are emerging as a viable medium of exchange globally. As per a recent report by Circle, the issuer of USD Coin [USDC], transactions worth more than $7 trillion were settled using stablecoins last year.

When compared with the combined global settlements of $14 trillion by payment giants Visa and Mastercard, this is a significant milestone.

Focus back on stablecoins

Unlike some of the other volatile cryptocurrencies, stablecoins remain tightly coupled to the underlying fiat currencies, most notably the U.S. Dollar (USD). This unique combination of decentralization and stability in market value has widened the scope of stablecoins in recent years.

As per AMBCrypto’s examination of CryptoQuant, the circulating supply of ERC-20 stablecoins saw a noticeable increase in the past month.

Such hikes in stablecoin market caps act as bullish signals for the broader crypto-market. This, because most traders use stablecoins to enter and exit trades on crypto-exchanges.

The stablecoin market cap went on a downward spiral after the dramatic collapse of Terra USD [UST] last year. With sentiment in the broader market turning bearish, trading activity declined, and with it, the demand for stablecoins.

However, the bullish vigor injected in the last two months has put the focus back on these crypto-derivatives of currencies.

Will stablecoins continue aiding the bull run?

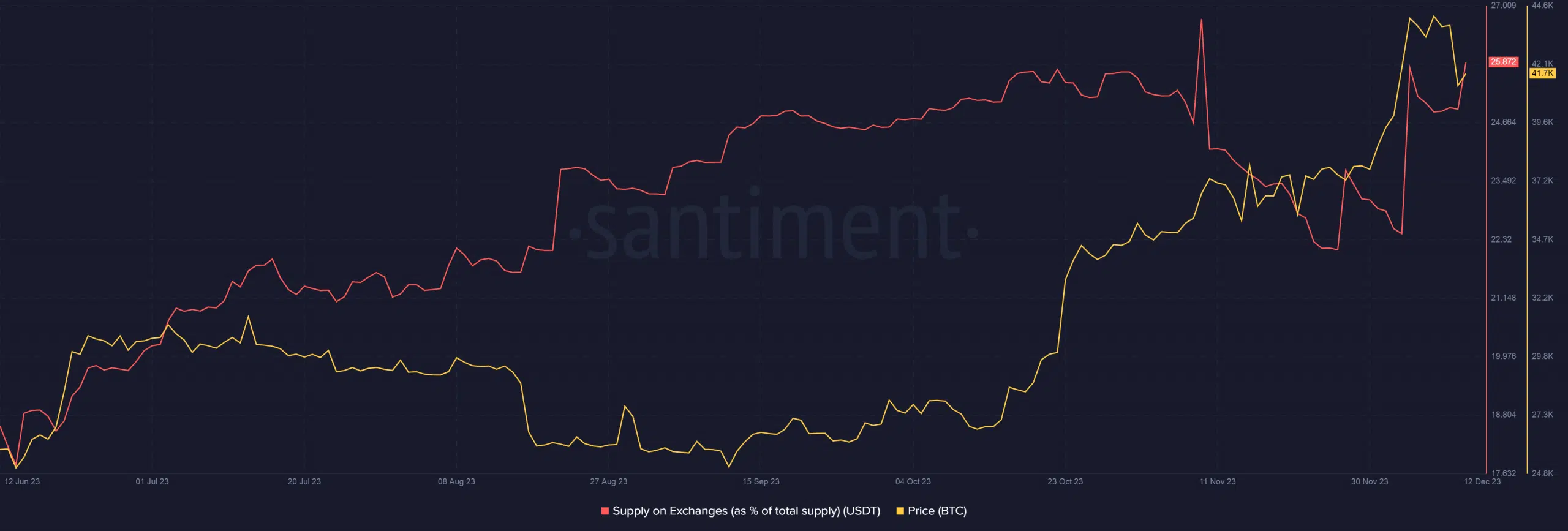

Preceding the market rally which commenced from mid-October, Tether [USDT] supply on exchanges started to hike gradually. In fact, from the period between 19 August to 16 October, about 3.54% of the supply moved into exchanges, AMBCrypto spotted using Santiment data. This was likely done to buy other cryptocurrencies.

After a fall in supply in November, USDT reserves on exchanges were again back to its October levels at press time. If history is any guide, this would be a precursor to another burst of buying activity in the coming days.

Solana drives stablecoin growth

Finally, according to AMBCrypto’s examination of DeFiLlama data, Solana [SOL] saw the highest growth in stablecoin supply over the past week, at over 8%.

The surge was fueled by a 21% jump in USDC deposits while USDT supply largely remained unchanged.